As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I must admit that the recent surge in Cardano (ADA) has caught my attention. Having entered the crypto world during its nascent stages, I’ve witnessed numerous ups and downs, but the consistent bullish momentum of ADA in the last seven months is a sight to behold.

For the initial time in nearly seven months, the price action of Cardano has shown significant upward thrust, mirroring Bitcoin‘s continuous setting of fresh record highs.

In the previous 24 hours, Cardano (ADA) stood out as the top performer among the top 100 cryptocurrencies, experiencing a 33% surge. Earlier today, it peaked at $0.594, a level not seen since April, and is currently trading at $0.57.

The value of Cardano’s market capitalization hit the impressive figure of $20 billion, placing it as the ninth largest digital currency. Moreover, its daily trading volume exceeded the significant threshold of $2 billion.

Bitcoin

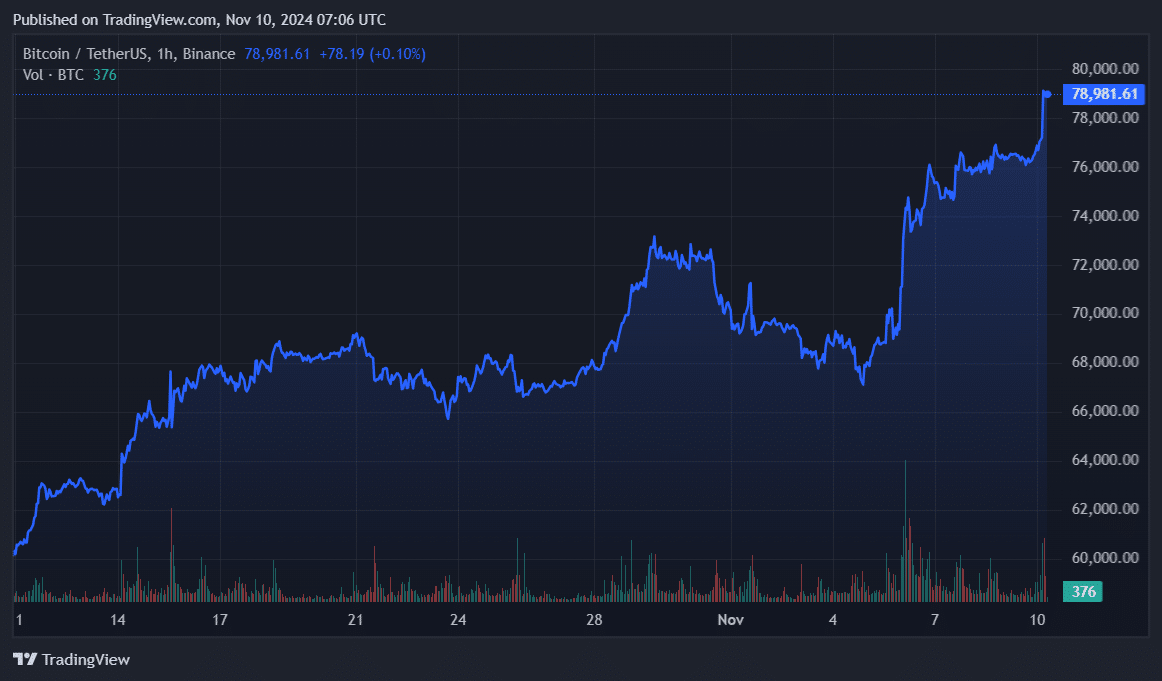

On November 5th, when Donald Trump secured both the popular vote and the electoral college, Bitcoin (BTC) experienced a surge. Reaching an unprecedented peak of $79,780 at 05:43 UTC today, Bitcoin also saw its market capitalization soar to $1.58 trillion. With a circulating supply of approximately 19.78 million coins, this digital currency has been in high demand.

Bitcoin is trading at $79,000 as some investors have already started profiting.

As per information from CoinGecko, the overall cryptocurrency market valuation stands at a staggering $2.85 trillion today, marking an increase of approximately $420 billion over the last week. In the last day alone, total crypto trading volume has amounted to an impressive $172 billion.

What’s pushing crypto?

Trump’s victory sparked a surge in the cryptocurrency market because he was often referred to as the “first pro-crypto president.” Following his election win on November 6, when he garnered more than 270 electoral votes, Bitcoin reached an all-time high (ATH) of $75,000.

On November 7th, there was a historic net investment of $1.37 billion into Bitcoin exchange-traded funds available in the U.S., further boosting optimism within the sector. The accumulated total net investments have now exceeded $25 billion.

In the last 24 hours, crypto liquidations have soared by 68%, amounting to approximately $384 million, as per statistics from Coinglass. Among these, Bitcoin accounted for around $102 million in liquidations, with $13 million being long positions and $89 million from short positions.

Usually, short liquidations trigger upward momentum.

ADA also saw $7.3 million in liquidations—$1.6 million longs and $5.7 million shorts—per Coinglass.

Keep in mind that when there’s a lot of trading activity and liquidations, it typically results in increased market volatility. A significant rise in long liquidations and short-term traders closing their positions might signal a possible broader market adjustment or correction.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-11-10 14:22