As a seasoned analyst with over two decades of experience in the financial industry, I’ve witnessed numerous regulatory battles that have shaped the landscape of various markets. The ongoing saga between Bitnomial and the SEC is no exception, and it presents an intriguing challenge to navigate the complex world of crypto regulations.

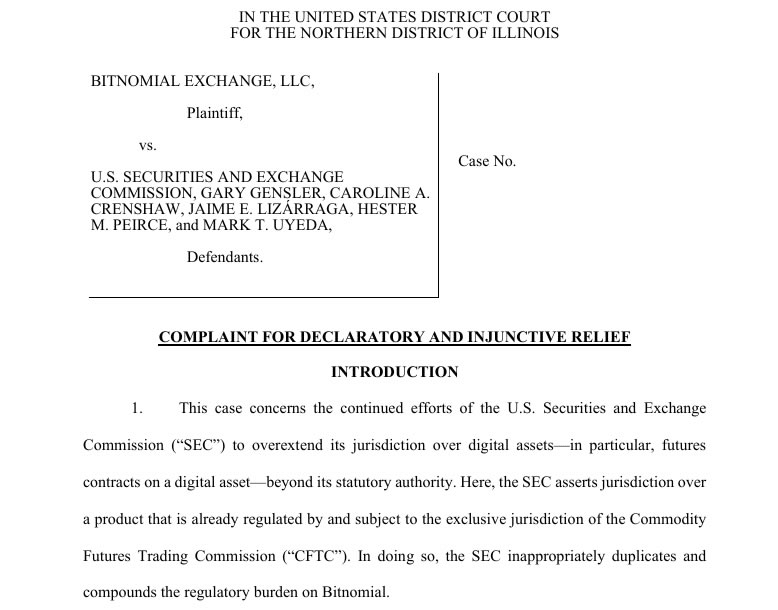

cryptocurrency platform Bitnomial has initiated a legal action against the United States Securities and Exchange Commission (SEC). This lawsuit aims to dispute the SEC’s stance that XRP futures fall under the category of securities, a classification that has sparked debate within the digital currency community.

As a researcher delving into the intricacies of digital assets, I’ve found myself grappling with the SEC’s long-held stance that XRP, the token tied to Ripple Labs, falls under the category of securities. This label carries substantial weight, as it means XRP and related financial instruments are subject to rigorous regulatory scrutiny. However, in a bid to challenge this classification, Bitnomial has filed a lawsuit, contending that XRP should not be considered a security. If successful, this would mean that the SEC would have no authority over XRP futures contracts offered by Bitnomial.

Biomnomial’s legal team asserts in their lawsuit filed on October 10 that the Securities and Exchange Commission (SEC) exceeds its jurisdiction by attempting to govern XRP futures. They maintain that XRP, similar to Bitcoin and Ethereum, should be classified as a commodity instead of a security. This classification is pivotal because commodities are within the authority of the Commodity Futures Trading Commission (CFTC), not the SEC.

This legal action further underscores the persistent debate regarding authority over digital assets between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Bitnomial anticipates that this court case will provide valuable clarity on the regulatory landscape for cryptocurrency derivative products.

The result of this court case might have significant effects on the cryptocurrency market. If Bitnomial wins, it may establish a precedent that restricts the Securities and Exchange Commission’s power to classify other digital assets as securities. This could potentially create a more advantageous regulatory landscape for crypto trading platforms and investors.

If the SEC’s classification is maintained, it may strengthen the agency’s control over more types of digital assets. This could result in enhanced regulatory oversight and higher compliance expenses for crypto businesses.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

2024-10-11 11:33