As an experienced financial analyst, I believe the recent outflows from Bitcoin ETFs, specifically BlackRock’s iShares Bitcoin Trust (IBIT), signify a growing sense of caution among investors. The $36.9 million outflow recorded on May 1st is a significant departure from the inflows we have seen in the past, and it marks a new trend that warrants attention.

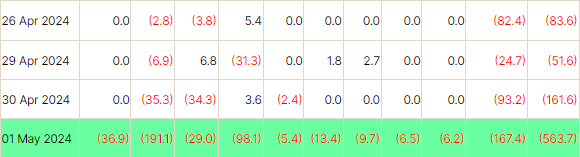

On May 1, 2023, BlackRock’s iShares Bitcoin Trust (IBIT) recorded its initial day of net redemptions, with approximately $36.9 million being withdrawn. This represents a new high for outflows among US Bitcoin exchange-traded funds (ETFs).

According to initial data from Farside Investors, among the nine Bitcoin ETFs besides Hashdex Bitcoin ETF (DEFI), a total of $526.8 million was withdrawn. Notably, DEFI showed no inflows or outflows during this period.

Approximately $191.1 million was withdrawn from the Fidelity Wise Origin Bitcoin Fund (FBTC), making it the fund with the largest outflow. The Grayscale Bitcoin Trust (GBTC) experienced an outflow of around $167.4 million, which ranked second in magnitude.

As a crypto investor, I’ve noticed an intriguing contrast in the gold ETF market this year. Despite iShares Gold ETF and SPDR Gold ETF experiencing significant outflows of $1 billion and $3 billion respectively, gold’s value has remarkably increased by 16% year-to-date.

The substantial withdrawals from Bitcoin ETFs during market fluctuations demonstrate investors’ increased caution, contrasting the persisting value growth of gold amid its own outflows.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-02 11:01