As a seasoned analyst with decades of experience navigating global financial markets, I must admit that yesterday’s Bitcoin trading frenzy was nothing short of breathtaking. The record-breaking volume on BlackRock’s iShares Bitcoin Trust (IBIT) surpassing that of heavyweight stocks like Berkshire, Netflix, or Visa is a testament to the burgeoning power of digital assets in our rapidly evolving financial landscape.

Yesterday marked the all-time highest trading volume for BlackRock’s iShares Bitcoin Trust (IBIT), with an astonishing $4.1 billion exchanged in a single day. This unprecedented activity occurred immediately following Donald Trump’s victory in the U.S. presidential election, sparking significant enthusiasm in the Bitcoin market.

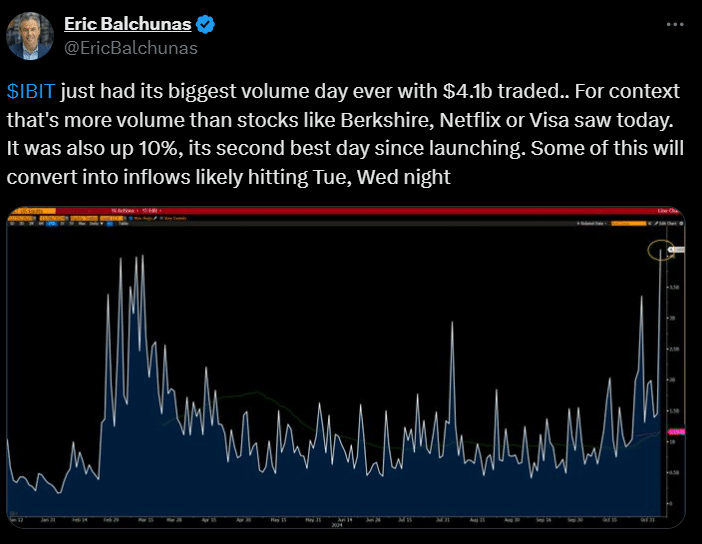

As stated by Bloomberg analyst Eric Balchunas, IBIT’s trading volume exceeded that of companies such as Berkshire Hathaway, Netflix, and Visa. Furthermore, within the initial 20 minutes of market opening, a staggering $1 billion worth of trades were executed in IBIT.

On November 6th, IBIT experienced its second-highest trading volume since its launch in January, marking a 10% increase compared to regular days. However, despite the significant growth, the fund recorded an outflow of $69 million, indicating that more shares were sold than bought on that particular day.

Conversely, significant investments were made into other significant Bitcoin ETFs. Specifically, Fidelity’s Bitcoin ETF, FBTC, attracted the largest amount with an inflow of $308.7 million, followed by ARK Invest’s ARKB with $127 million. Additionally, funds from Grayscale and Bitwise recorded over $100 million each in inflows. Collectively, U.S. spot Bitcoin ETFs experienced a total net inflow of $622 million, breaking a three-day trend of outflows.

Yesterday, the combined trading volume of Bitcoin ETFs in the U.S. reached a staggering $6 billion, more than doubling their daily average. Balchunas remarked that this made it an exceptionally strong day for a burgeoning sector that never fails to surprise.

According to ETF specialist Nate Geraci from The ETF Store, he anticipates that investments into Bitcoin ETFs may keep increasing, with a projection that total net investments in these funds will exceed one billion dollars before the week concludes.

The price of Bitcoin reached an all-time high surpassing $75,000 after Donald Trump won against Kamala Harris in the election. Known to be supportive of cryptocurrency, Trump has pledged potential changes beneficial for the sector. These include appointing a new chair for the Securities and Exchange Commission, establishing a crypto advisory council, and endorsing U.S. Bitcoin mining.

In contrast, international markets responded diversely. Certain BlackRock iShares ETFs based in Asia and South America experienced declines. This might be attributed to apprehensions about Donald Trump’s trade policies, as these could potentially influence global markets.

Yung-Yu Ma, head of investments at BMO Wealth Management, pointed out that although the U.S. economy appears robust, international markets could be significantly influenced by tariff policies.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Hero Tale best builds – One for melee, one for ranged characters

- USD CNY PREDICTION

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- EUR CNY PREDICTION

- Roblox: Project Egoist codes (June 2025)

- Brent Oil Forecast

2024-11-07 11:32