On this fateful day, March 6, 2025, the behemoth known as BlackRock, the titan of asset management, decided to dip its toes into the wild waters of cryptocurrency. With a flourish, they snatched up 432 shiny Bitcoins through their iShares Bitcoin ETF, as if they were collecting rare coins from a dusty old shop.

According to the wise sages at Lookonchain, this little shopping spree cost them a cool $38.9 million, at a price of $90,046 per Bitcoin. Now, with this latest haul, BlackRock’s treasure chest of Bitcoin swells to a staggering 572,658 BTC, worth about $51.57 billion. Yes, you read that right—billion with a ‘B’! 💸

But wait, there’s more! Back in December, they went on a bit of a binge, purchasing $1 billion worth of Bitcoin in just 48 hours. They might have snagged 9,695 BTC at the time when the price was a jaw-dropping $103,187.94. Talk about a shopping spree that would make even Santa Claus jealous! 🎅

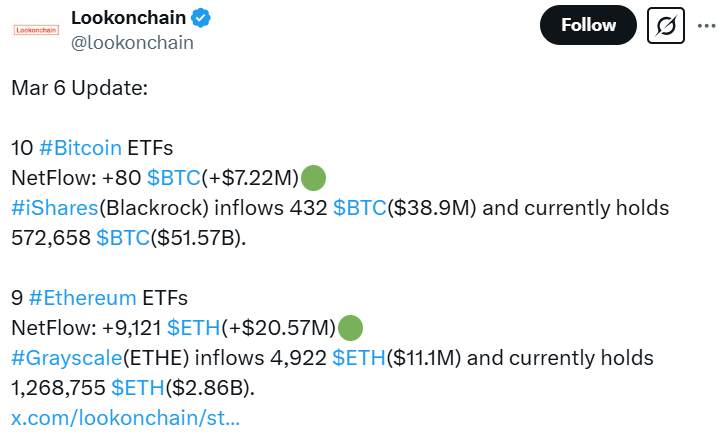

Lookonchain also pointed out that Bitcoin ETFs saw a net inflow of +80 BTC ($7.22M), with BlackRock leading the charge, showcasing a rising tide of institutional confidence. Meanwhile, Ethereum ETFs were not to be outdone, recording +9,121 ETH ($20.57M) inflows, with Grayscale’s ETHE adding 4,922 ETH ($11.1M) to its already hefty 1.27M ETH ($2.86B) holdings. It’s like a game of Monopoly, but with real money! 🤑

And let’s not forget MicroStrategy, who also joined the party, acquiring 7,633 BTC between February 3-9, 2025, for a staggering $742.4 million at an average price of $97,255 per BTC. This brings their total to 478,740 BTC, purchased for $31.1 billion at an average cost of $65,033 per BTC. It’s a Bitcoin buffet, and everyone’s invited! 🍽️

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Pi Network (PI) Price Prediction for 2025

2025-03-06 23:09