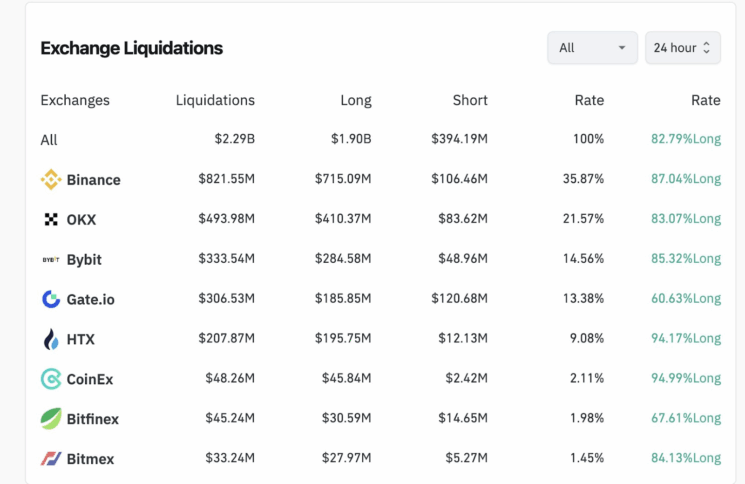

In a recent revelation, Ben Zhou, CEO of Bybit, has disclosed that the actual liquidation figure in the crypto market far exceeds the reported $2.24 billion.

The cryptocurrency market experienced a tumultuous period, with Bitcoin and Ether leading the charge downwards. Bitcoin plummeted below $92k, while Ether dropped to $2400, losing 17% of its value overnight.

Zhou, in a recent tweet, expressed his concerns, stating, “I am afraid that today’s real total liquidation is a lot more than $2B.” He estimates the actual number to be between $8 billion and $10 billion.

Bybit has API limitations that restrict how much liquidation is displayed, meaning that traders might not be seeing the full losses, and the market situation could even be worse than it appears.

As of now, Ethereum is trading for $2,713, after gaining back 7% for the day according to Coingecko.

Ethereum saw the largest loss, with $622 million in long and short-liquidated positions, according to Coinglass. Long positions took a beating too, with $1.9 billion in liquidation, representing 84% of the overall figure. Ethereum longs represented $473 million of that figure.

Presto Research’s analyst Min Jung said that Ethereum’s sharp fall was much greater compared to Bitcoin and Solana. She added that Ethereum’s poor performance also has to do with some inner battles in its Ethereum Foundation, which included the leadership battles and its transition towards becoming more institutional. According to her, all of this created a negative sentiment towards the coin.

Meanwhile, this is ETH‘s biggest intraday drop since May 2021, when it dropped from a high of $4,308 to $2,200 in seven days. At the time, Ethereum traded at almost 48% below its record high of $4,878 from November 2021.

Moreover, the volatility spike during the crash was massive. In Asia trading hours, Ethereum’s one-day at-the-money volatility rose from 34% to 184%, which means a lot of traders panicked.

The put-call ratio, an indicator that measures how traders perceive risk, increased from 0.6 to 2.5. Also, a dormant whale transferred $228.6 million worth of Ethereum to Bitfinex at the eleventh hour, putting additional pressure on sell-offs.

But what caused this crash? Well, the overall market was already on edge due to Trump’s new tariffs. These tariffs impacted Canada, Mexico, and China and increased concerns about inflation and decelerating the economy.

Many investors stayed away from high-risk investments like cryptocurrencies due to these concerns. Historically, such political tension often put pressure on the market.

Right now, the crypto market is very volatile. If the tension gets worse, it could lead to a bearish trend. 😱

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-02-03 21:09