As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The recent surge in BOME, the third-largest meme coin, has caught my attention, not just because of its impressive 25% rise in a single day, but also due to the broader context of the crypto market.

As a researcher observing the cryptocurrency market, I noticed an impressive surge in the value of BOME, the third-largest meme coin, on October 14th. This increase in value can be attributed to the recovery of Bitcoin, which returned to levels similar to those at the start of last week.

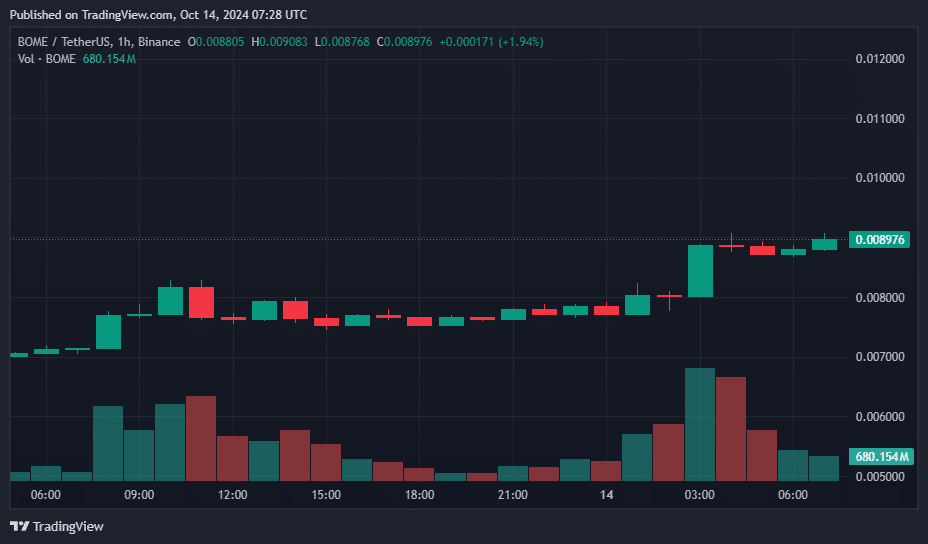

In the past day, The Book of Meme (BOME), a cryptocurrency built on the Solana network that focuses on memes, has experienced a significant increase of more than 25%. This surge has pushed its value up to $0.008841, which is its highest point in the last two months, as reported by crypto.news.

The significant increase in BOME‘s price caused its market capitalization to soar to an impressive $610 million, making it the 131st largest digital asset. Furthermore, the daily trading volume experienced a substantial rise of more than 195%, reaching a staggering $928 million. The majority of this activity was observed on Binance, with Gate.io and Bitget trailing closely behind.

At the same time, the amount of contracts held open in future markets saw a substantial rise. According to CoinGlass, the open interest for BOME futures reached an all-time high of $131.12 million, nearly doubling from its previous low of $57 million last week.

The rally took place at the same time that the overall market was surging, with Bitcoin (BTC) and various other cryptocurrencies experiencing significant price hikes. As a result, the global crypto market experienced a growth of 2.6%, climbing from $2.27 trillion to $2.33 trillion.

Based on data from CoinGlass, a recent surge resulted in approximately $167.2 million worth of liquidations. Out of this total, around $101.6 million was due to short traders. This indicates that numerous investors might have been taken aback by the bullish trend, as they had positioned themselves against the increasing prices, essentially betting on a decline.

A rapid increase in liquidations might have added to the price increase since it compelled those with short positions to close them, thereby amplifying the market’s momentum.

The general opinion towards BOME in the community is optimistic, as shown by 71% of 3,792 traders on CoinMarketCap anticipating short-term price increases. Furthermore, the outlook for cryptocurrency X has also become more positive, with various analysts and traders forecasting robust upward trends for altcoins.

Based on insights from the pseudonymous trader known as Bluntz, BOME has managed to surpass a crucial daily resistance level of $0.0085, a hurdle it had been finding difficult since August 24th. He expects continued growth for this meme coin, buoyed by an uptick in daily trading activity and the recent positive trend in Bitcoin’s price movement.

A different investor pointed out that the price of BOME seemed to have burst through a descending triangle on the daily graph, which is often seen as a positive sign. They suggest that this digital currency might reach heights up to 80% to 120% higher than its current value range.

As a researcher, I’ve observed an intriguing alignment: my work on BOME seems to coincide with a significant jump in the worldwide meme coin market. Over the past 24 hours, this sector has experienced a 1.4% growth, as reported by CoinGecko. This surge has propelled the total market capitalization of all tracked meme tokens to surpass an impressive $57.6 billion.

As an analyst, I expressed in a post on October 11th that based on my observations, the altcoin market appears to be entering a prolonged period of upward momentum, or what I refer to as an “up-only season.” This prediction is supported by the Altcoin Season Index, which has been exhibiting an Inverse Head and Shoulders pattern over the past 3.5 years – a technical formation known for its bullish tendencies.

This frequently signals an impending significant surge, implying that altcoins might soon begin a prolonged uptrend, marking a turn from years of sluggish growth and bearish trends.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-10-14 10:54