As a seasoned researcher who has witnessed the rise and fall of numerous market trends, I must admit that the events surrounding Bitcoin following Donald Trump’s election victory were quite intriguing. The unprecedented trading volume seen by BlackRock’s iShares Bitcoin Trust (IBIT) on Nov. 6 was nothing short of astonishing, outshining even the volumes of major stocks like Berkshire Hathaway, Netflix, and Visa.

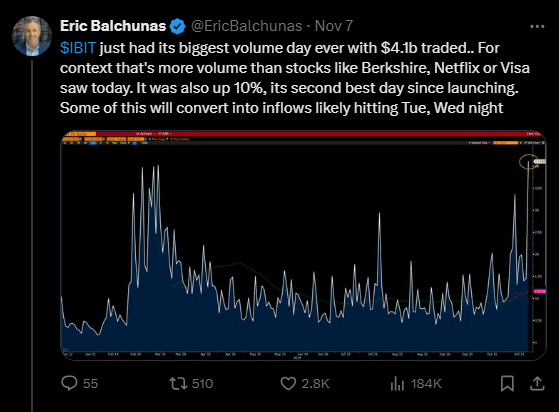

On the day of Donald Trump’s victory in the U.S. presidential election, the iShares Bitcoin Trust (IBIT) experienced a record-breaking surge in trading activity, with daily trades amounting to over $4.1 billion on November 6th.

As a researcher, I recently observed an interesting trend in the market. According to my analysis based on Bloomberg ETF analyst Eric Balchunas’ findings, Invesco BulletShares 2025 High Yield Corporate Bond ETF (IBIT) experienced its busiest trading day since its launch, surpassing the volumes of well-established stocks such as Berkshire Hathaway, Netflix, and Visa. To add to this, Balchunas mentioned that this surge in trading activity resulted in a 10% price increase for IBIT, making it the fund’s second-highest gain since its inception.

Other Exchange-Traded Funds (ETFs) focused on Bitcoin experienced significant increases as well, with daily trading volumes nearly doubling their usual amount during a period of heightened optimism concerning Bitcoin’s future potential. On November 6th, the price of Bitcoin peaked at an unprecedented $76,500, only one day after the pro-cryptocurrency candidate Donald Trump won the presidential election. Later on, the price slightly decreased to $75,267, as reported by TradingView.

In a recent article, the president of ETF Store, Nate Geraci, emphasized Bitcoin’s significant influence among ETF launches in 2024, as Bitcoin-related products accounted for six out of the top ten new ETF introductions that year.

Investment managers are increasingly looking towards a more expansive cryptocurrency ETF market, filing proposals for products such as altcoins like Solana, XRP, and Litecoin, in addition to diverse crypto index ETFs. Balchunas compared these applications to “options on a Trump victory,” indicating the optimistic outlook in the crypto market regarding favorable regulations under the incoming administration.

In the future, it’s anticipated that Bitcoin’s upward trend will persist, as per Copper.co’s head of research, Fadi Aboualfa, who predicts a possible price reaching $100,000 by the time Donald Trump is inaugurated on January 20th.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-08 15:32