So, it turns out that a tidal wave of short-term holder panic is sending Bitcoin’s price on a downward spiral, and analysts at Glassnode are waving their arms like they just spotted a shark in the kiddie pool. 🦈

Bitcoin (BTC) is now under so much selling pressure that it’s practically begging for a lifeguard. Short-term holders are offloading their coins at a loss, which is just like a bad breakup—everyone’s crying, and nobody’s stepping in to save the day. 💔

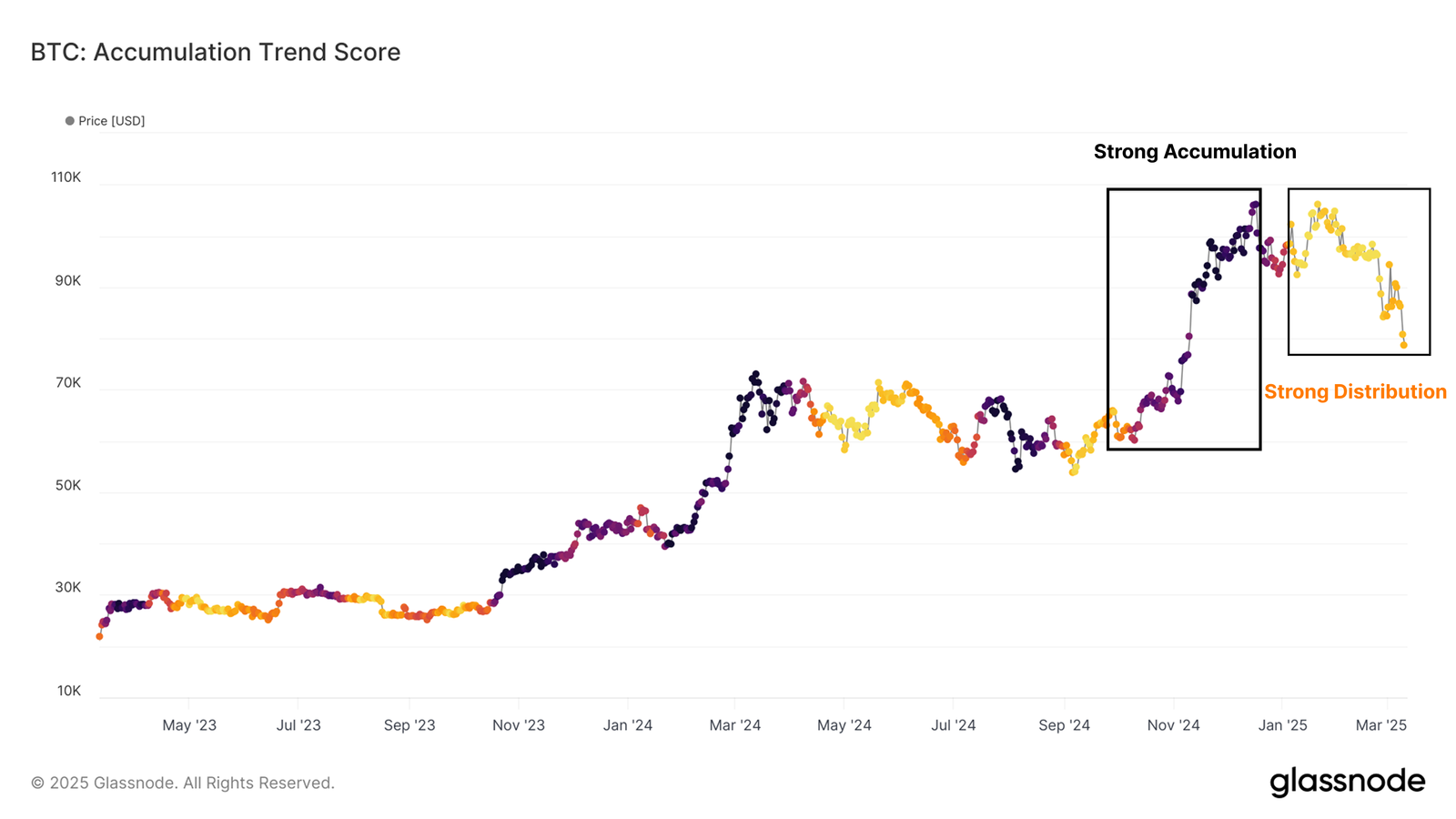

Since January, the accumulation trend has been as weak as my willpower in front of a donut, showing that buyers are not exactly rushing in to soak up the sell-off. 🍩

In a plot twist worthy of a soap opera, Bitcoin has slid from $108,000 to $93,000, triggering concerns about demand fading faster than my New Year’s resolutions. Glassnode reported that market confidence took a nosedive in late February, thanks to external risks like the Bybit cyberattack and rising U.S. tariff tensions. Talk about a bad hair day for the market! 😩

//crypto.news/app/uploads/2025/03/uhsdufhsudihfusd.png”/>

Another key metric, short-term holder coin days destroyed, confirms that panic-driven selling is in full swing. Glassnode says the recent sell-off by top buyers has driven this indicator to -12.8K coin days per hour. That’s like realizing you’ve eaten an entire pizza by yourself—intense loss realization, indeed! 🍕

“A similar pattern emerged in August 2024, when Bitcoin plunged to $49k amid market stress and macro uncertainty. The current structure suggests a comparable capitulation phase.”

— Glassnode

With Bitcoin now trading near key cost-basis levels, analysts suggest the market could enter a consolidation phase before finding firm support. So, grab your popcorn, folks; this show is just getting started! 🍿

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-03-12 09:48