Ah, Bitcoin. The cryptocurrency that’s more volatile than my Aunt Edna after a few too many gin and tonics. Over the weekend, it took a nosedive of 11%—thanks to none other than our favorite former president, Donald Trump, who decided to use seized BTC for reserves. Because, you know, nothing says “financial stability” like using confiscated digital currency. 🙄

On March 7, Trump signed an executive order that made Bitcoin the new hot potato in the government’s strategic reserve. It opened at a robust $90,000, only to plummet to a mere $80,751 by March 9, according to CoinGecko. But wait! It’s like a bad magic trick—it’s back up to $82,154! Down 4% in the last 24 hours, but who’s counting? 📉

It seems the market was expecting the government to swoop in and buy up BTC like it was on sale at a clearance rack. Spoiler alert: that didn’t happen. The order did leave the door open for future purchases, but only if they’re “budget-neutral.” Because, of course, we wouldn’t want to burden taxpayers with the cost of digital currency. Heaven forbid! 😅

Meanwhile, the Bitcoin price is feeling the heat from macroeconomic pressures, particularly tariffs. The trade war with China is heating up like a pot of boiling water, with Beijing retaliating against Trump’s import duties by slapping tariffs on U.S. agricultural goods. And let’s not forget Jerome Powell, the Federal Reserve Chairman, who’s taking a “wait-and-see” approach to interest rates. It’s like watching paint dry, but with more anxiety. 🎨

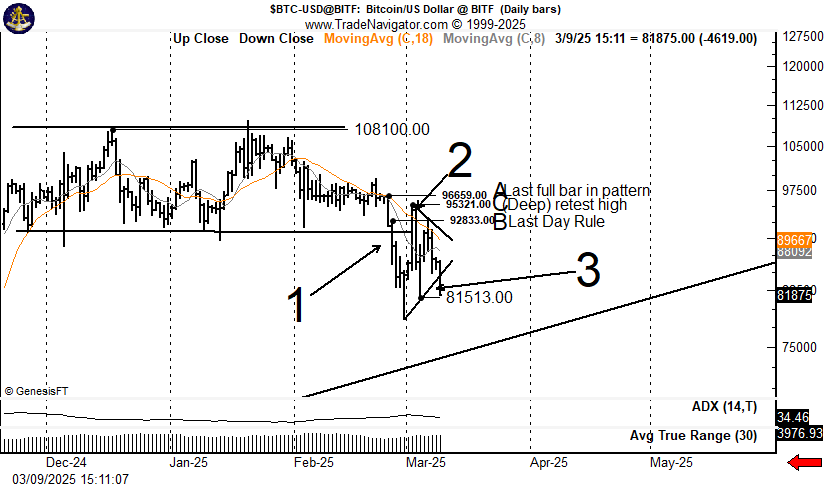

On the technical side, chart analyst Peter Brandt pointed out that Bitcoin completed a double top pattern—no, not a new dance move, but a bearish signal. After peaking at around $108,100, it broke down below key support levels. Now, if it falls below $81,513, we might as well start planning the funeral for Bitcoin’s price. 💀

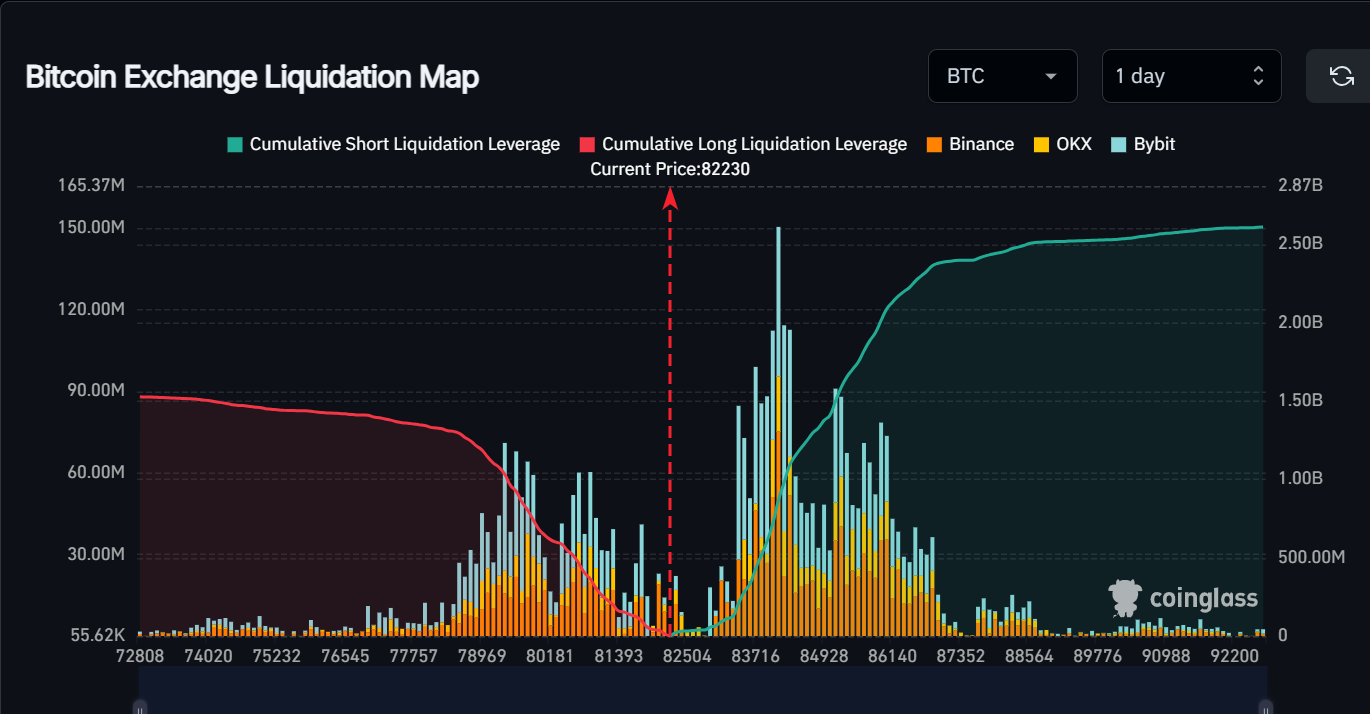

If it drops below that level, we could see around $1.3 billion in leveraged long liquidations. That’s right, folks—grab your popcorn because this is going to be a show! 🍿

Arthur Hayes, the oracle of crypto, predicts that Bitcoin will retest the $78k level. If that doesn’t hold, $75k is next on the chopping block. He’s got a lot of investors placing bets around the $70,000-$75,000 range. “If we get into that range, it will be violent,” he warns. Sounds like a fun rollercoaster ride, doesn’t it? 🎢

An ugly start to the week. Looks like $BTC will retest $78k. If it fails, $75k is next in the crosshairs. There are a lot of options OI struck $70-$75k, if we get into that range it will be violent.

— Arthur Hayes (@CryptoHayes) March 9, 2025

The Silver Lining

But wait! There’s a silver lining! Some experts believe that the Bitcoin reserve news is actually bullish in the long run. Matt Hougan, a chief investment officer at Bitwise Asset Management, told CNBC that the market is just “short-term disappointed.” Apparently, the government didn’t announce it would buy 100,000 or 200,000 bitcoins right away. Shocking, I know! 😲

Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve.

The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings. This means it…

— David Sacks (@davidsacks47) March 7, 2025

And here’s a fun fact: wallets holding over Bitcoin have accumulated almost 5000 BTC since March 3, according to Santiment. So, if the whales keep munching away, the second half of March might just be a little less bloody than the last seven weeks. Fingers crossed! 🤞

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-03-10 13:45