As a seasoned analyst with years of experience in the tech industry, particularly with IBM and now delving into the blockchain realm, I find myself deeply entrenched in the dynamic world of dApp development. The potential for innovation is palpable, yet the current state of fragmentation and vendor lock-in presents a significant challenge to the long-term progress of this technology.

In the realm of blockchain technology, no individual entity, influential group, or ideological party holds exclusive control or influence. Instead, the industry encompasses diverse perspectives, some favorable, others critical. However, amidst these differences, there exists a common goal: to foster widespread acceptance and adoption of this technology on a mass scale.

More people, businesses, and communities must benefit from crypto and blockchain tech worldwide. To achieve this fully, anyone should be able to build high-quality dApps and on-chain tools. Devs must have the freedom to express themselves in any language and on any chain. They should be able to build once and deploy anywhere.

Although it appears that institutions and governments are becoming more interested in cryptocurrencies now, this interest often serves personal gains. The ‘crypto-friendly’ environment we see today may not last for five years, according to Vitalik Buterin. What makes a good dApp (decentralized application) is its embodiment of the core principles and possibilities of blockchain technology. Once developed, these applications can continue to benefit the community based on pre-set rules that are resistant to censorship—even if the original developer is no longer present, like with Bitcoin (BTC).

As a researcher immersed in the realm of cryptocurrency, I find that the ultimate objective lies in strengthening both developers and users alike. It’s crucial to ensure that no singular interest or ideology, be it political or technological, dictates our course. In essence, crypto embodies the spirit of liberty—liberty from intermediaries and censorship, liberty to articulate thoughts and ideas through coding.

DApps make blockchain real—and valuable

To move blockchain technology beyond its current speculative phase and into widespread, everyday use by the masses, it needs to address genuine, practical issues faced by individuals. Unfortunately, the surge in financial skepticism and meme coin popularity suggests that many people prioritize speculation over fundamental values.

Yet speculation without actual underlying value is unsustainable. Only those apps and platforms that generate value through fees, transaction volumes, etc., will still be around in ten years or more. As of August 7, 2024, Uniswap, for example, collected about $13 million in weekly fees—that’s hundreds of millions in annual revenue. With the 10x price-to-earnings heuristic often applied to high-growth tech companies, it seems Uniswap (UNI) $4.5 billion valuation is on par, and the market is pricing it appropriately.

As a crypto investor, I’ve come to appreciate the transformative role that DApps play in our space. They democratize the use of blockchain technology, empowering ordinary users like myself with the power of unalterable code that operates without the need for intermediaries. This means that activities such as trading, lending, gaming, and even services like rideshares can all be executed transparently, ensuring that value is not surreptitiously or unfairly extracted by any single entity.

Initially, cryptocurrencies emerged from Bitcoin and had a strong association with money, leading to disruptions in the financial sector as the first industry impacted. However, the growing trend of decentralized gaming, social platforms (DeSoc), physical infrastructure (DePIN), AI, and other applications on affordable and high-speed networks like Binance Smart Chain or Solana demonstrate that this technology has a far broader reach than just reshaping financial goods and services.

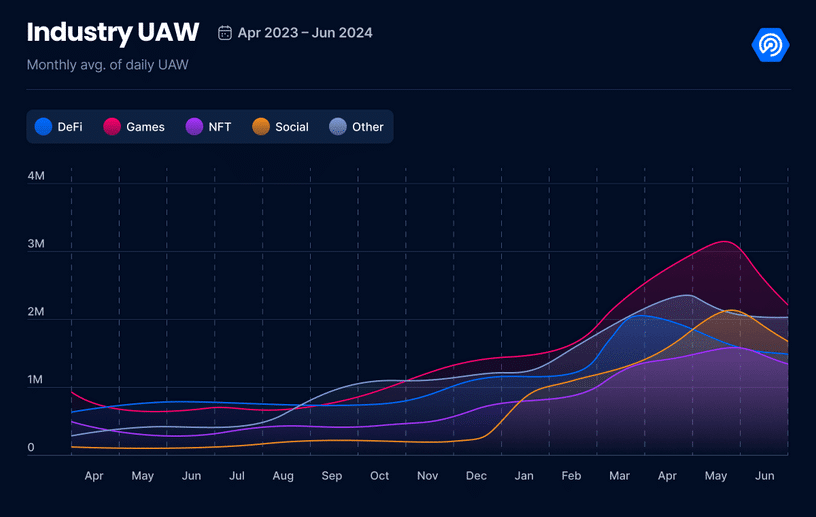

Due to this trend, there’s been a significant increase in the need for decentralized applications (dApps) worldwide. In fact, the number of unique wallet interactions per day hit a record high during Q2 of 2024.

It took landline telephones 99 years to reach their highest level of use, while automobiles managed it in 78. Conversely, computers reached 89% usage in just 24 years. Interestingly, social media and tablets accomplished a similar feat much faster – within 14 and 7 years respectively.

As someone who has witnessed the evolution of technology over the past few decades, I can attest to the fact that newer technologies are indeed being adopted at a faster pace than their predecessors. In my personal and professional life, I have seen this trend play out multiple times – from smartphones becoming ubiquitous in just a matter of years to social media platforms reshaping how we communicate and share information.

From user-friendly graphical interfaces to making backend components frictionless/invisible to end-users, dApps are inevitable. And those who say blockchain needs more dApps and less infra are quite right from this view.

Anywhere, anytime, all at once

In the expanding world of cryptocurrency, a influx of gifted developers has emerged, some hailing from tech giants like Google, Meta, IBM, and so forth, such as the founders at Aptos and Sui, to name a few. This influx has led to remarkable advancements. Rising like a phoenix from the remnants of Diem and SVM from FTX are two noteworthy examples of this new generation of developers opting for alternatives to the traditional Ethereum Virtual Machine (EVM) framework. Lowering the hurdles for decentralized application (dApp) development is crucial now to foster the growth of more projects.

For a long time, the Ethereum Virtual Machine has been the only standard available to blockchain developers. Along with Solidity, the EVM was built to deploy and run custom programs on Ethereum. Likewise, there is ‘Solana VM’ on Solana, ‘Move VM’ on Aptos or Sui, Web Assembly on Cosmos, etc. Although these are great innovations with many merits, they have caused fragmentation and vendor lock-in. EVM-based dApps can’t run natively on Solana, and SVM-based dApps can’t use Ethereum, Binance Smart Chain, or other EVM-powered platforms.

Simplifying deployment of decentralized applications (dApps) across numerous blockchains is quite challenging and often impractical, mainly due to high costs. To elaborate, developers are required to manage multiple codebases which increases complexity and workload significantly. Consequently, truly multi-chain and interoperable dApps are rare. Notable exceptions include AAVE and Pancakeswap, as they have the means for multi-chain deployment. However, even these projects struggle with innovation in non-EVM code due to high costs and time constraints. Furthermore, users often find themselves locked into specific vendors, requiring them to use multiple wallets and handle assets from diverse ecosystems because their preferred dApp, wallet, or token does not support the new chain they wish to utilize.

Developers yearn for liberation from these walled gardens to foster the future growth of blockchain technology. Ideally, they should construct an app that can be accessible to users across various platforms, categories, and virtual machines – not just one specific one. Similarly, users seek this same freedom.

Translating this to simpler terms: Creating wallets, chains, and even virtual machines (VMs) that can be adapted is a practical approach. This flexibility allows developers to create decentralized applications (dApps) using any programming language on any VM and run them across various other chains or VMs. Best of all, it can be done with minimal or no extra costs and without compromising security.

Simplifying complexities will make it simple for anyone to construct resilient decentralized applications (dApps) with just a few clicks. This could revolutionize everything. Web3 is expected to match the speed and efficiency of web2 once the mass market embraces container technologies such as Kubernetes, which eliminated the issue of public cloud vendor lock-in. Furthermore, developers will be able to select different chains or platforms for various dApp features depending on specific requirements, like using Solana for high-frequency transactions, Ethereum for final settlement and data availability, and so forth.

Solving vendor lock-in will improve the developer and end-user experience. Everyone can reap the benefits of the underlying tech stack and that’s the path to mass adoption. More dApps can enter the market than ever before. All of them won’t be great. But the more there are, the higher the chances of finding the next gamechanger.

Alejo Pinto serves as both co-founder and chief growth officer at Pontem Network, a cutting-edge product development studio. This innovative team is dedicated to creating Move, SVM, and EVM-compatible products that aim to simplify web3 for developers and users alike. With a rich history in the tech sector, Alejo brings valuable expertise garnered during his tenure at IBM, where he honed his skills in blockchain technology applications.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-15 14:35