In the grand circus that is the cryptocurrency market, the past few weeks have been a veritable three-ring spectacle of uncertainty and volatility, all thanks to the ever-shifting sands of global macroeconomics. Picture, if you will, Bitcoin pirouetting between $74,000 and $83,000 as if it were auditioning for a role in a particularly dramatic ballet.

Our dear BTC took a nosedive towards $74,000 at the start of last week, sending crypto investors into a tizzy reminiscent of a cat in a room full of rocking chairs. This panic was sparked by none other than President Donald Trump, who decided to announce new trade tariffs, because why not add a little spice to the global economy? But lo and behold, on Thursday, April 10, Bitcoin decided to reclaim its dignity and bounce back to $83,000 after Trump had a change of heart and paused tariffs on all countries except China. Because, of course, China.

Is Bitcoin Now A ‘Mature Asset’?

Now, one might wonder if Bitcoin has finally donned its big-boy pants and become a ‘mature asset’. The price has been reacting to every whisper in the global trade winds, showcasing the volatility of the cryptocurrency market like a peacock showing off its feathers. However, an on-chain analytics expert, who probably has a crystal ball, has pointed out that the current volatility is but a mere shadow of past calamities.

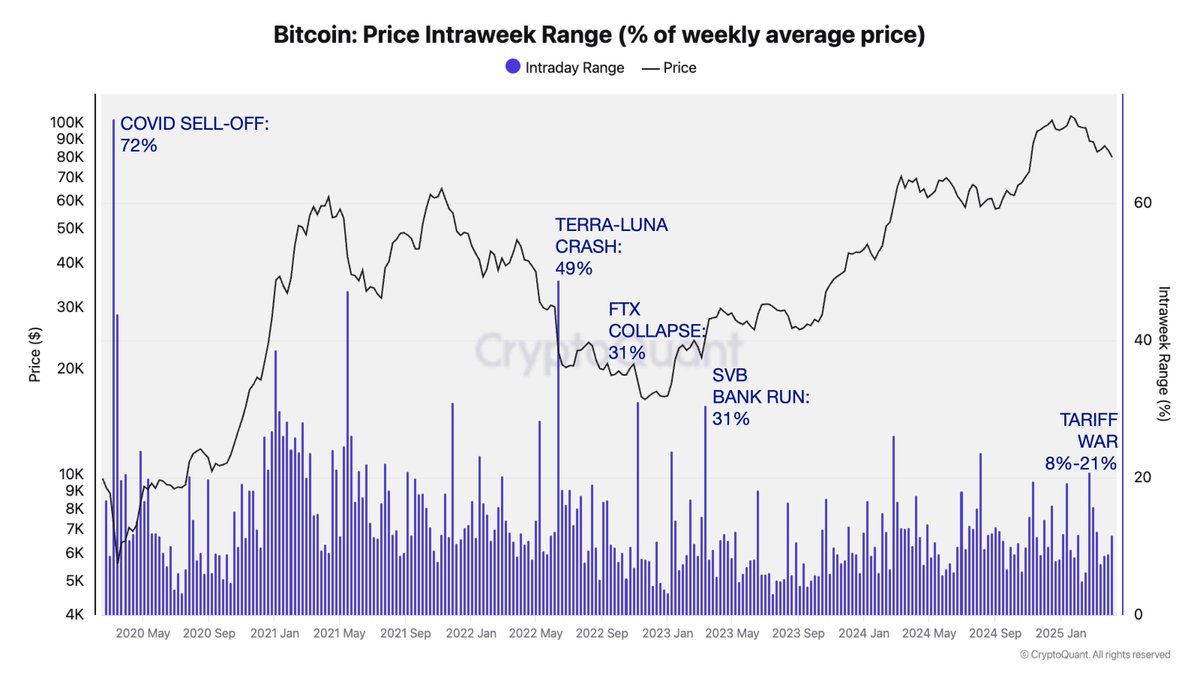

In a recent post on the social media platform X (formerly known as Twitter, because rebranding is all the rage), CryptoQuant’s head of research, Julio Moreno, revealed that the current Bitcoin price volatility is “so far lower” than during previous episodes of chaos, such as the COVID-19 crash, the Terra-Luna collapse, the FTX fiasco, and the Silicon Valley Bank (SVB) bank run. Quite the list, isn’t it?

The magic number

The chart above illustrates that the BTC Intraweek Range metric soared to 49% after the Terra Luna ecosystem crash in May 2022. Meanwhile, it reached a modest 31% following the collapse of the Sam-Bankman-Fried-led FTX exchange in late 2022 and the SVB bank run in early 2023. It’s like watching a soap opera, but with more numbers and fewer dramatic pauses.

With trade tensions between the United States and China escalating like a poorly written sitcom, the Bitcoin Price Intraweek Range metric now hovers between 8% and 21%. This reduced volatility suggests that our beloved cryptocurrency has matured, with deeper liquidity and a market structure that’s less like a house of cards and more like a well-built brick wall.

The relatively stable price action can be attributed to a growing base of long-term holders and steady corporate adoption. Institutional players are beginning to see Bitcoin less as a high-risk asset and more as a hedge against the uncertainties of the macroeconomic landscape. Who knew that Bitcoin could grow up so fast?

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $83,700, reflecting a 5% increase in the past 24 hours. It’s like watching a toddler take its first steps—adorable and slightly nerve-wracking.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Pi Network (PI) Price Prediction for 2025

2025-04-13 01:13