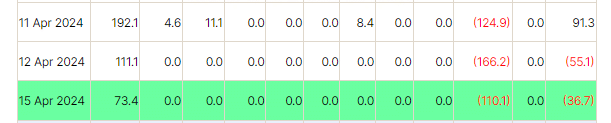

On April 15, BlackRock’s iShares Bitcoin Trust (IBIT) saw net investments of $73.4 million, even though this was a decrease from the $110.1 million inflow experienced the day prior, based on information from Farside Investors.

Over the last two days, IBIT was the sole U.S. Bitcoin fund to attract investments, while other ETFs, with the exception of Grayscale’s, saw no new inflows or even decreases.

Despite IBIT experiencing inflows, it fell short of the GBTC’s outflows of $110.1 million on April 15, which had been larger at $166.2 million the previous day. The net result was that all 10 Bitcoin spot ETFs experienced outflows totaling $91.8 million over the two days.

During the past week, Bitcoin’s price dropped by 11.7% to reach $62,743, which aligns with the cryptocurrency’s recent market instability. Additionally, global investment products related to Bitcoin experienced outflows totaling $126 million by April 12. According to James Butterfill from CoinShares, this trend indicates that investors are currently exercising caution.

On April 20th, the bitcoin supply will be reduced by half during the next halving event. This development creates apprehension among traders, as they speculate about potential price fluctuations in response.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-16 09:08