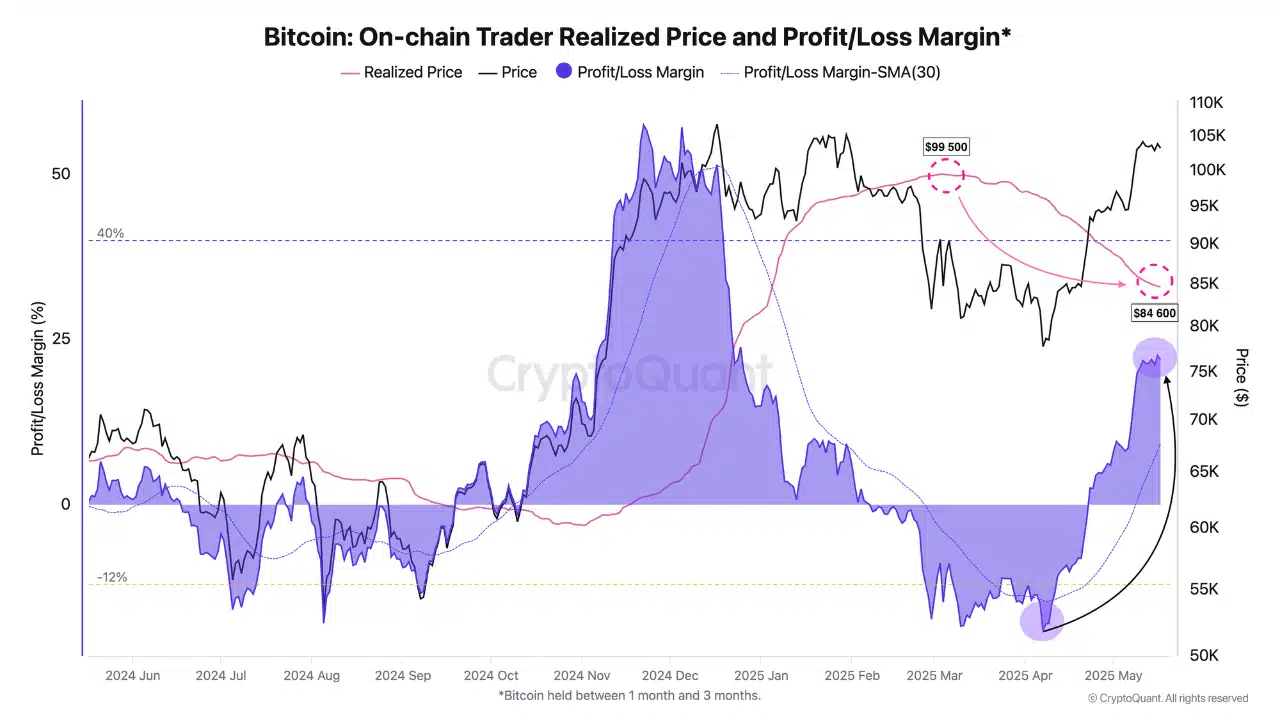

Right, so Bitcoin [BTC]. You know, that thing your slightly eccentric uncle keeps going on about at family gatherings? Well, apparently, its short-term holders – bless their cotton socks – have had a bit of a rebound. Their Profit/Loss Margin has jumped from -19% in April to a positively giddy +21% in May. 🎉 Which, if you understand any of this financial gibberish, is supposedly a good thing. More optimism, less sobbing into their digital wallets.

Apparently, the Realized Price for the 1–3 month cohort has stabilized at $84,600. Which sounds like a lot of money to me, but then again, I’m easily impressed by numbers. At press time, BTC was hovering around $103,447, up a staggering 0.03% in the last 24 hours. Hold onto your hats, folks! 🚀

And get this: the 30-day Moving Average of the Profit/Loss Margin is now at +9%. Apparently, the overheated threshold is +40%. So, there’s room for more gains without people suddenly deciding to cash in and buy a small island somewhere. Maybe. 🏝️

Here’s a picture, because why not? It seems relevant, in a vaguely financial sort of way.

Is BTC’s valuation outpacing its fundamentals? (Or, Are We All Just Making This Up?)

Now, before you start planning your early retirement, a word of caution. Not all indicators are playing along nicely. There’s always a catch, isn’t there? 🙄

The Network Value to Transaction (NVT) Ratio has climbed by nearly 70% to hit 52.81. This, in layman’s terms (because let’s face it, we’re all just winging it here), means that Bitcoin’s market capitalization is growing faster than the actual volume of transactions. 💸

This could be a sign of bullish expansion, or it could be the prelude to a monumental face-plant. It’s like when your houseplant grows too big for its pot – eventually, something’s gotta give. 🪴

So, the current spike is raising eyebrows, especially if the growth remains detached from actual network usage. You know, like a party where everyone’s invited but nobody actually shows up. 🎉…crickets…

In fact, network usage has failed to keep up. It’s like the IT department promised to increase the bandwidth but nothing has changed.

Bitcoin’s Stock-to-Flow Ratio has dropped by 16.66% to 1.0595 million. This decline reflects reduced scarcity pressure. Which, if you ask me, sounds a bit like they’re printing more money. 🖨️

When stock-to-flow trends lower, newly mined BTC enters circulation faster, potentially creating mid-term supply pressure if demand doesn’t rise in tandem. It’s like when the shop assistant is too quick to put more stock on the shelves, and nobody wants to buy it.

Is BTC’s network activity too weak to sustain the rally? (Or, Is This All Just Smoke and Mirrors?)

Despite Bitcoin rallying to over $103K, Daily Active Address (DAA) Divergence remains deeply negative at -241.32%. Sounds ominous, doesn’t it? 😨

This indicates a disconnect between price action and user activity, as fewer unique addresses are interacting with the network relative to its rising valuation. It’s like a ghost town where the property prices are inexplicably through the roof. 👻

Historically, such steep negative divergence signals weakening on-chain fundamentals behind price moves. So, basically, it’s not looking good. 😬

On top of that, transaction count and network growth dropped sharply to 67.2K and 52.9K, respectively. Numbers, numbers, everywhere! 😵💫

The cool-off in usage signals hesitation from both new and existing participants. An unusual backdrop for a sustained rally, which sounds like a polite way of saying “this is probably doomed.” 📉

A healthy rally typically aligns with increased user adoption and transaction throughput. However, this recent decline contradicts price momentum and suggests the rally may lack strong fundamental support. So, maybe don’t remortgage the house just yet. 🏡

Long/Short Ratio signals rising indecision in the derivatives market (Or, Nobody Knows What They’re Doing)

Looking at derivatives (whatever they are), the Long/Short Ratio fell to 0.9964.

Longs made up 49.91%, while shorts ticked up to 50.09%—nearly even.

This near-equal distribution reveals increasing uncertainty in trader expectations. The sharp shift from a previously long-heavy bias highlights growing caution after Bitcoin’s recent price surge. Basically, everyone’s hedging their bets. 🤷

The current market outlook presents a conflicting narrative. It’s like a choose-your-own-adventure book, but instead of a fun quest, you’re just losing money. 😫

On one hand, Bitcoin’s recovery in trader profit margins and sustained price strength suggests bullish momentum. Huzzah! 🎉

On the other hand, a sharp rise in valuation is not being matched by growth in transaction activity, user engagement, or network expansion. Boo! 👎

This disconnect raises concerns about the sustainability of the rally. For the upward trend to continue in a healthy manner, fundamental on-chain metrics must improve. So, basically, we’re all just waiting to see if this thing crashes and burns.🍿

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-05-18 15:08