As a seasoned analyst with over two decades of experience in the tech and financial industries, I’ve witnessed countless market trends come and go. However, the surge of Bittensor (TAO) in September has certainly caught my attention. With its impressive 108% jump, it’s hard not to be intrigued by this fast-growing AI token.

In September, Bittensor, an AI-focused digital token that’s rapidly expanding, ranked as the second top-performing cryptocurrency among the first 100, with Sui taking the lead position.

TAO jumped by 108% in September

During the past month, Bittensor (TAO) experienced a significant increase of 108%, with Sui (SUI), a well-known competitor on the Solana network, soaring by an even greater margin at 115%. Remarkably, TAO has seen a massive surge of 276% since its lowest point in August, elevating its market capitalization above $4.4 billion.

As a researcher, I observed an interesting synchronization: The surge in Bittensor’s value happened concurrently with the recovery of prominent Artificial Intelligence (AI) stocks such as Nvidia, C3.ai, Alibaba, and Palantir.

As a crypto investor, I closely followed significant advancements in the artificial intelligence (AI) sector. A pivotal moment was when Alibaba announced the release of more than 100 new open-source AI models, aiming to establish itself as a dominant force within this burgeoning industry.

OpenAI’s valuation significantly increased over a two-week period, rising from $100 billion on August 30th to an impressive $150 billion by September 14th. This company, responsible for ChatGPT, has now established itself as one of the most valuable in the AI sector. Generally, digital assets associated with AI, such as Bittensor, perform favorably when the industry is experiencing growth.

After Grayscale introduced the TAO fund, Bittensor experienced a surge. This fund has amassed more than $4.1 million in assets and is currently trading at a 5.6% premium compared to its net assets. Additionally, Grayscale launched a SUI fund, which garnered $2.3 million in assets.

Over the course of this period, the need for Bittensor in the futures market significantly escalated, peaking at an all-time high of $172 million on September 30. This figure represented a substantial increase from the $46 million low recorded during September. The swelling open interest indicates that traders and investors are showing heightened interest in Bittensor.

According to on-chain information, it’s clear that the Bittensor network is expanding. The number of active user accounts has surpassed 127,000, while the total amount staked now stands at approximately 5.9 million.

According to certain experts, the potential for Bittensor’s token could increase significantly, with one analyst even forecasting a potential rise to $1,000, based on its robust technical indicators.

A different user has highlighted an imminent release of BIT001, enabling Bittensor’s subnetworks to mint their own unique tokens.

Bittensor formed a golden cross

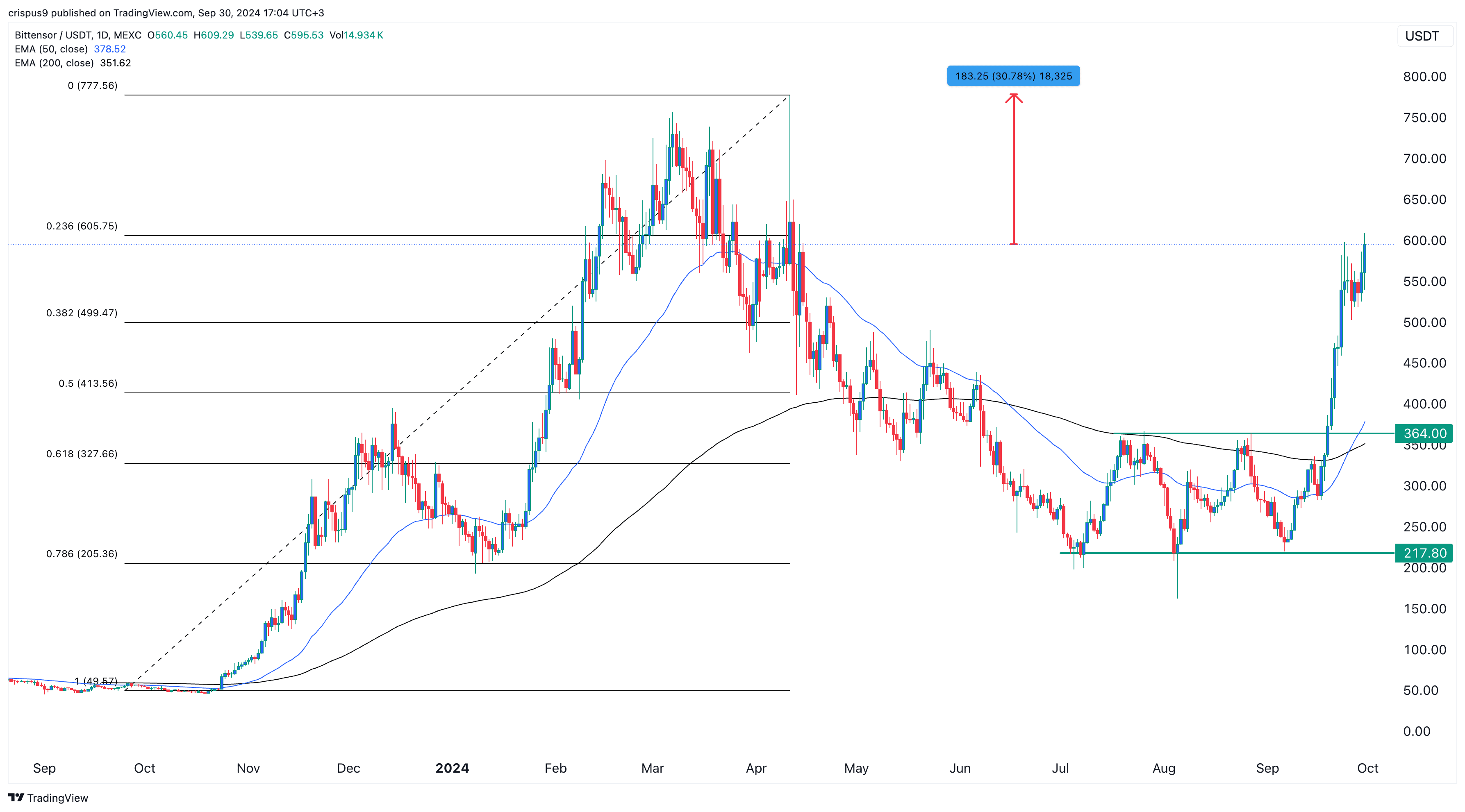

Following the formation of a triple-bottom pattern at $217, the TAO price surged past its neckline at $365, which was its peak on both July 26th and August 27th.

Additionally, Bittensor displayed a ‘golden cross’ formation when its 200-day and 50-day moving averages intersected one another.

As of September 30th, it was nearing the 23.6% pullback mark and attempting to surpass the significant price milestone at $600. If it manages to rise above that figure, it suggests potential growth up to $777 – its highest point in 2021 – which represents a 30% increase from its current value.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-30 17:26