As a seasoned analyst with years of experience navigating the tumultuous seas of the cryptocurrency market, I find myself intrigued by Bitcoin SV’s (BSV) recent surge past the $50 mark. While it’s important to remember that BSV is no stranger to extreme volatility, its current price increase and rising open interest have caught my attention.

There’s growing interest among temporary investors and speculators in Bitcoin SV, as its value exceeds $50 while experiencing significant price fluctuations.

Right now, Bitcoin SV (BSV) has surged by 17% over the past 24 hours and is being traded at approximately $52.95. At the moment, its market capitalization stands at a whopping $1.05 billion, ranking it as the 67th largest cryptocurrency in existence.

Data shows that BSV’s daily trading volume skyrocketed by 215%, reaching $93 million.

Since late June, Bitcoin Satoshi Vision (BSV) has been experiencing significant fluctuations, struggling to break past the $50 barrier following its drop from a two-year peak of $128 in March.

At this point, BSV is down by 89% from its all-time high of $491 on April 16, 2021.

It’s worth mentioning that BSV’s price increase aligns with a broader positive trend in the market. The total value of the global cryptocurrency market has exceeded $2.5 trillion, as per data from CoinGecko. For the first time since June, Bitcoin (BTC) climbed up to $71,000.

Open interest rises, thanks to shorts

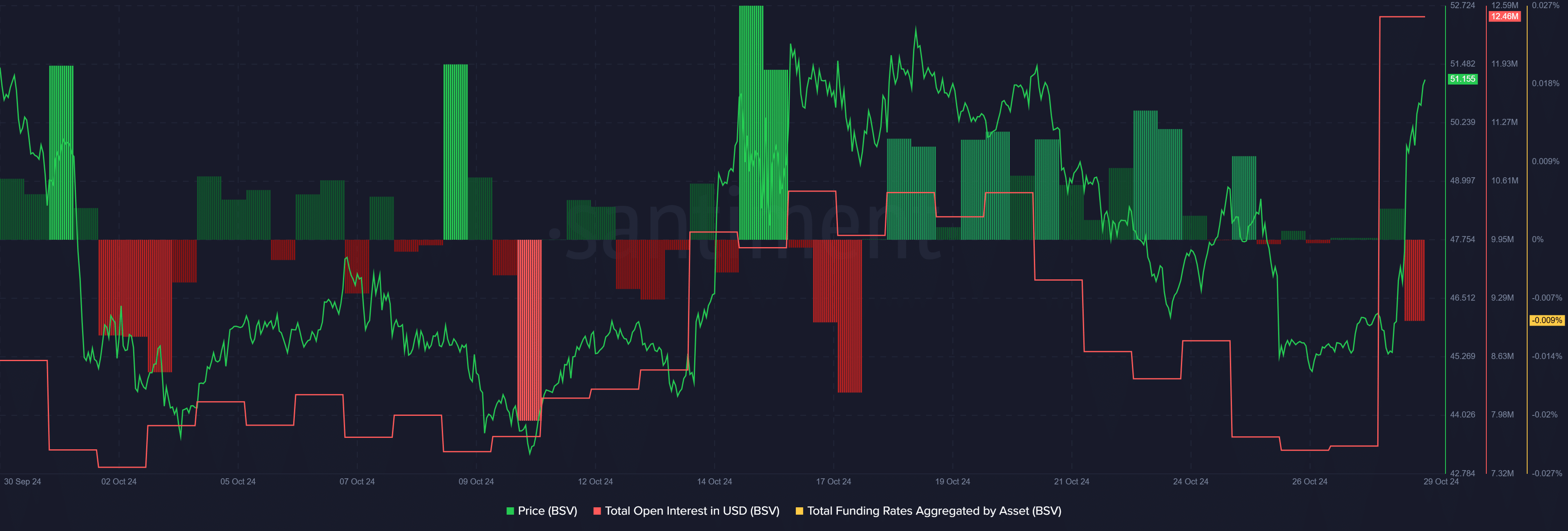

BSV’s price surge comes along with rallying open interest.

As an analyst, I’ve observed a significant surge in the open interest for BSV. Based on the data from Santiment, the open interest has spiked by approximately 63% within the last 24 hours. This notable increase translated to a rise from $7.6 million to $12.4 million.

Conversely, the token seems to be anticipating a drop in price, but the growing open interest and trade volume suggest that there might be an uptick in demand instead.

This might suggest that a significant number of short-term investors are aiming to capitalize on swift profits, as they expect the BSV price to drop soon.

The start of short liquidations could potentially push the price higher and vice versa.

According to data from Santiment, the general mood or attitude towards BSV has predominantly remained neutral during the last month, with some fluctuations occurring on October 18th and 25th, where it spiked and dipped respectively.

As a diligent analyst, I would like to draw your attention to the fact that back in 2019, prominent cryptocurrency exchanges such as Binance and Kraken chose to delist Bitcoin SV (BSV). More recently, in February of this year, Coinbase also decided to remove BSV from its trading platform.

Binance said the asset didn’t meet its requirements after the Australian computer scientist Craig Wright claimed that he was Satoshi Nakamoto, the creator of Bitcoin. Kraken even called it “fraudulent claims” in its delisting announcement.

For Coinbase, the major reason was the 51% attack on the BSV network in 2021.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-29 10:59