As a researcher, I find it interesting to observe the recent trend in Bitcoin ETF investments. Last week, we saw significant outflows from spot Bitcoin ETFs, with investors withdrawing a total of $51.53 million. This was led by ARK 21Shares’ BTC ETF, which recorded $31.34 million in exits.

Based on the previous week’s trend in sentiment towards digital asset investment products, Bitcoin ETFs experienced outflows, with investors withdrawing their funds on April 29th.

Based on SoSoValue’s report, a total of $51.53 million was withdrawn from U.S.-listed Bitcoin (BTC) ETFs in a single day.

As an analyst, I’ve observed an unusual shift in the Bitcoin exchange-traded fund (ETF) market recently. While Grayscale’s GBTC fund reported net outflows of approximately $24.66 million, investors showed a stronger preference for ARK 21Shares’ BTC ETF, resulting in net inflows totaling around $31.34 million. Fidelity’s spot Bitcoin ETF also experienced outflows to the tune of $6.85 million.

As a researcher examining the recent trends in the Bitcoin Exchange-Traded Fund (ETF) market, I’ve come across some noteworthy findings. Specifically, five different issuers, among them BlackRock’s IBIT fund, have experienced no inflows during this period. This discovery is intriguing given that BlackRock has managed to surpass Grayscale as the market leader in the spot Bitcoin ETF sector. Despite debuting over a decade later than Grayscale’s GBTC, BlackRock’s offering now trails GBTC by a mere $2 billion in assets under management.

As a crypto investor following the market trends closely, I’ve noticed an intriguing development with BlackRock’s fund – it marked a four-day streak without any inflows recently. Previously, this fund had seen daily inflows for 71 consecutive days in a row, which significantly boosted its performance compared to rival funds. However, ETF expert Eric Balchunas pointed out that such trends are not uncommon on Wall Street. In simpler terms, BlackRock’s fund experienced a brief pause in investment inflows after a long period of consistent growth.

Normal occurrence: Approximately 78% of all Exchange-Traded Funds (ETFs) experienced no new investments yesterday. Extreme case: The ETF $EEM has reported zero inflows for approximately 150 consecutive days, while trading shares valued at around $80 billion. This simply indicates that natural outflows were balanced by equal inflows.

— Eric Balchunas (@EricBalchunas) April 25, 2024

Bitcoin undeterred by spot ETF outflow, post-halving price lull

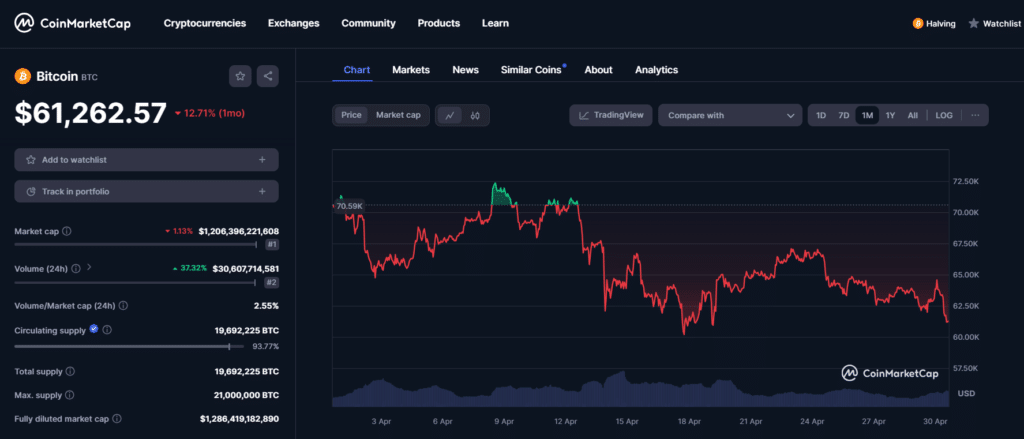

According to CoinMarketCap’s current report, Bitcoin was priced below $61,000 at the moment of check, marking a 12% decrease over the past month. This downturn could be attributed to the market adjustment in anticipation of the upcoming halving event.

In simpler terms, the value of most cryptocurrencies besides Bitcoin (BTC) has recently stopped increasing, and as a result, the overall crypto market capitalization has dropped below 2.3 trillion dollars. Additionally, the price movements of Bitcoin and the broader cryptocurrency market have been closely linked.

The sideways trend in the cryptocurrency market after a halving event is nothing new, yet there’s much debate about its current condition. In an interview with crypto.news, Sunil Srivatsa, the CEO of Storm Labs, expressed his belief that the bull market has already begun.

Based on widespread agreement, it’s believed that we’ve entered a new bull market. Experienced investors are prepared for the normal market fluctuations in the form of corrections. Exciting times lie ahead with potential interest rate reductions on the horizon and the long-anticipated approval of an ETH Exchange-Traded Fund (ETF) coming up.

Sunil Srivatsa, Storm Labs CEO

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-30 17:14