As a seasoned cryptocurrency investor with years of market experience under my belt, I must say that the current state of Bitcoin is a familiar dance we’ve seen before. The Stochastic Relative Strength Index (Stoch RSI) patterns hint at a possible downtrend, reminiscent of the market cycle in 2019. However, as history has taught us, Bitcoin is never predictable and can always surprise us with unexpected twists and turns.

The current surge in Bitcoin‘s value may be a prelude to a decline, based on various signs. For instance, the dispersal of Bitcoin from Mt. Gox and Germany’s massive sale have temporarily affected Bitcoin’s price but have also caused a recovery. Nevertheless, factors like the Net Unrealized Profit/Loss and Stochastic RSI are suggesting possible drops in the near future. This article looks into how these elements could influence Bitcoin’s upcoming trends.

Table of Contents

Mt. Gox distributions and German government sell-offs

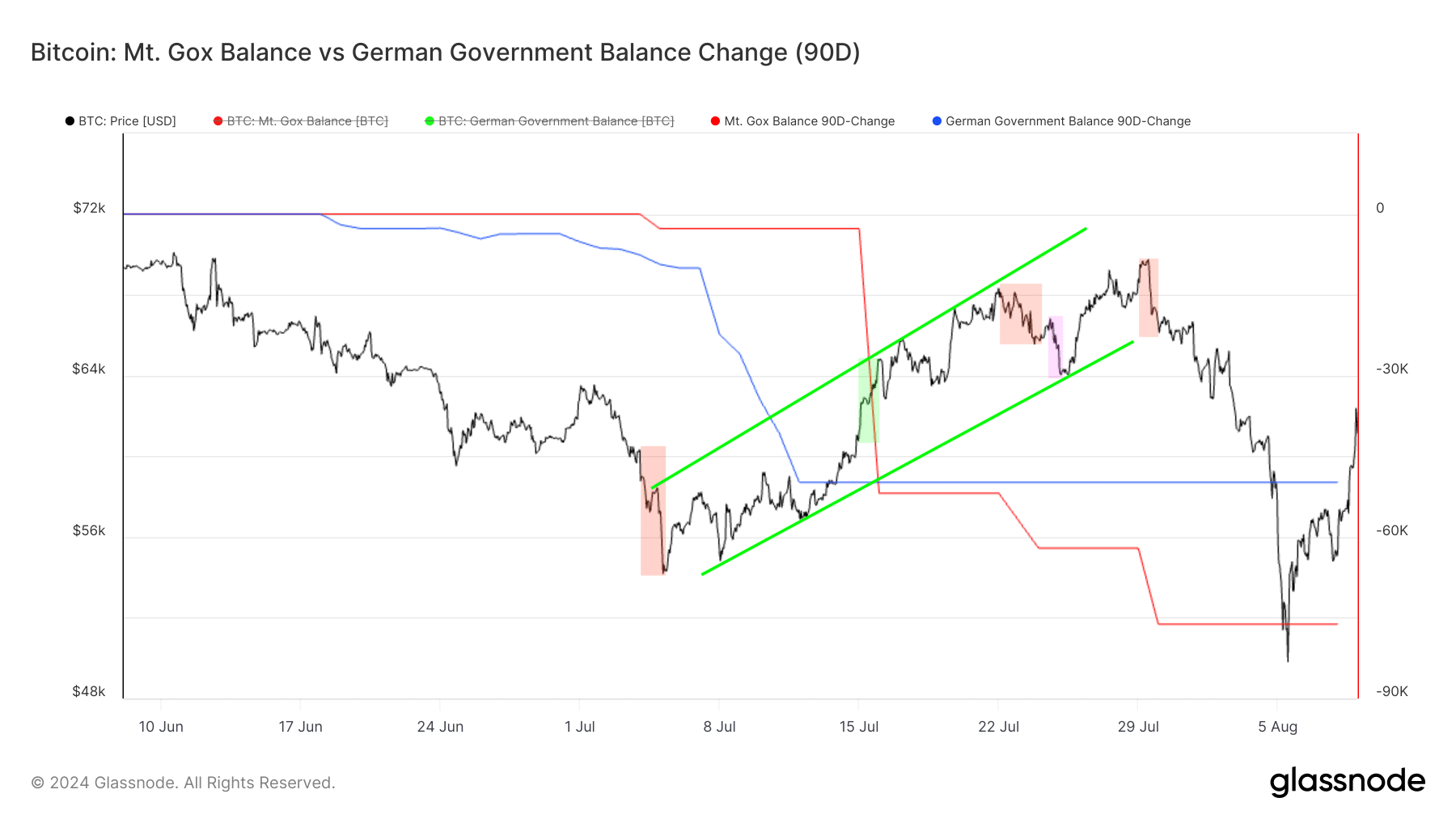

In July and August, a series of unfavorable developments occurred for Bitcoin (BTC). The events kicked off with the chaos caused by Germany’s massive Bitcoin liquidation and the start of Mt. Gox’s redistribution phase.

On July 5, the downward trend in Bitcoin’s price was set off by an early round of sales from Germany, bottoming out at $53,542.

The situation worsened even more when Mt. Gox put 2,701 Bitcoins onto the market. Prior to this, Germany had already sold a significant amount, approximately 9,332 Bitcoins during its selling frenzy. Despite this continued sale by Germany, another 59,190 Bitcoins, starting from July 5, the Bitcoin market started recovering. By July 12, the price surged to $57,889, representing a recovery of over 8%.

After the intense demand for selling Bitcoin subsided, it started looking attractive to investors once more. The market’s resilience against the government’s selling pressure suggested an increasing interest among buyers. Subsequently, when it was announced that Germany had liquidated all their Bitcoin holdings, this led to a further increase in price.

Despite a massive transfer of 49,079 BTC from Mt. Gox, which was their largest movement, the upward trend persisted, showing a 26% surge from its low on July 5. Although subsequent releases from Mt. Gox caused temporary downturns in the market, they didn’t halt the overall growth and recovery.

As a crypto investor, I’m thrilled to announce that long-awaited funds from the Mt. Gox estate, including Bitcoin and Bitcoin Cash, have finally been distributed by KrakenFX. It’s been almost a decade since they were chosen by the Trustee to handle this task, and it’s been an honor to play a part in this process. Our responsibility was clear: to investigate and return client funds, and we’ve done just that.

— Dave Ripley (@DavidLRipley) July 23, 2024

It’s probable that psychological factors significantly influenced this situation. People who received BTC from Mt. Gox didn’t actively choose to hold onto it over the years; they were unable to access it until the recent distributions. Over time, many might have come to understand that keeping Bitcoin could be more profitable than instantly selling it. This change in thinking could be due to Bitcoin’s historic price spikes in 2017, 2021, and even 2024. If they had owned BTC during those highs, many might have sold their investments. However, the delay enforced by the situation unwittingly turned them into long-term holders, which ultimately proved beneficial. This interpretation is bolstered by the market’s response to the distributions. The minimal 4% drop seen after Kraken and Bitstamp started their distributions on July 24 quickly stabilized, suggesting that the selling pressure from these recipients was relatively light.

It’s predicted that the distribution of the remaining 65,476 BTC from Mt. Gox won’t lead to substantial market disturbances because any minor disruptions should be promptly handled by the market. This is due to the assumption that most beneficiaries will probably hold onto their cryptocurrency instead of selling it.

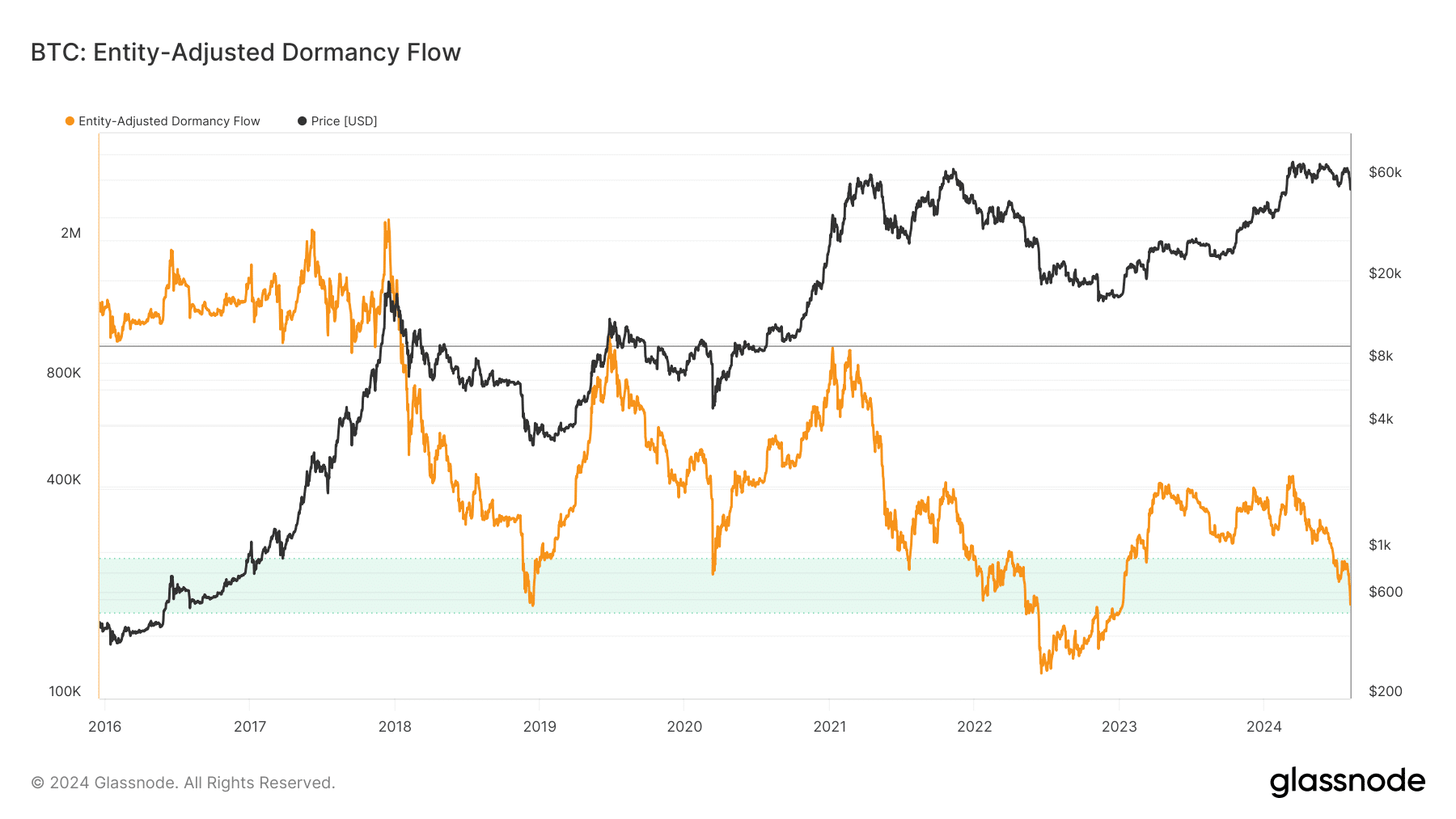

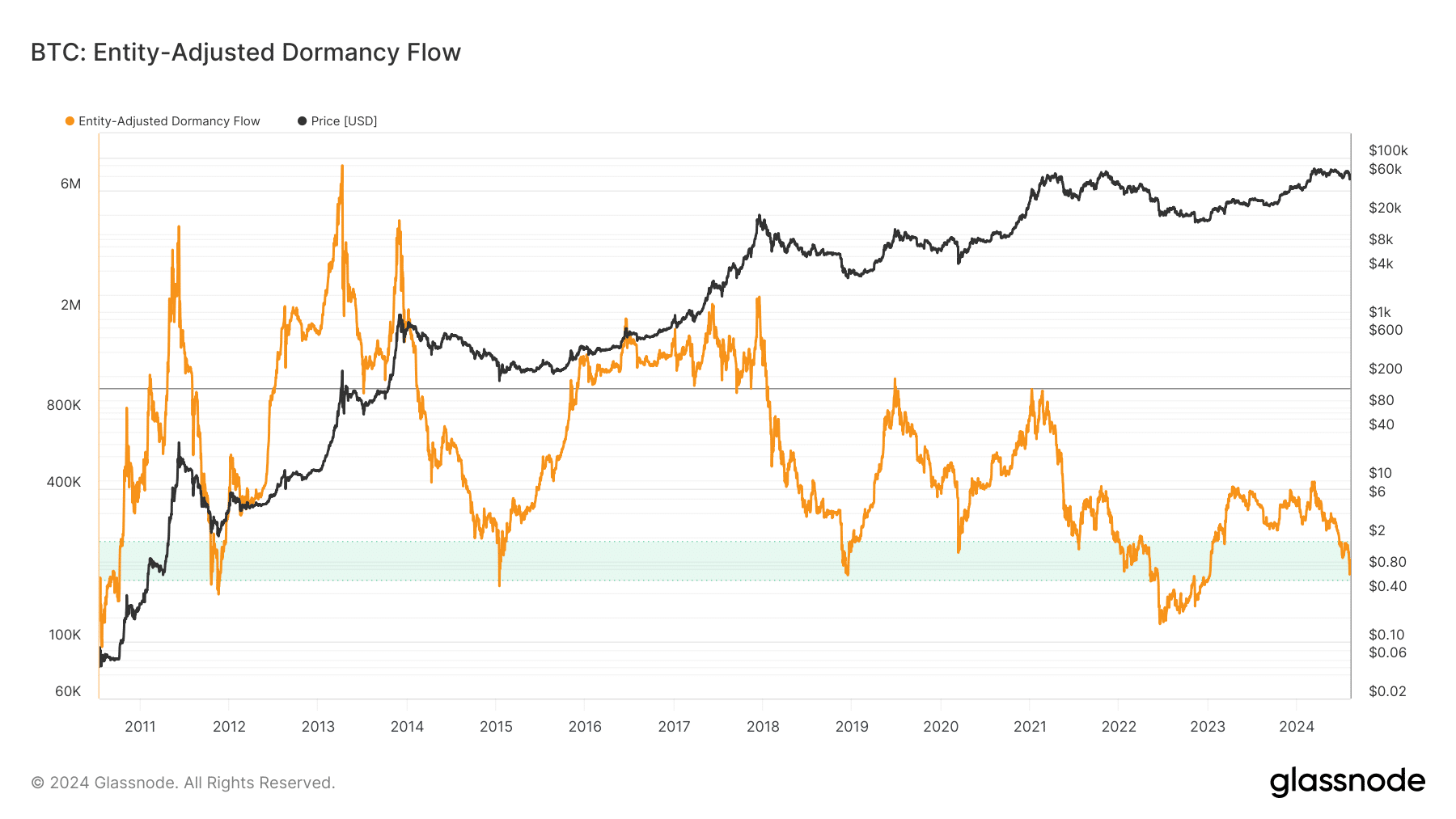

Entity-Adjusted Dormancy Flow as a predictor of Bitcoin market bottoms

In simpler terms, Entity-Adjusted Dormancy Flow (EADF) calculates the relationship between a cryptocurrency’s current market value and its dormancy value. The dormancy value represents the average number of days that each Bitcoin remains idle (unmoved), multiplied by the amount of Bitcoin transacted on that day, then converted into USD. This metric helps us understand the behavior of long-term holders by showing how much older Bitcoin is being sold or moved in the market.

Using this tool, it has been consistently helpful in predicting market bottoms and determining if the Bitcoin market continues to behave normally (bullish trend) or starts moving towards a bearish condition.

Every time the EADF index falls into the range between $170 and $250 (the green zone), it’s typically a sign that the market has reached its lowest point. More specifically, whenever the index approaches $170, it has historically been quite accurate in predicting Bitcoin’s price bottoms. Lately, on August 5, the EADF dropped to $184, which, based on past trends, suggests that Bitcoin may have hit its lowest point. This decrease is often followed by an upward trend, and if previous patterns are any indication, this could signal the beginning of a recovery phase for Bitcoin’s price, potentially leading to an increase in value in the near future.

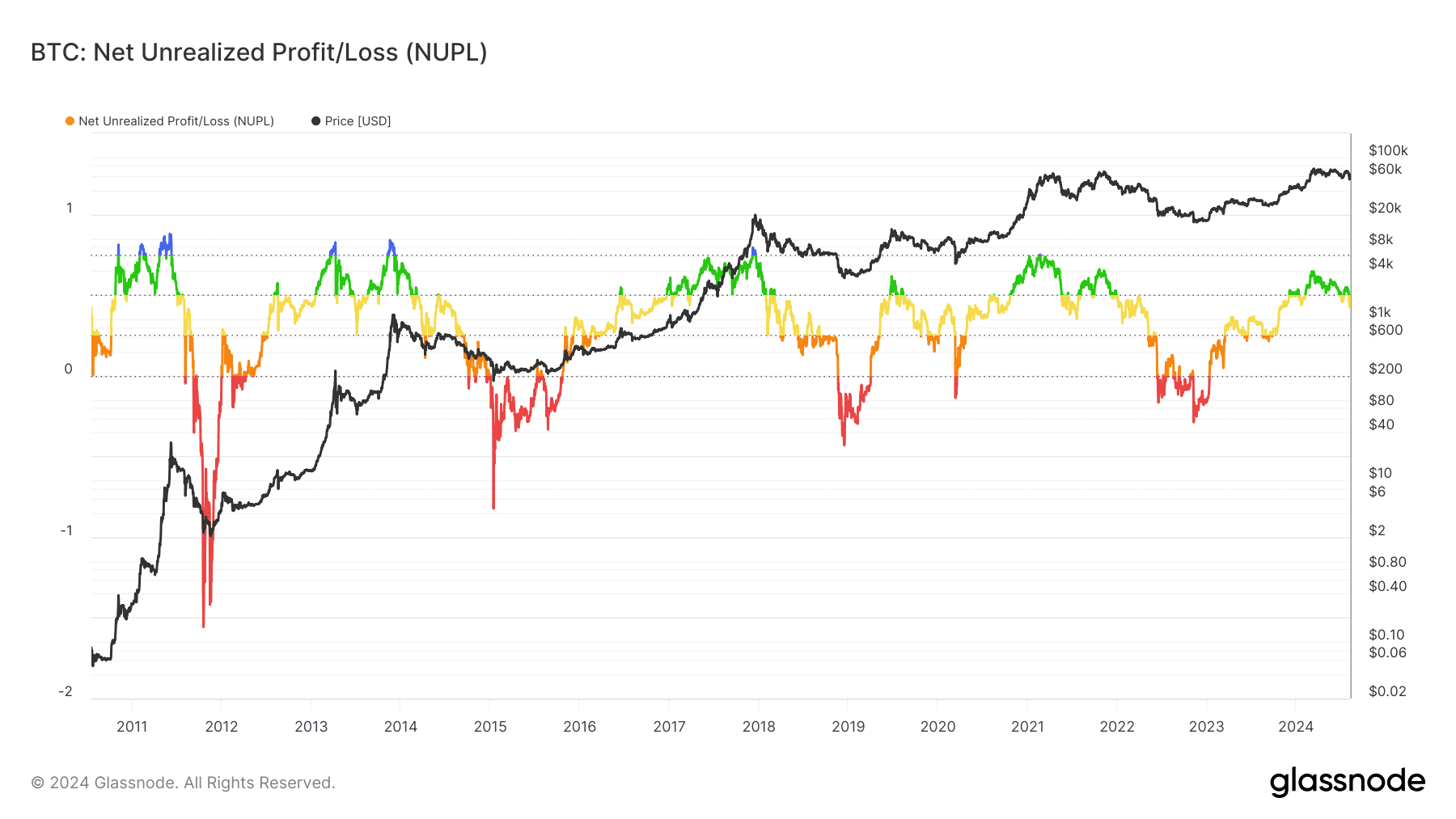

Net Unrealized Profit/Loss as a predictor of Bitcoin market tops

The Net Unrealized Profit/Loss (NUPL) is a measurement that gauges the general attitude of Bitcoin owners by calculating the disparity between the total Bitcoin held for profit (relative unrealized profits) and the total Bitcoin held at a loss (unrealized losses). Essentially, NUPL summarizes these two values to show whether, on average, the market is experiencing gains or losses.

In the past, when the Network Value to Transactions Ratio (NUPL) surpassed 0.4, it has often suggested that Bitcoin might be experiencing overvaluation. Yet, this doesn’t automatically mean that Bitcoin’s price will begin to drop right away. For instance, from 2010-2011, 2013-2014, 2017-2018, and 2020-2021, the NUPL remained above 0.4 for significant periods, even reaching nearly a year, before eventually dipping below it, which usually signaled the end of a bullish trend.

Under the present market trends, Bitcoin might continue to hover within the NUPL zone above 0.4, occasionally dipping slightly below it, until a peak is hit, potentially around 2025. This period could bear some similarities to the situation in 2019.

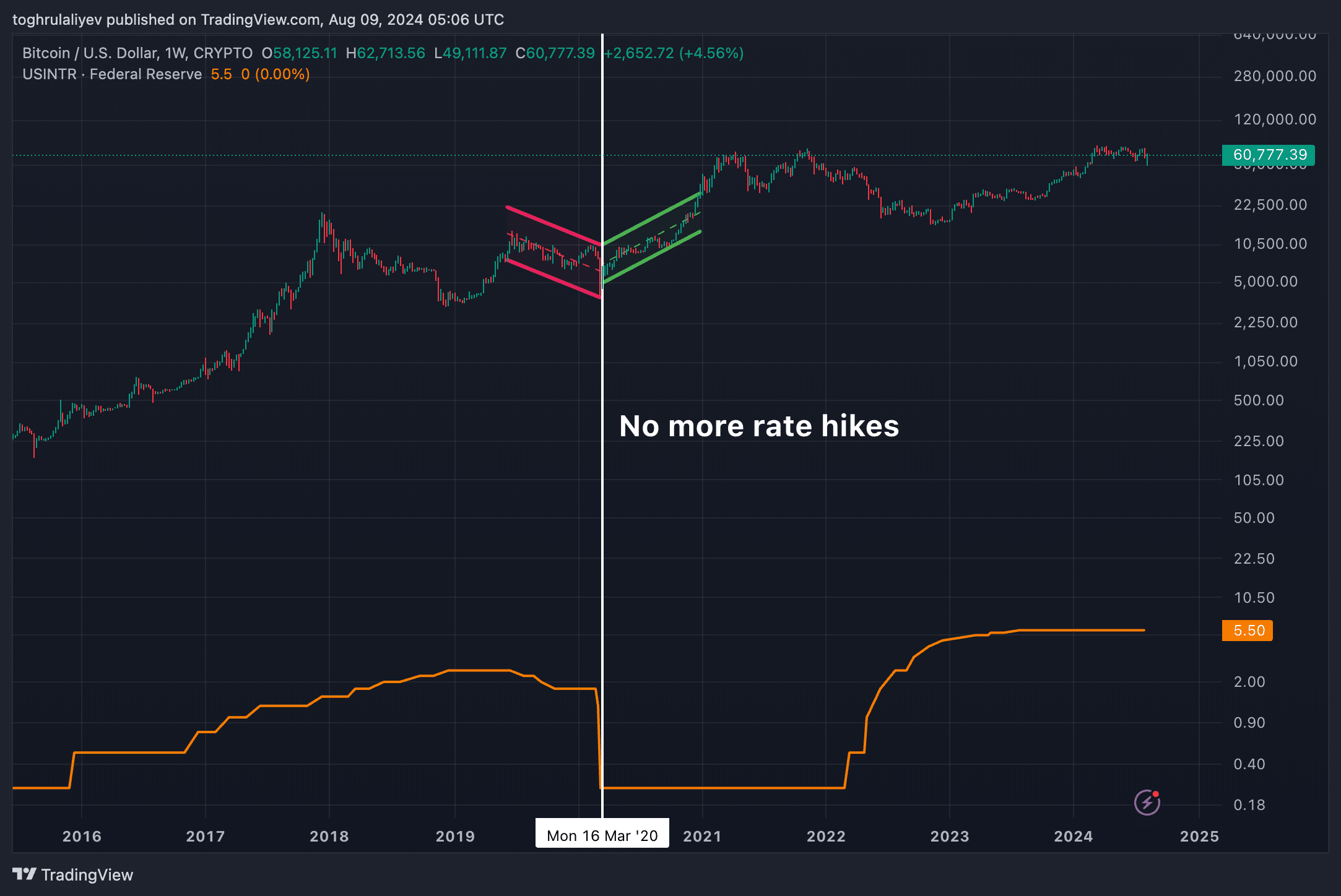

In June of that year, NUPL hit 0.4 and held steady until August. However, from September onwards, it started decreasing. A significant factor behind this was the Federal Reserve’s move to reduce interest rates effective July 31st. This rate reduction, combined with no subsequent changes in either cuts or increases, might have played a role in NUPL’s decline and the subsequent drop in Bitcoin’s price trend.

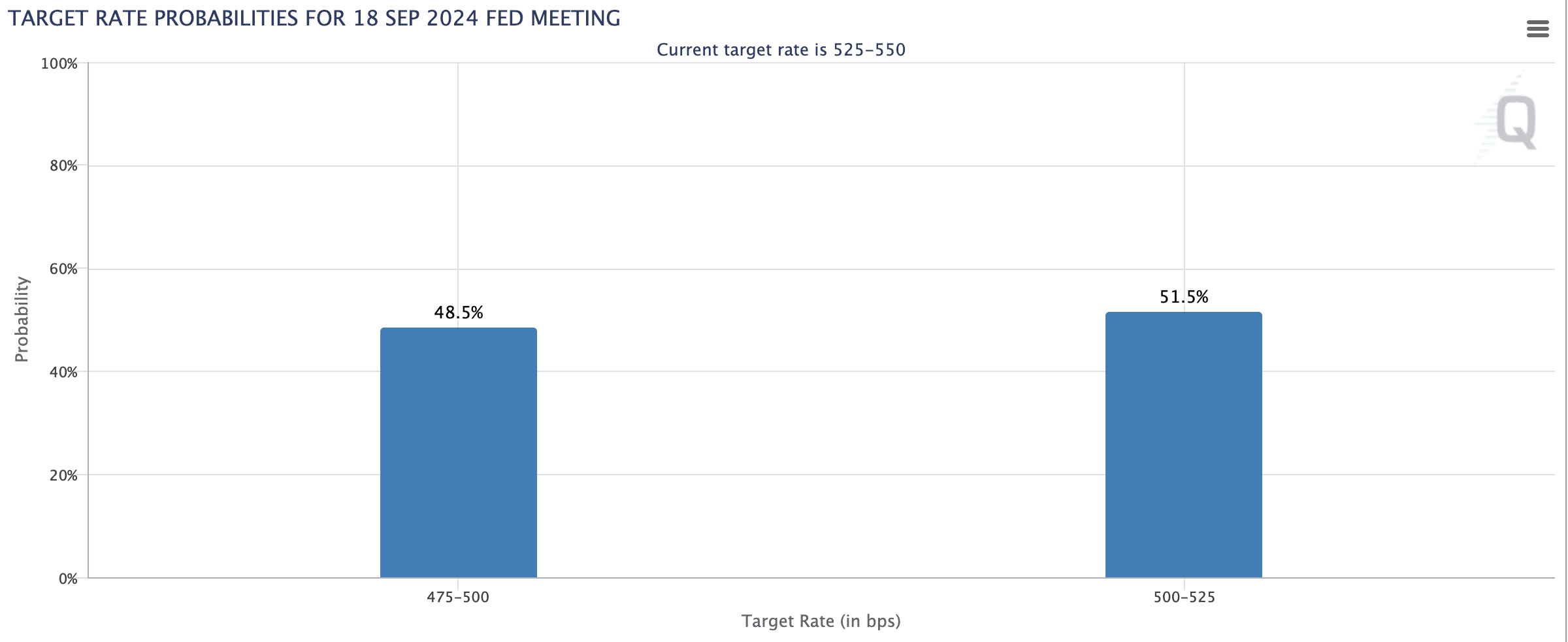

By March 2020, the NUPL value fell below zero, which was around the same time that the COVID-19 pandemic started and the Federal Reserve decided not to change interest rates for an extended period. When the Federal Reserve stopped lowering rates, both the price of Bitcoin and the NUPL trend turned upwards again. If the Federal Reserve reduces rates in September as predicted, a pattern similar to 2019 might emerge, potentially causing Bitcoin’s price to decrease once more.

Stochastic Relative Strength Index patterns in Bitcoin market cycles

The Stochastic Relative Strength Index (Stoch RSI) is a tool used by traders to predict an asset’s future price trend by examining the relationship between its current closing price and the price range it has been within during a specified timeframe. Unlike traditional methods, this indicator doesn’t focus on comparing absolute prices, but rather the position of the Relative Strength Index (RSI) within its high-low range over that period. This emphasis makes the Stoch RSI more responsive to recent price fluctuations and helpful in identifying potential market extremes like overbought or oversold conditions.

The Stochastic Relative Strength Index (Stoch RSI) fluctuates between 0 and 1. Values above 0.8 usually signal overbought conditions, while those below 0.2 suggest oversold conditions. Instead of merely focusing on whether the indicator is overbought or oversold, a more refined strategy includes analyzing the pattern in which the Stoch RSI crosses these thresholds.

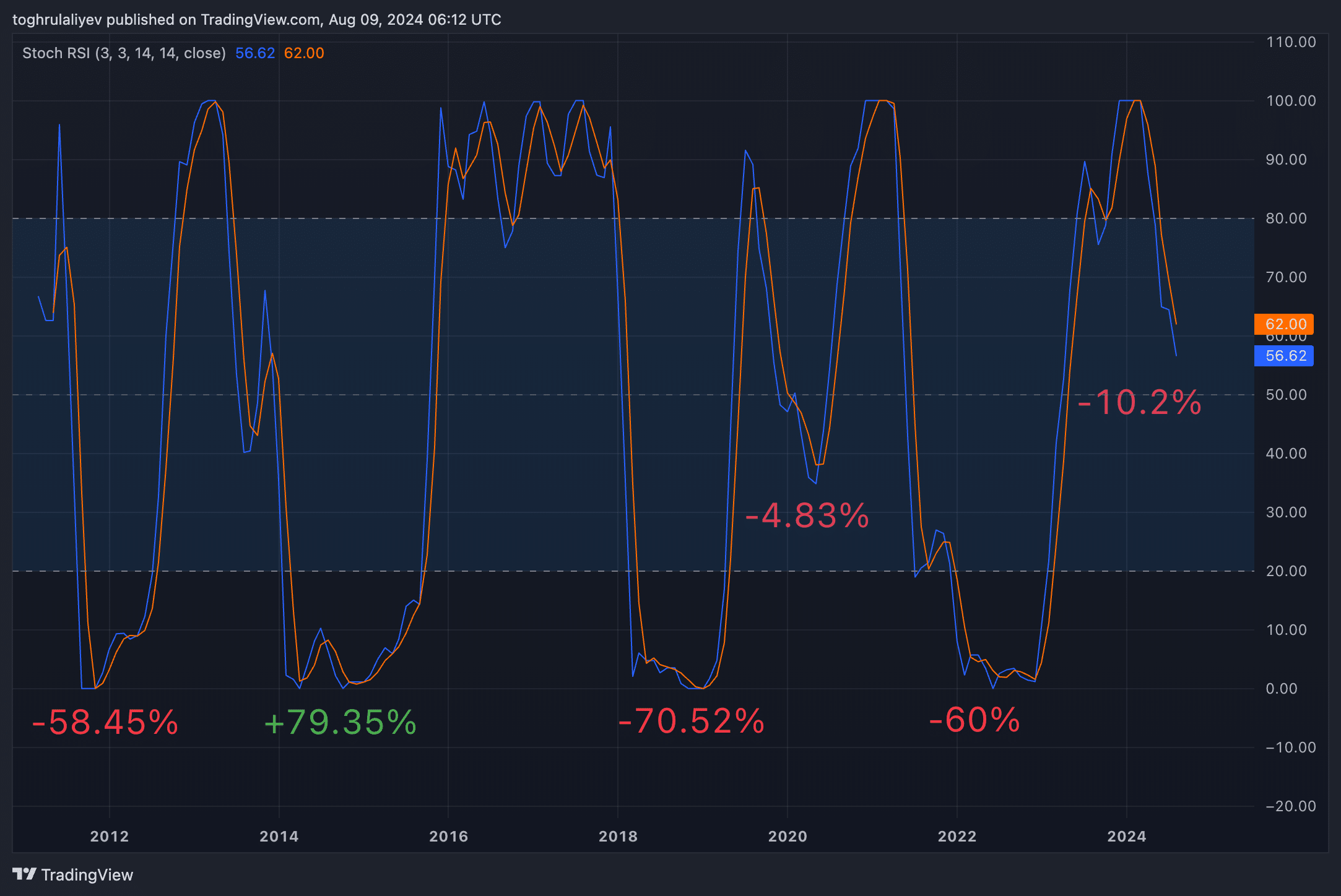

Historically, when Bitcoin’s Stochastic RSI (Relative Strength Index) line has moved beyond its upper limit during a downtrend, dipped below its lower limit indicating oversold conditions, and then later crossed above the lower band as an upward trend resumed, Bitcoin’s price usually drops. On average, from the opening price on the day of the first dip below the upper limit to the opening price on the day of the first upward crossing of the lower limit, Bitcoin has generally decreased by approximately 22.89%.

As an analyst, I prefer this method because it helps steer clear of the traps set by deceptive signals. Relying solely on the Stochastic RSI for determining peaks or valleys can be misguiding, as the indicator might suggest false bottoms where it momentarily rises before plummeting again. By adopting a sequence-based approach—first a break of the upper band, followed by the lower band, and concluding with an upward break of the lower band—my analysis achieves a higher success rate, although there’s a possibility I might join the trend slightly late.

If we disregard the unusual event from 2014-2015, the typical decline amounts to approximately 48.45%, which we can round up to about a 50% average drawdown for clarity.

At the moment, looking at a monthly perspective, Bitcoin has dropped approximately 10.2% from its opening prices. This suggests that based on past trends, the price might decrease even more, potentially reaching around $36,000 this year. However, it’s also worth considering an alternate possibility reminiscent of the last halving cycle in 2020.

In the year 2020, the Stochastic RSI didn’t dip below its lower limit, instead, it displayed an unusual pattern by first crossing above its upper band, then the middle band, and subsequently going above the middle band again as it rose. If this trend repeats itself, Bitcoin could find a steady position around $58,000 to $60,000 – a range it is currently fluctuating within. Should this prediction come true, it might signify the final notable dip for Bitcoin before the next major surge, similar to what occurred following the 2020 halving event.

Conclusion

Given the existing trends, Bitcoin may be in for a tough journey. With three out of four crucial factors pointing towards a bearish market, there’s a strong likelihood that its value could drop even more. Although the dormancy flow indicator is still within its usual range, past data indicates it might fall below the lower limit, implying that potential risks are persisting. Consequently, our view remains cautious, and we anticipate Bitcoin to remain under $60,000 until at least late September or October.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-08-12 15:35