As a seasoned researcher with a penchant for all things crypto, I find myself consistently intrigued by the dynamic nature of this ever-evolving market. The latest wave of short liquidations, totaling $138.23 million, serves as yet another testament to the bullish sentiment that continues to dominate the landscape.

In simpler terms, a new round of sell-offs occurred for Bitcoin and Ethereum, which has strengthened their upward price trend.

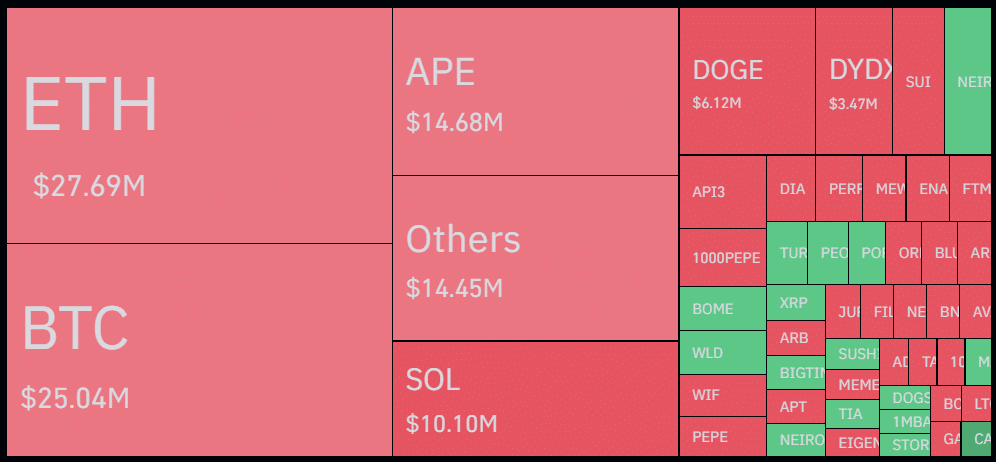

Based on statistics from Coinglass, the overall crypto liquidation amounted to approximately $138.23 million, as a positive market outlook prevails. Out of this figure, more than $95 million was liquidated from short trades, representing around 71% dominance over long positions.

Increased short liquidations usually create buying pressure.

In the present context, Ethereum (ETH) stands out as it currently has $27.69 million worth of positions being liquidated—with $23.84 million in short positions and $3.85 million in long positions. Over the last 24 hours, ETH has risen by 3.1%. At the time of this writing, it’s trading at approximately $2,730.

Its daily trading volume rallied by 117%, reaching $17.4 billion, as investors interest increases.

To highlight, the most significant liquidation event took place on Binance, the leading cryptocurrency exchange regarding trading volume, valued at approximately 6.64 million USDT when traded against Ethereum (ETH).

Right now, Bitcoin (BTC) ranks second with a liquidation amount of about $25 million—with $21 million in short positions and $4 million in long positions. This situation led to Bitcoin reaching a four-month peak price of $69,460 earlier today. Although there was a recent dip, Bitcoin is still seeing an increase of 0.45% over the past day, and it’s currently being traded at $68,700 as we speak.

The flagship crypto asset saw a 74% surge in its daily trading volume, currently at $24 billion.

The total value of all cryptocurrencies worldwide has climbed to a peak of $2.49 trillion over the past three months, with most top alternative coins experiencing positive price increases, as reported by CoinGecko’s data.

Should long positions begin to be closed out, there’s a possibility that this action could lead to intense selling activity as traders strive to limit their losses.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-21 11:24