As an analyst with a background in studying cryptocurrency trends and market dynamics, I find the recent surge of Solana-based meme coin Bonk (BONK) particularly intriguing. In just the last 24 hours, BONK has outperformed all other meme coins in the top 100 with a more than 25% price increase.

As a cryptocurrency analyst, I’ve noticed an impressive surge of over 25% within the last 24 hours for Bonk (BONK), which is built on the Solana blockchain and categorized as a meme coin. This growth has outpaced all other meme coins in the top 100 cryptocurrencies, making it an intriguing development to keep an eye on.

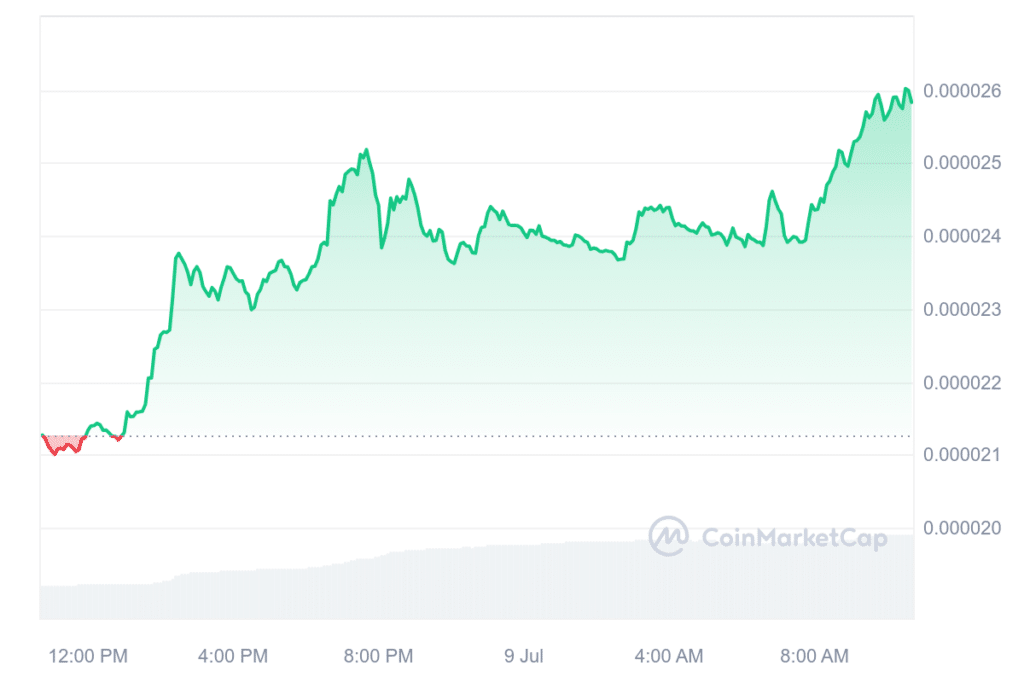

Currently, BONK is experiencing a significant surge, rising by 24.3% within the past 24 hours. The value of this crypto asset is currently priced at $0.000026 according to CoinMarketCap data. Notably, its market capitalization has surpassed $1.8 billion, outpacing Dogwifhat (WIF), another Solana-based meme coin with a market cap of 1.71 billion dollars.

As a researcher studying meme coins, I’ve observed that the daily trading volume of this particular coin underwent a significant increase of 155% in the past day, reaching approximately $544 million. Yet, despite this surge, the coin is currently 44% below its all-time high, which it achieved on March 4 at $0.000047.

In the year 2023, the meme coin named Bonk experienced a substantial surge in value due to the meme coin fad that favorably influenced the price of the Solana platform.

At first, Bonk was just another meme coin associated with dogs. However, the team behind it has broadened its scope to include decentralized finance (DeFi) applications. Moreover, Bonk is partnering with cross-chain communication platforms, NFT marketplaces, and other crypto ecosystems to increase its reach and utility within the digital currency sector.

Major exchanges like Binance, Coinbase, OKX, and Bitstamp now support trading for BONK pairs.

The recent surge in BONK‘s price can be attributed to a July 8 announcement on X by BONK DAO. This decentralized organization managing the Bonk project proposed and executed the burning of 84 billion BONK tokens, valued at approximately $2 million, from its treasury. During the second quarter, these tokens were transferred to the DAO by BONKBot.

The Bonk DAO is considering a proposal to destroy approximately 84 billion BONK tokens from its reserves. This corresponds to the quarterly distribution of BONK received from BONKBot during Q2.— BONK DAO (@bonk_dao) July 8, 2024

Removing a specific quantity of tokens from circulation through the process called token burning leads to a decrease in the number of existing tokens. Consequently, this reduction in supply can trigger a scarcity response among market participants, possibly boosting the token’s demand and causing its price to rise.

An X post on FishTheWhales’ whale tracking platform indicates that whales have been purchasing BONK, which is likely adding fuel to its rising price.

BONK’s recent price spike also coincides with a broader rally in meme coins.

On Tuesday, Pepe (PEPE), which features a frog theme, ranked as the second-strongest performer amongst its peers. Its holders saw gains of over 12% in just 24 hours. Notably, its trading volume surged by 42%, reaching an impressive peak of $1.12 billion – the highest for any meme coin.

Meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB) experienced growth, with Dogecoin increasing by 3.9% and Shiba Inu posting a gain of 3.11%.

The total value of the meme coin market grew by 7% over the last day, reaching a market capitalization of $42.53 billion.

Meme coin rallies have emerged with significant cryptocurrencies such as Bitcoin bouncing back following their dip below the $55,000 mark on July 5 – a five-month low.

As a Bitcoin analyst, I observed that the digital currency ended last week around $55,850, marking an 11% decline from its previous weekly closing price of $62,775. The market experienced considerable selling pressure, causing BTC to dip as low as $53,500 on Thursday. However, the cryptocurrency rallied back and closed the week at $58,250 before settling at its final price of $55,850.

As an analyst, I’ve observed that during this economic downturn, investors have poured in a total of $238 million into Bitcoin Spot Exchange-Traded Funds (ETFs). The cumulative trading volume of these funds since their inception now hovers around $315 billion. This figure represents a decrease in trading activity, which is a common trend during the third quarter.

Matteo Greco, a research analyst at Fineqia International, noted to crypto.news that the drop in cryptocurrency activity observed recently is more likely a normal seasonal occurrence than a cause for concern. Remarkably, Bitcoin Spot ETF price movements have not followed the usual trend of being strongly influenced by Exchange Traded Fund flows in recent times.

“Greco remarked for the first time since its creation, there’s a significant divergence between pricing trends and investor funds inflows in the crypto market. This suggests that recent price fluctuations are primarily influenced by internal trading among crypto enthusiasts.”

On Tuesday, Bitcoin experienced a rise of more than 3% within a day, reaching a price of $57,515. The lowest point in the previous 24 hours was at $55,256, while the highest point was at $57,879.

The drop in Bitcoin’s leadership in the cryptocurrency world by 0.26 percentage points to 53.64%, signifies a surge of interest in the alternative coin sector. Concurrently, the total value of all cryptocurrencies has grown by 3.4% to reach an impressive $2.12 trillion.

The surge in popularity and value of meme coins has frequently been attributed to Bitcoin’s impact on the overall crypto market.

When Bitcoin thrives, it often increases investor trust and curiosity towards other cryptocurrencies, such as altcoins and meme coins. This phenomenon can lead to a self-reinforcing cycle, with escalating values drawing in additional investors, thereby fueling even greater price increases.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-09 10:42