As a seasoned researcher with extensive experience in the cryptocurrency market, I find Bybit’s latest proof of reserve report intriguing. The 17.8% increase in USDT holdings among users is noteworthy and aligns with my observations of investors’ growing preference for stablecoins during periods of market volatility.

Bybit, a leading cryptocurrency exchange, has made public its twelfth proof of reserves, revealing a growth of 17.8% in their holdings of Tether (USDT).

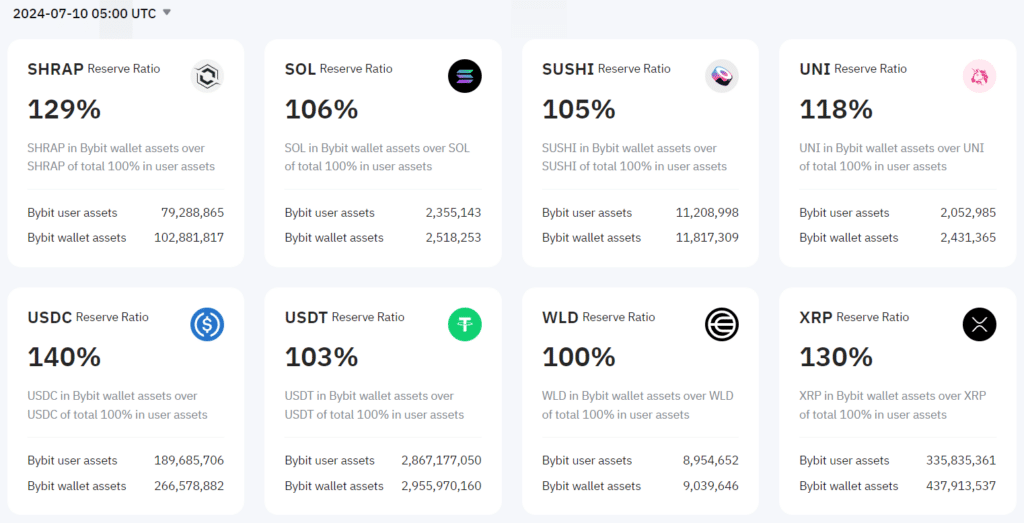

Crypto market participants have shown a growing interest in stablecoins, as evidenced by the nearly 18% surge in holdings of Tether (USDT) at Bybit exchange over the past month. The exchange’s recent proof of reserve disclosure indicates that USDT balances have increased by approximately $433 million as of July 10, representing a significant 17.8% uptick from the figure reported on June 6.

The report highlighted a significant rise in Circle’s USD Coin (USDC), as deposits grew by more than 150 million USDC, representing almost a 4-fold increase compared to June. Conversely, DAI, an algorithmic stablecoin from MakerDAO, saw a drop, with holdings shrinking by 33% during the same timeframe.

During this period, the ownership of Bitcoin (BTC) and Ethereum (ETH) increased by approximately 5.62% and 0.46%, implying that investors could be shifting their resources from less risky stablecoins towards these more volatile cryptocurrencies.

As a researcher studying the crypto market, I’ve observed an intriguing correlation between the surge in stablecoin holdings and the increasing sector market capitalization. It’s worth noting that Bitcoin seems to have found a local price bottom around this time. CryptoQuant CEO Ki Young Ju brought attention to this trend in a July 17 post on their platform. Specifically, he pointed out that the total stablecoin market cap reached an unprecedented high earlier in July, with USDT accounting for approximately 70% of that amount.

Although Ju admitted that present liquidity may not heavily influence price fluctuations, he considered the ongoing uptrend as “notable” considering the existing market circumstances.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-07-19 13:35