As a seasoned cryptocurrency investor with years of experience under my belt, I must say that the recent developments between Solana (SOL) and Ethereum (ETH) have caught my attention. The way SOL has been performing against ETH is quite intriguing, to say the least.

In the year 2024, Solana’s native token, SOL, has experienced a substantial increase of 70% compared to Ethereum‘s token, ETH. Despite Ethereum’s dominant market capitalization, Solana has proven itself as a formidable competitor in the smart contract blockchain sector.

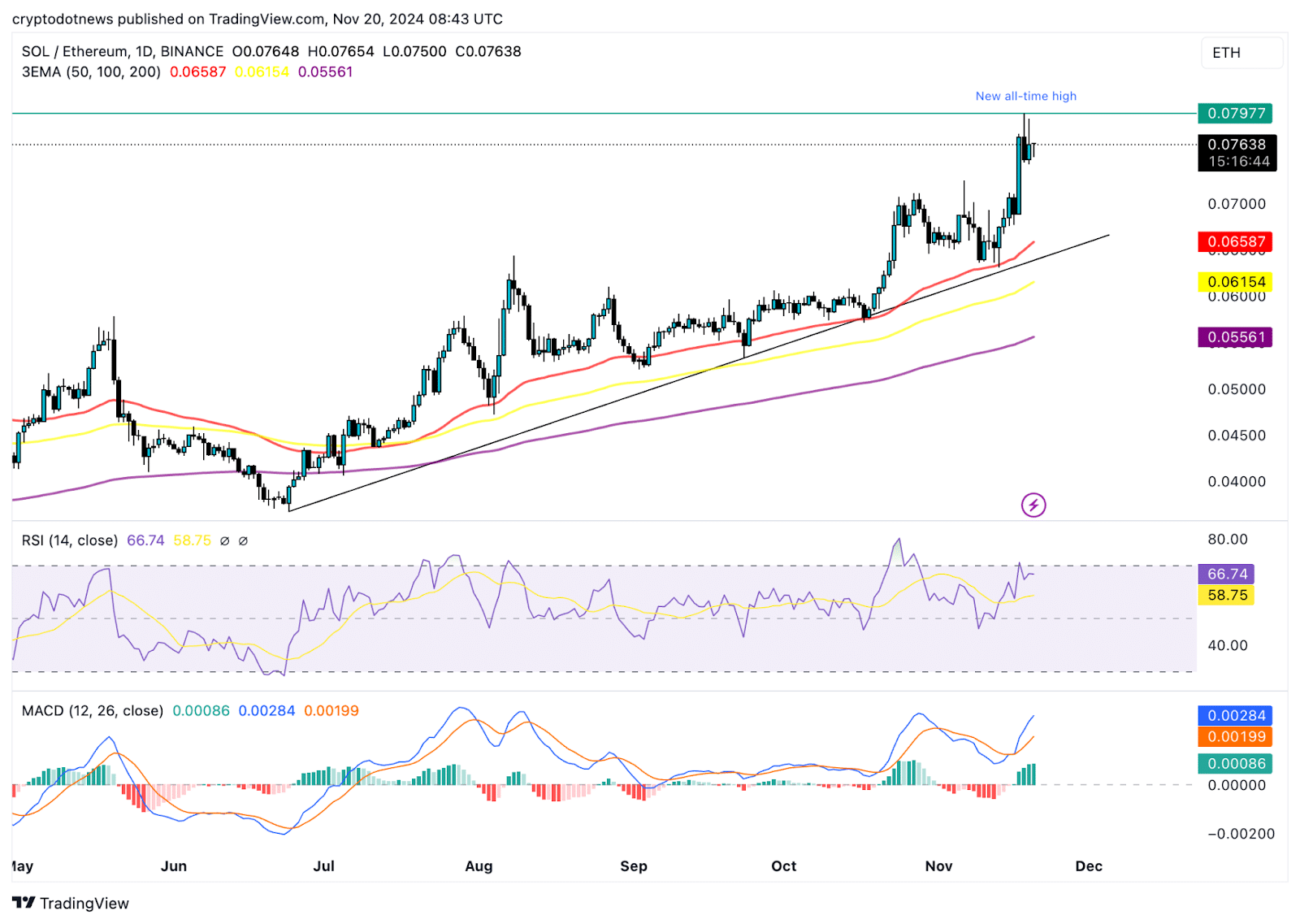

The ongoing debate in terms of Solana (SOL) overtaking Ethereum (ETH) is backed by bullish on-chain metrics, SOL’s dominance in DEX metrics, volume and protocol revenue. Solana hit an all-time high against Ethereum on Monday, November 18, when SOL/ETH climbed to 0.07977.

Table of Contents

Solana could overtake Ethereum, on-chain metrics suggest

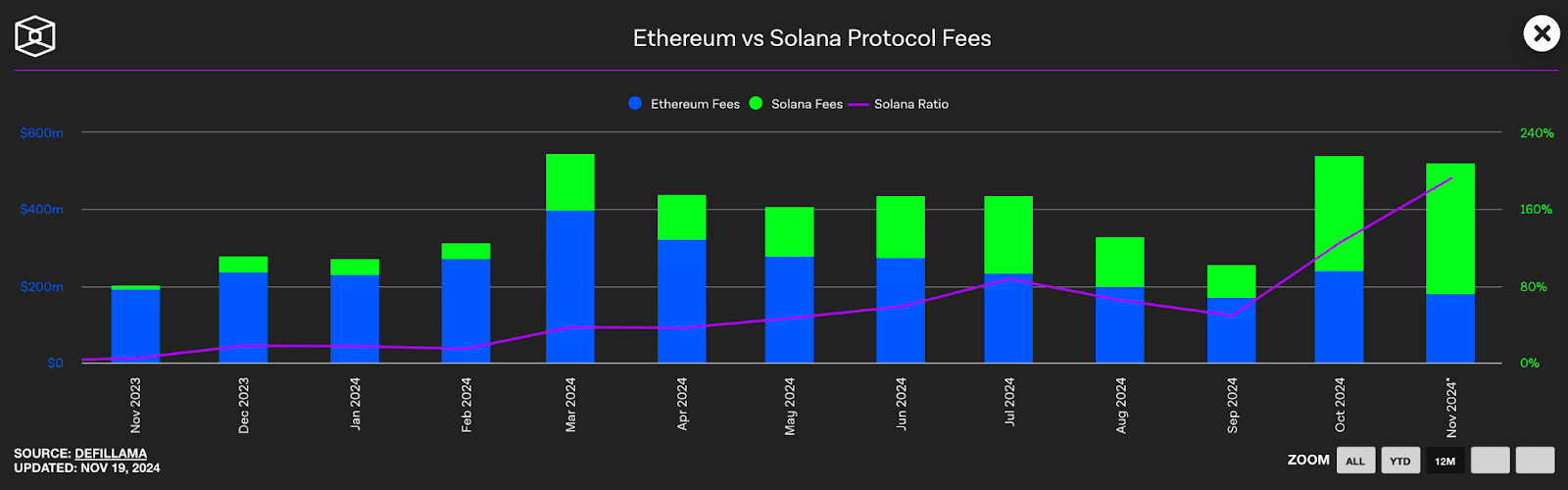

In November 2024, the fee for transactions on Solana’s network, which is a modest proportion of the transaction amount used to keep the blockchain running smoothly, will be almost double that of Ethereum.

As of Tuesday, November 19, it’s been reported that Solana has garnered approximately $343.96 million in protocol fees, compared to Ethereum’s $178.65 million. After liquidity providers have been compensated, these fees serve as a source of income for the project.

Based on the data, it appears that Solana is expected to generate more income than Ethereum during October and November of 2024.

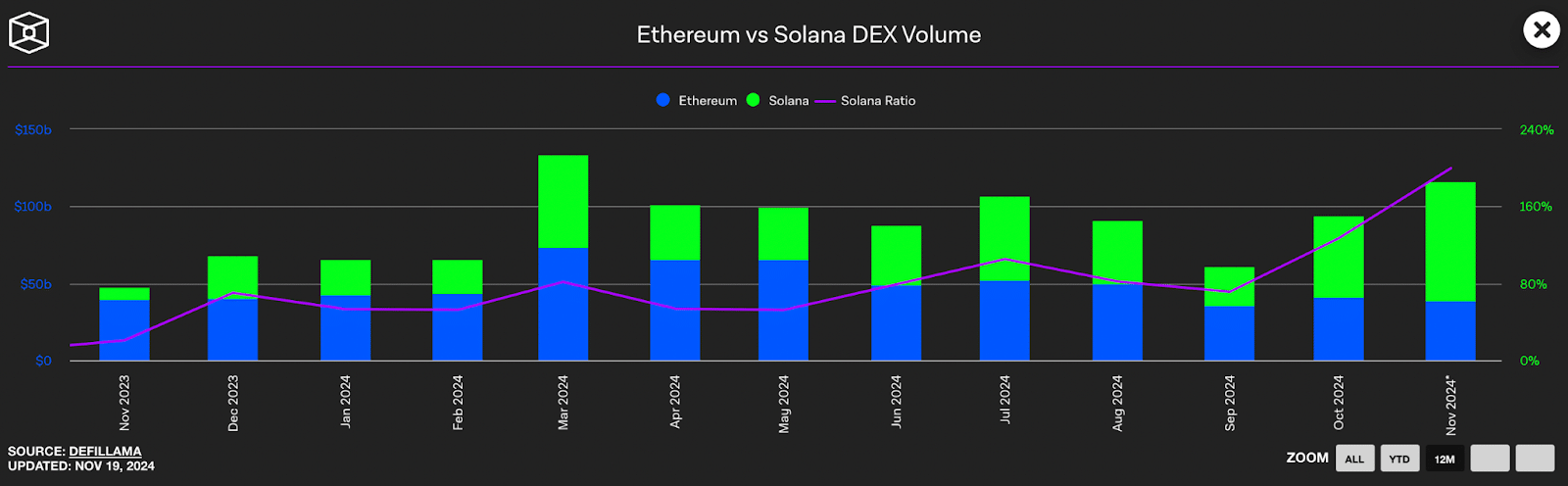

A significant indicator to consider is the amount of transactions taking place on decentralized exchange systems, often referred to as DEXs. For instance, when it comes to Solana, the transaction volume on DEXs is almost double that of Ethereum in November. In contrast, while Solana ranked higher than Ethereum in terms of DEX volume during October, the difference was relatively minimal.

The trading volume on Solana’s decentralized exchanges amounts to approximately $77.51 billion, while Ethereum’s is about $38.81 billion. During the month of October, Solana recorded a volume of around $52.5 billion compared to Ethereum’s $41.4 billion.

A greater trading volume on the Decentralized Exchange (DEX) of one blockchain suggests higher functionality and acceptance compared to another. Solana has emerged as a popular choice among traders on decentralized exchanges, possibly because of the numerous new projects launched on Pump.fun’s platform, which are frequently listed on DEXs like Raydium following a significant milestone.

According to data from TheBlock, Solana is standing out as the preferred choice among decentralized traders and platforms, making it a strong contender.

As a seasoned analyst, I can confidently say that my focus lies predominantly on Ethereum, given its substantial lead in the circulating stablecoin supply and the considerable Total Value Locked (TVL) within its blockchain. This dominance places it at the forefront of the cryptocurrency landscape.

As a researcher, I’ve observed that Solana is trailing significantly behind Ethereum in key metrics, primarily due to Ethereum’s first-mover advantage. However, given the ongoing adoption and demand for both platforms, I am optimistic that in the long run, Solana may surpass Ethereum in these areas.

How Solana could overcome challenges, and flip Ethereum

The Solana network is seeing more stablecoins being introduced, which could increase both the total amount of stablecoins in circulation and the TVL (Total Value Locked) measure. Previously known as Maker, Sky – a protocol for decentralized finance lending and borrowing – has launched its USDS stablecoin on Solana.

This signifies the initial launch of a stablecoin specifically designed for Decentralized Finance (DeFi) on the Solana platform, which may boost its DeFi liquidity in competition with Ethereum.

Last week, Solayer introduced sUSD, a stablecoin backed by real-world assets on the Solana blockchain. This unique token’s value is tied to a mix of low-risk investments, primarily U.S. Treasury bills, which sets it apart from other stablecoins in circulation.

Developments akin to those on the Solana network may empower Solana (SOL) to surpass the network’s influence and the initial lead enjoyed by Vitalik Buterin’s Ethereum blockchain, potentially setting the stage for a possible shift or “flippening” in the future.

Why this matters, implications for your crypto portfolio

Data from CoinGecko reveals that meme tokens built on the Solana platform surpassed a market cap of $22 billion, while over 70% of the top 10 meme tokens have experienced double-digit growth in the last week.

The surge in popularity of Solana, compared to Ethereum, may have sparked growth within its associated tokens, contributing to a rise in meme coin values and boosting the total value of the crypto market sector. This development benefits cryptocurrency portfolios that include dog and cat-themed, as well as politically and culturally themed meme tokens, along with Solana itself.

As a researcher delving into the world of Ethereum, I’ve observed that the beta trials encompass two key areas: the Layer 2 token ecosystem and Layer 3 projects. Regrettably, neither of these sectors seems to be picking up speed during this current phase, indicating some challenges in their adoption journey.

Traders who own staked, restaked, Layer 2, or Layer 3 cryptocurrency tokens might notice potential paper losses in their portfolios due to Ethereum’s challenges amidst increasing competition from platforms such as Solana.

Solana hits all-time high against Ether, expect this from SOL price

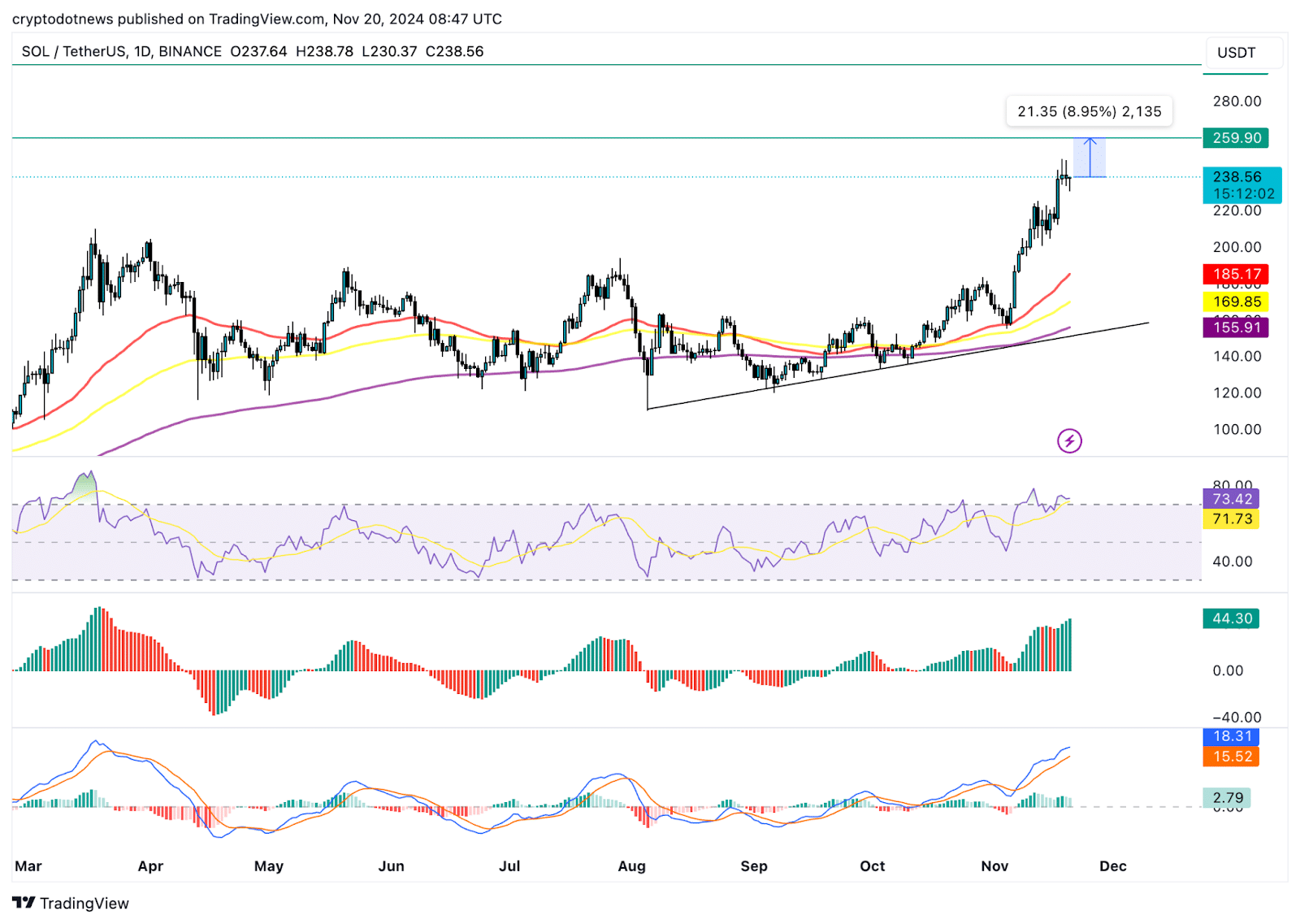

On the 18th of November, I witnessed an exciting moment as Solana reached a new peak when exchanged against Ethereum, specifically at 0.079770. This achievement is significant for Solana, as the SOL/USDT pair is now just under 10% away from its previous all-time high of $259.90, which it reached back in November of last year.

The potential exists for the Solana (SOL) to Solana Ethereum (ETH) exchange rate to surge by about 5%, possibly reaching its record high of 0.079770 once more. At present, SOL is being traded above all three of its moving averages at the 10-day, 50-day, and 200-day levels, indicating a prolonged upward trend that has persisted for almost five months.

As an analyst, I am observing a favorable outlook for the SOL/ETH pair based on the technical indicators. Specifically, the Relative Strength Index (RSI) stands at 66, and the Moving Average Convergence Divergence (MACD) indicator exhibits green histogram bars above the neutral line. These signs suggest a bullish trend in the SOL/ETH pair.

Should Solana surpass its previous peak and continue its upward trend, the SOL/ETH ratio might aim for approximately 0.090000, representing a 13% increase from its all-time high.

On November 20th, Wednesday, the SOL/USDT exchange rate stands at $238.56, representing an 8.95% drop from its all-time peak. Based on technical analysis, it appears that the pair might experience more growth, potentially allowing SOL to revisit its record high once again.

If this test is passed successfully again and a significant advancement occurs, Solana might surpass the noteworthy $300 milestone, which represents a 15% increase from its previous record high of $259.90.

In simpler terms, the Relative Strength Index (RSI) currently stands at 73, which some traders interpret as a signal to sell. However, the Awesome Oscillator is displaying more and more tall green bars, suggesting a potential increase in buying activity, and the Moving Average Convergence Divergence (MACD) doesn’t indicate an impending trend reversal at this moment.

The momentum underlying SOL price trend is likely positive, supporting further gains in Solana.

The three EMAs could act as support in the event of a market correction.

The relationship between Solana’s price movement and that of Bitcoin is quite strong, with a correlation coefficient of 0.98 as per data from Macroaxis.com. This suggests that the price trend of Solana tends to mirror that of Bitcoin closely. If there is a market correction in Bitcoin, it could lead to a decrease in the value of SOL, and investors should keep this in mind before making further investments in both assets.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-20 13:08