As a seasoned analyst with years of experience in the dynamic world of cryptocurrencies, I find it fascinating to witness such significant surges in open interest for Bitcoin and Ethereum in futures markets. The all-time highs reached by both these digital assets underscore their increasing maturity as investment options, reflecting a growing confidence among traders and investors.

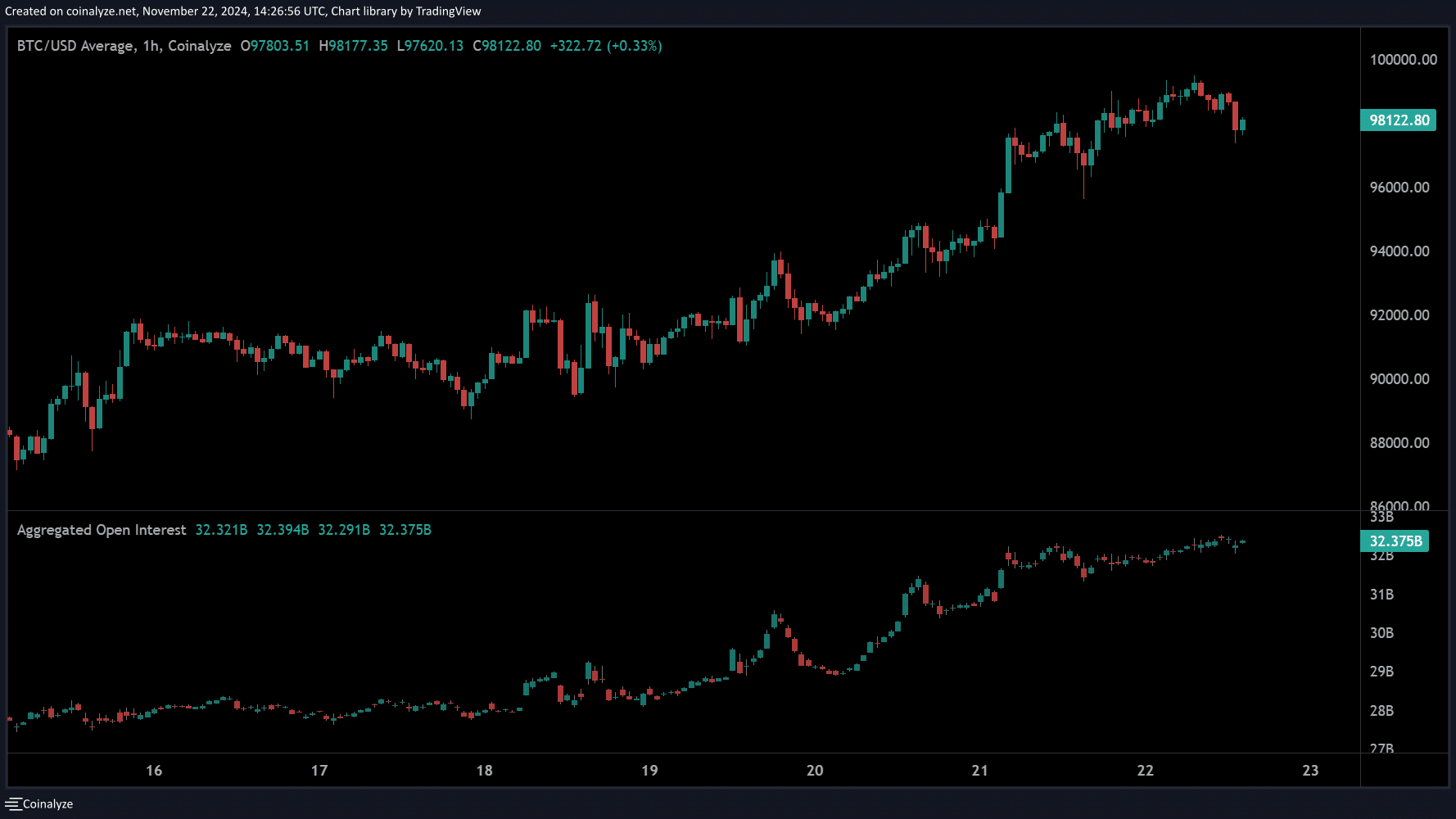

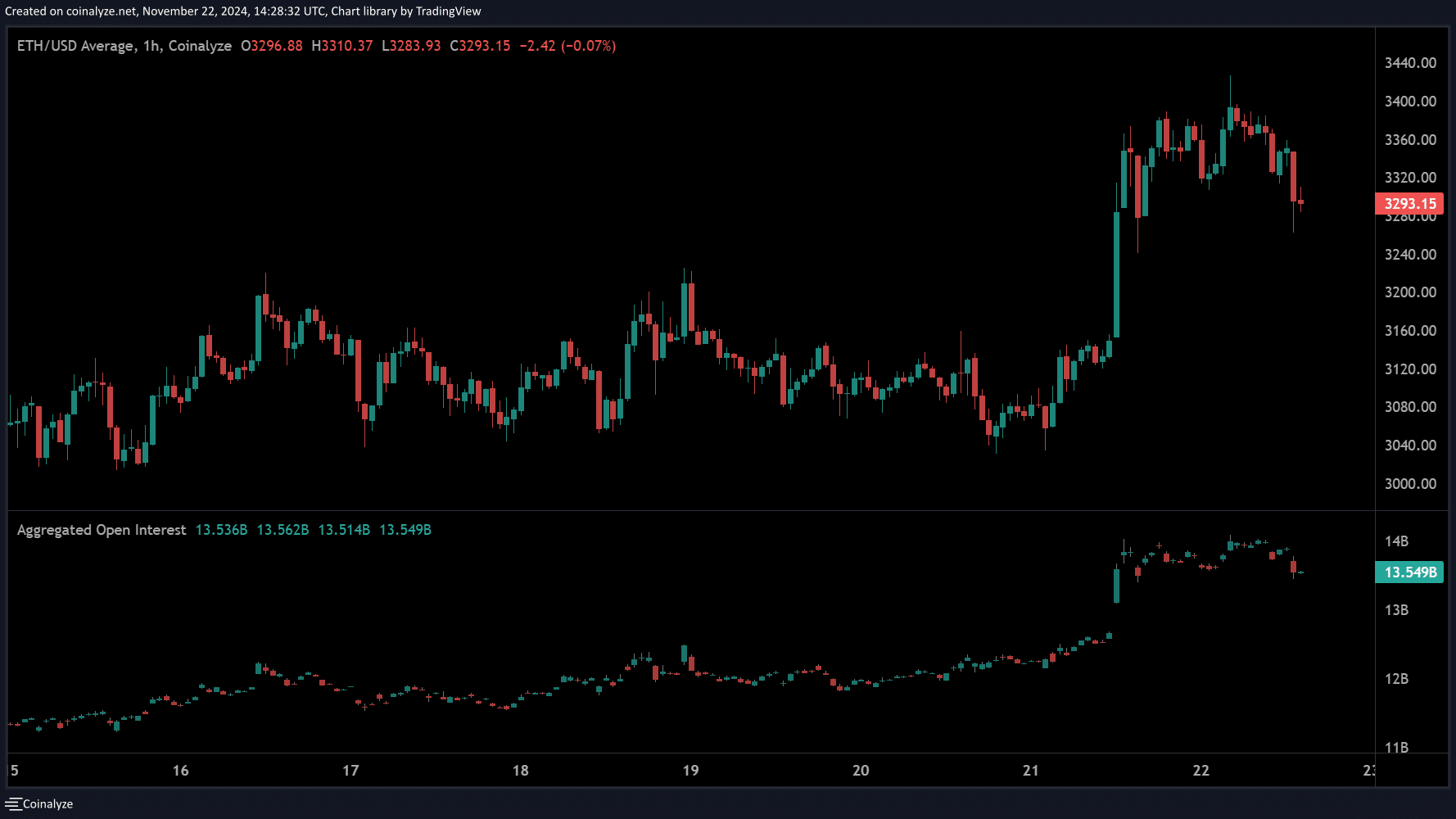

In the last 24 hours of trading, open interest for both Bitcoin and Ethereum in the futures market reached unprecedented highs. This surge followed a period where Bitcoin momentarily approached the $100,000 mark.

In the last 24 hours, the Open Interest for Bitcoin (BTC) hit a record $57 billion, marking a peak. Simultaneously, Ethereum (ETH) saw an increase of 12%, reaching an all-time high of $20.8 billion during the same period. Both cryptocurrencies experienced their highest Open Interest levels to date after experiencing dips at the start of November.

In the world of cryptocurrencies, open interest serves as a key indicator. It represents the number of open futures contracts being utilized across various trading platforms. A higher open interest signifies increased activity and suggests that the associated crypto asset is highly liquid and enjoys substantial popularity.

Just a few hours later, Bitcoin hit an unprecedented peak at $99,486, inching ever nearer to the $100,000 milestone. Meanwhile, Ethereum experienced a 7% increase as well.

According to Coinglass statistics, the current Open Interest for Bitcoin is approximately $64.08 billion. A significant portion of this, over 33%, is controlled by CME, which holds around 216,820 BTC worth about $21.23 billion.

After Binance, the leading cryptocurrency exchange in terms of trading volume, holds approximately 19.2% of the entire Bitcoin Futures Open Interest (OI), which amounts to more than 124,740 Bitcoins valued at roughly $12.22 billion.

Bybit holds the third spot with a 13.39% share of Bitcoin Options Inventory (OI), amounting to approximately 87,020 BTC or around $8.53 billion. Meanwhile, Bitget and OKX are also notable players in the top five, with each controlling 9.87% and 8.4% respectively.

On Ethereum’s side, the total value of ETH Open Interest stands at approximately $20.08 billion. Unlike Bitcoin, Binance dominates the majority of this figure, accounting for about 31.19% or 1.9 million ETH, which translates to a value of around $20.09 billion.

Bybit ranks second in terms of Ethereum Open Interest (OI), controlling approximately 18.18% of the market and holding nearly 1.11 million Ethereum, which equates to roughly $3.65 billion. Coming in third is CME with around 663,180 Ethereum, worth about $2.19 billion, representing approximately 10.88% of the overall Ethereum OI.

OKX and HTX make it into the top five, with each exchange holding 9.38% and 7.82% respectively.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- USD MXN PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-11-25 10:14