As a seasoned crypto investor with a keen eye on market trends, I’ve seen my fair share of ups and downs in the world of Bitcoin ETFs. The latest news about significant capital outflows from various spot Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust ETF (IBIT), is a cause for concern.

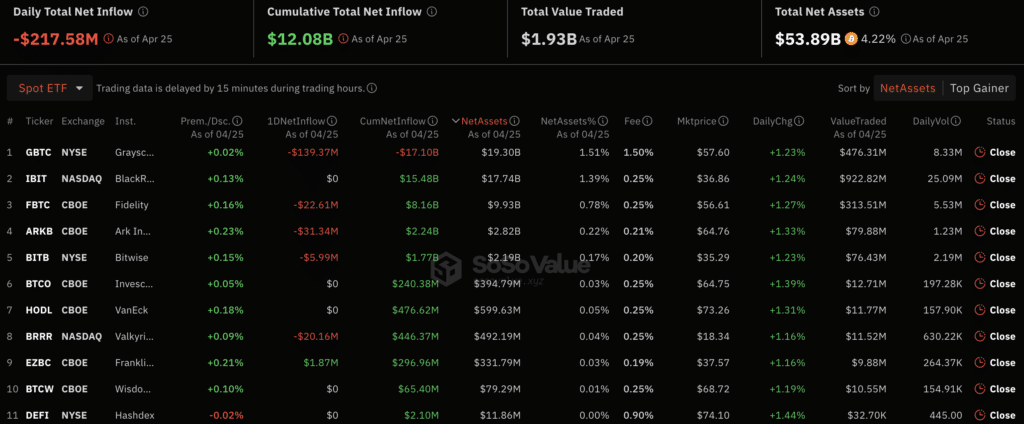

As a crypto investor, I’ve noticed that the Bitcoin spot ETF sector has taken a turn for the worse once more. On April 25 alone, there was a significant outflow of funds to the tune of $217 million.

As a crypto investor following the market closely, I’ve noticed an intriguing pattern emerging with some ETFs, including BlackRock’s iShares Bitcoin Trust ETF (IBIT). According to SoSo Value’s latest data, no funds have been moved in these five specific ETFs for two consecutive days. Surprisingly, IBIT has not experienced any inflow of capital for the second day running.

As a researcher studying the recent trends in Bitcoin Exchange-Traded Funds (ETFs), I’ve noticed an intriguing development. Besides the Grayscale Bitcoin Trust ETF (GBTC), there have been outflows reported in four other funds. Specifically, Fidelity Investments and ARK Invest/21Shares were among those experiencing these outflows.

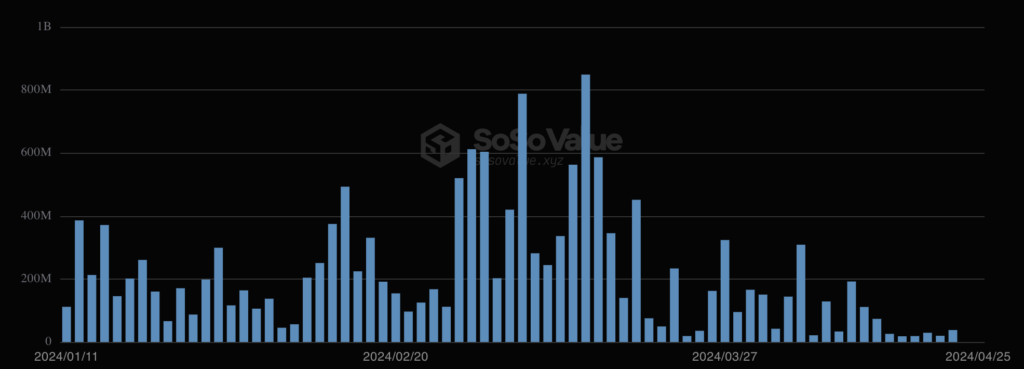

As a crypto investor closely following the market trends, I’ve noticed that IBIT has consistently been among the top 10 ETFs with robust capital inflows for an extended period. However, starting from early March 2024, there’s been a noticeable decrease in the amount of capital flowing into this fund.

The inflow of capital into Bitcoin spot ETFs has noticeably decreased in the past few weeks, according to the average volume. However, Bitwise CEO Hunter Horsley reveals that some major institutional investors are clandestinely readying themselves to pour substantial amounts of money into crypto-related financial instruments.

Horsley firmly believes that introducing a fresh category of digital assets could make the crypto market all the more appealing to potential investors.

By the year 2024, it will be astonishing to see how many wealth management firms have acquired a bitcoin Exchange-Traded Fund (ETF). These firms are knowledgeable and well-informed, and they’re all expressing strong belief in Bitcoin. Importantly, their investment strategies focus solely on buying assets, not short selling or other forms of hedging. Bitcoin ETFs will become an impressive addition to the diverse portfolios of these financial institutions.

— Hunter Horsley (@HHorsley) April 20, 2024

In the last week, there’s been a noticeable decrease in demand from institutional investors for cryptocurrency-related products. According to CoinShares analysis, approximately $206 million was taken out of these investment vehicles during this period.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-26 17:06