As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I must admit that the recent surge of Bitget Token (BGB) has piqued my interest. The price soar this week, reaching an astounding high of $4.97 and increasing by over 470% from its lowest level this year, is nothing short of remarkable.

This week, the cost of the Bitget Token kept climbing higher, despite the fact that a traditional year-end surge in the cryptocurrency market, often referred to as the “Santa Claus Rally,” has yet to appear.

The price of Bitget Token (BGB) surged to reach $4.97, representing an impressive increase of more than 470% compared to its lowest point in 2021.

It’s uncertain exactly why this increase occurred, but it may be due to its expanding influence within the cryptocurrency market. According to CoinGecko, it now ranks eighth among exchanges, with a trading volume of more than $91 billion last month.

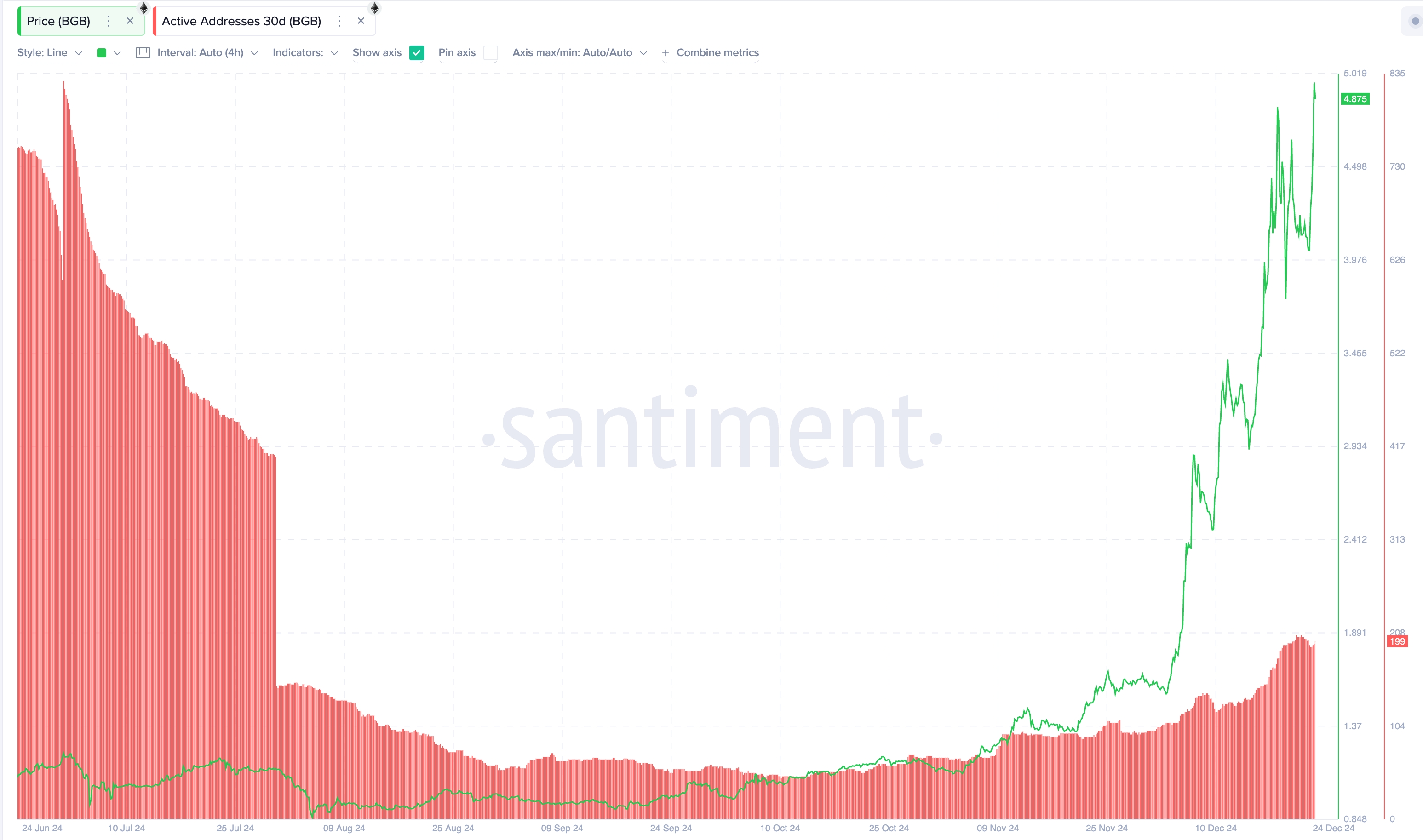

According to on-chain statistics, the recent increase in BGB’s price appears to have sparked some FOMO (Fear of Missing Out), as the number of active wallets has grown significantly. In just a month, the number of 30-day active addresses has nearly doubled, climbing from less than 100 in October to almost 200 now.

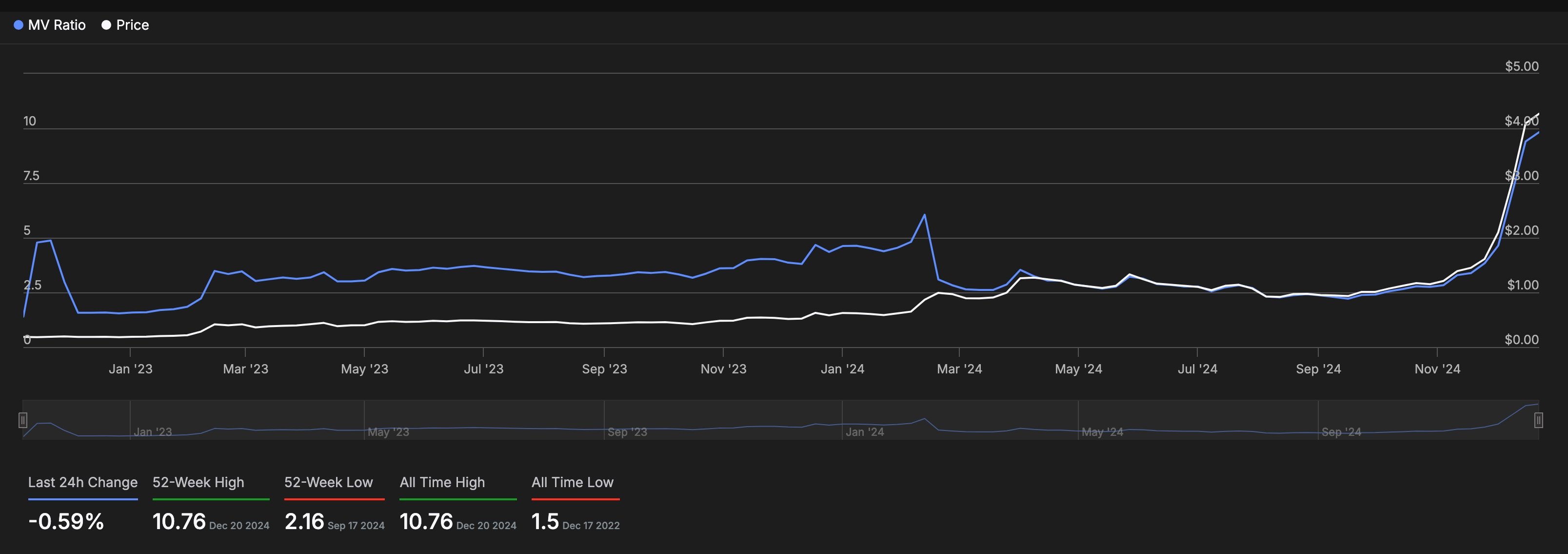

Bitget Token price MVRV indicator soars

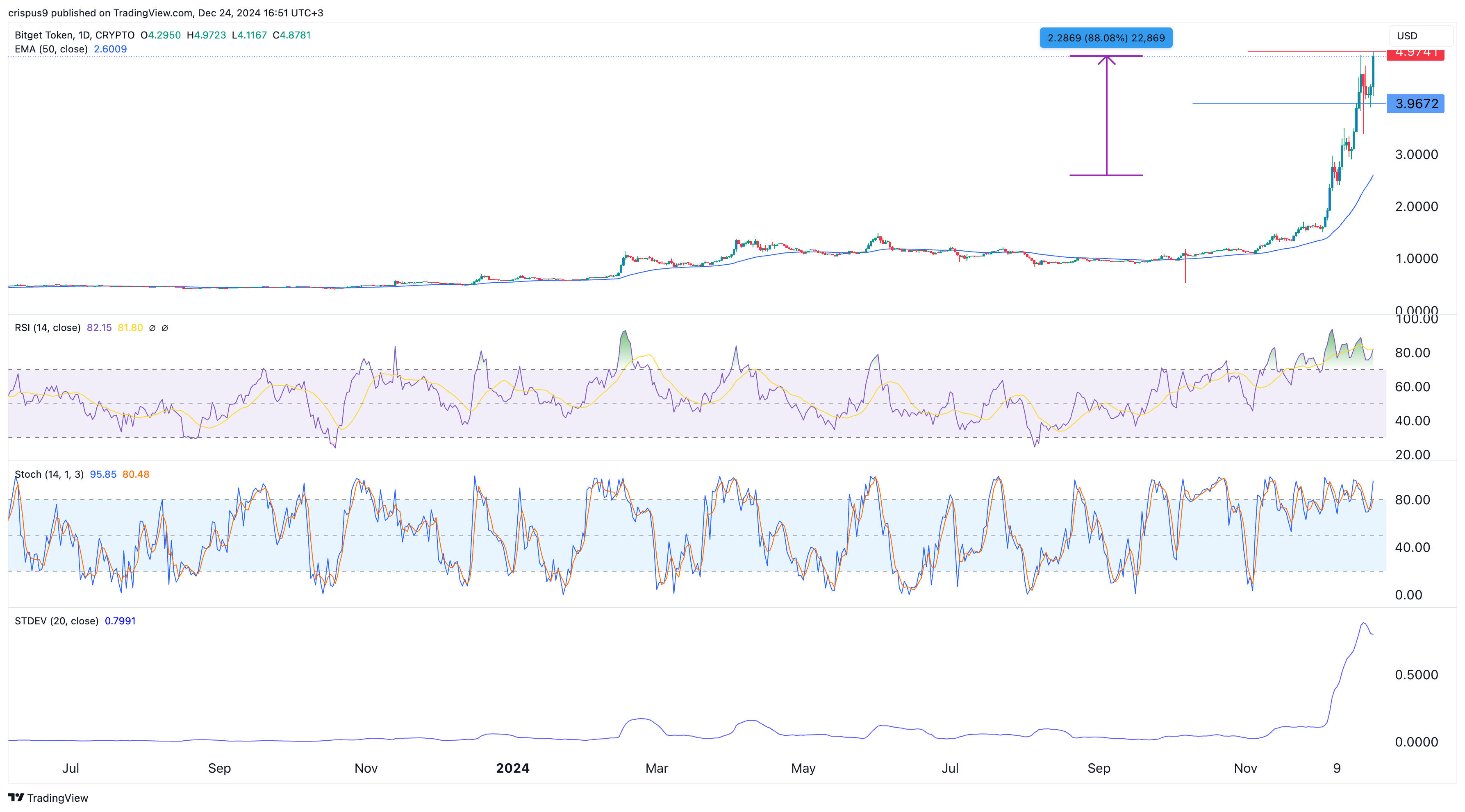

In the upcoming days, there’s a possibility that the BGB price might dip. One reason for this could be its entry into the markup phase according to the Wyckoff Method. This phase follows a prolonged accumulation period, which in this case spanned over two years. This stage typically has more supply than demand and is often preceded by further phases of distribution and discounting.

2. According to IntoTheBlock’s data, the Market Value to Realized Value (MVRV) ratio has reached an all-time high of 9.83. This widely used metric calculates the difference between a cryptocurrency’s market value and its realized value, then determines its standard deviation.

In simpler terms, when the MVRV (Market Value to Realized Value) ratio for an asset exceeds 3.8, it is considered overbought. For BGB in particular, this ratio has spiked to 9.83, indicating that it’s significantly overbought, suggesting a possible correction or pullback might occur.

BGB is overbought, and mean reversion is possible

Currently, the price of BGB might pull back due to the coin being excessively bought up. The Relative Strength Index is reaching an extremely high overbought point at 82, and the two lines on the Stochastic Oscillator are approaching 100, indicating a strong buying trend.

Additionally, it continues to surpass both the 50-day and 100-day Exponential Moving Averages significantly, sitting approximately 88% above the 50-day average. This could indicate a potential for mean reversion, a phenomenon where an asset typically returns to its moving average after deviating for an extended period. Noteworthy is that the standard deviation has reached its peak this year, suggesting increased volatility.

As a researcher analyzing market trends, I’ve noticed that coins similar to Ripple and Stellar, which have experienced significant growth, often encounter a sharp correction once investors decide to cash out their gains. Therefore, it seems plausible that these coins could experience such a reversal soon.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-24 17:42