Ah, the grand spectacle of BlackRock, that financial behemoth, plunging headfirst into the choppy waters of Bitcoin, as if it were a refreshing plunge into a pool of liquid gold, despite the tempestuous market winds swirling around. 🏊♂️💰

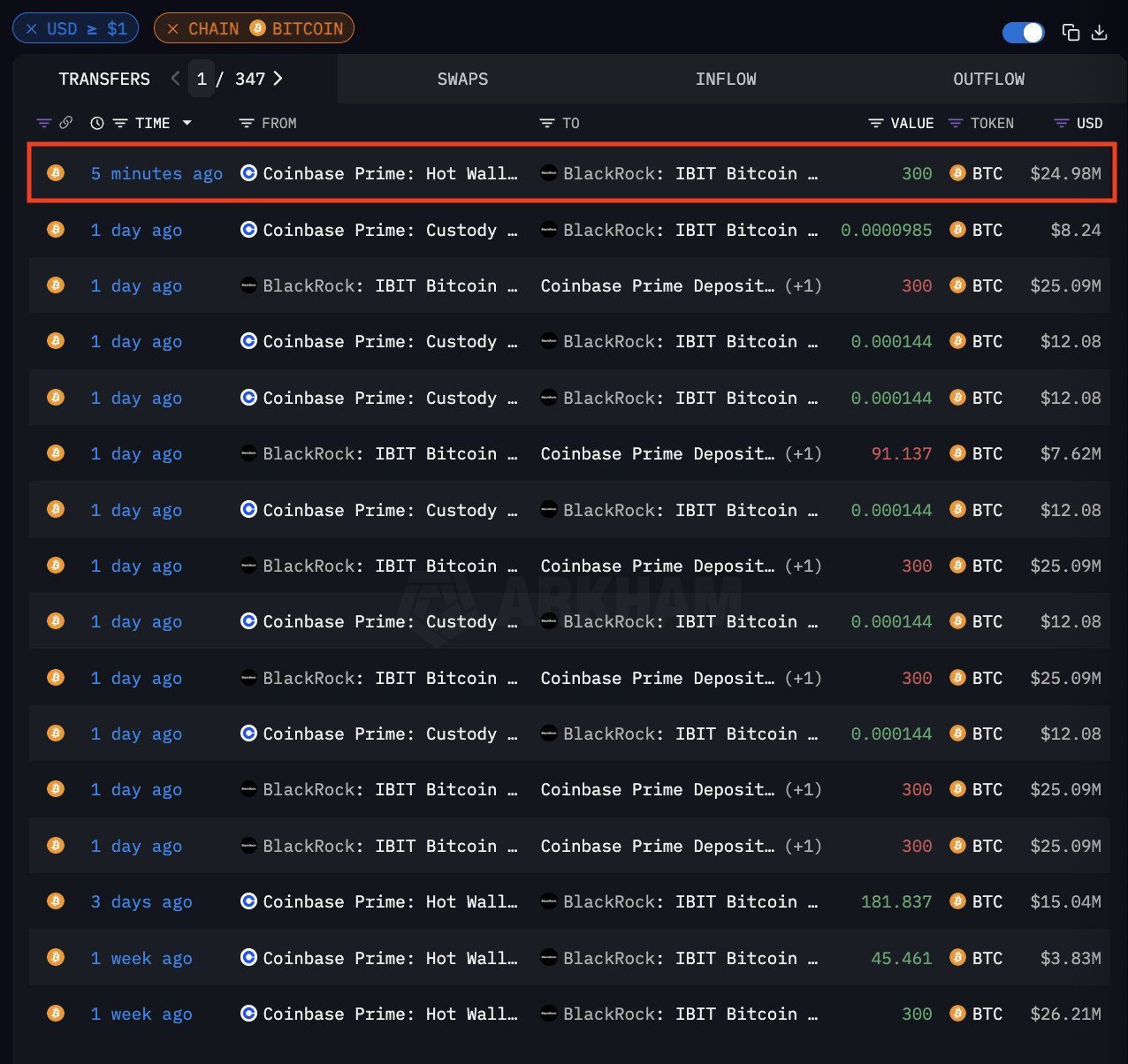

According to the ever-watchful eyes of Arkham, BlackRock’s spot ETF, IBIT, has just gobbled up another $25 million worth of Bitcoin, as if it were a gourmet delicacy at a lavish banquet. 🍽️

As Bitcoin flirts with the tantalizing figure of $83,300, it has managed to gain a modest 1% on Friday, while the Nasdaq 100, poor thing, has been on a rollercoaster of despair, suffering a second day of sharp declines, all thanks to the newly announced trade tariffs. 🎢

With the Nasdaq now down over 16% year-to-date, and Bitcoin having dipped nearly 12% in the same timeframe, one might wonder if the digital currency is the tortoise to the Nasdaq’s hare, outpacing it in the long run. 🐢💨

BlackRock’s relentless accumulation of Bitcoin is a testament to its unwavering faith in this digital marvel. This conviction was echoed earlier this year by the illustrious CEO Larry Fink, who, in his annual shareholder letter, raised a clarion call about the U.S. dollar’s waning global dominance. 📉

With a national debt ballooning like a hot air balloon at a fair and geopolitical risks lurking like a cat in the shadows, Fink warned that Bitcoin might just become the shiny new store of value, outshining the old dollar. He also cautioned that decentralized finance could very well gnaw at the U.S.’s economic edge, like a persistent mouse nibbling at a cheese platter. 🧀

Is Bitcoin the New Safe Haven?

Despite Bitcoin’s recent escapades in outperforming traditional equities, the debate rages on: does it serve as a risk-off asset? Historically, Bitcoin has danced in sync with other risk assets, showing a strong correlation with stocks, much like a couple at a prom. 💃🕺

Bloomberg’s ETF analyst, the ever-astute Eric Balchunas, chimed in, suggesting that Bitcoin should not be sold as a hedge against anything but inflation and monetary debasement. “It is 100% hot sauce,” he quipped, adding that while it may not be a safe haven, IBIT is still basking in a glorious 78% increase since its launch just over a year ago. 🌶️

Yeah IMO the issuers should not sell it as a hedge to anything except the global money printer. It is 100% hot sauce, which is not a bad thing IMO, but if you go in knowing that then no chance of surprise. And btw $IBIT is STILL up 78% since launch barely over a year ago.

— Eric Balchunas (@EricBalchunas) April 4, 2025

As institutions like BlackRock continue to throw their weight behind Bitcoin, the perception of this digital asset may evolve — not merely as digital gold, but as a potent, albeit capricious, tool in an increasingly uncertain macroeconomic landscape. 🌍💸

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2025-04-05 15:46