As a seasoned crypto investor with a few years under my belt, I’ve seen my fair share of market ups and downs. And let me tell you, the past few weeks have been particularly challenging for us Bitcoin (BTC) holders. The asset has been hovering in the bearish zone after a series of massive selloffs, which triggered a market-wide downturn.

Bitcoin (BTC) has been staying low after a string of significant sell-offs instigated a broader market slump.

At present, Bitcoin (BTC) has experienced a 0.6% price hike over the past 24 hours and is currently valued at approximately $58,180. The market capitalization of this digital asset hovers around $1.14 trillion. Notably, daily Bitcoin trading volume has surged by 42%, resulting in a significant turnover of nearly $29.5 billion.

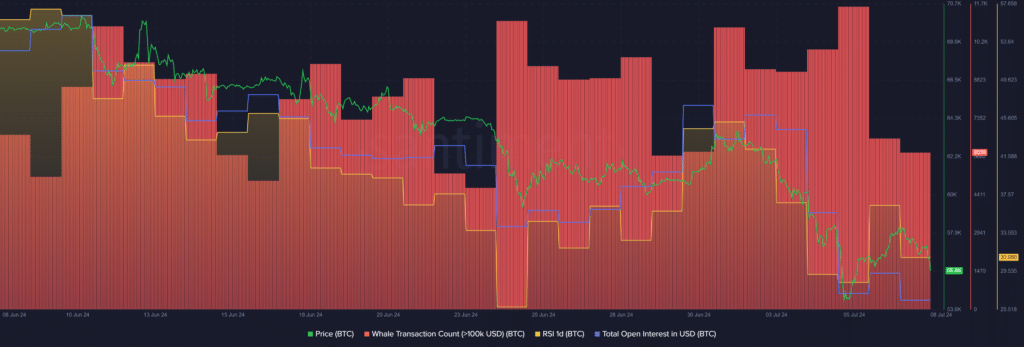

Based on Santiment’s data, the total open interest for Bitcoin decreased from $10.29 billion to $10 billion within the last 24 hours. This reduction occurred concurrently with a significant $148 million worth of BTC liquidations.

As an analyst studying cryptocurrency market data, I’ve noticed some significant position liquidations based on the information from Coinglass. In the last 24 hours, approximately $100 million in short positions and $48 million in long positions have been terminated. The largest of these liquidations, valued at around $22.24 million in BTC-USDT-swap, took place on the OKX crypto exchange.

With decreasing open interest, Bitcoin’s price volatility is likely to reduce as well due to fewer liquidation events taking place.

According to Santiment’s data analysis, the Bitcoin Relative Strength Index (RSI) presently stands at 30. This implies that Bitcoin is currently oversold at its current price level. Furthermore, the RSI in conjunction with the decreasing open interest may potentially signal a brief price surge for Bitcoin.

On July 5, as Bitcoin dipped below the $54,000 threshold, there was a noticeable decrease in whale activity. Based on data from Santiment, the number of significant Bitcoin transactions, each worth over $100,000, dropped dramatically from 11,648 to just 6,063 unique transactions at present.

As a crypto investor, I can’t stress enough how significant the selling pressure from Bitcoin (BTC) over the past three weeks has been in driving the bearish market-wide momentum. According to recent reports by Crypto.news, influential players such as the U.S. and German governments, as well as the now-defunct exchange Mt. Gox, have offloaded a staggering $1 billion worth of Bitcoin since June 19th.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-07-08 13:29