As an analyst with over two decades of experience in the financial markets, I have seen countless bull flag patterns and their eventual resolutions. While the trend for Simon’s Cat (CAT) has been impressive, with a 37.6% surge over the past week, I find myself cautiously optimistic about its short-term prospects.

Simon’s Cat was trending on Google as a bull flag pattern formed on the meme coin’s 1-day chart.

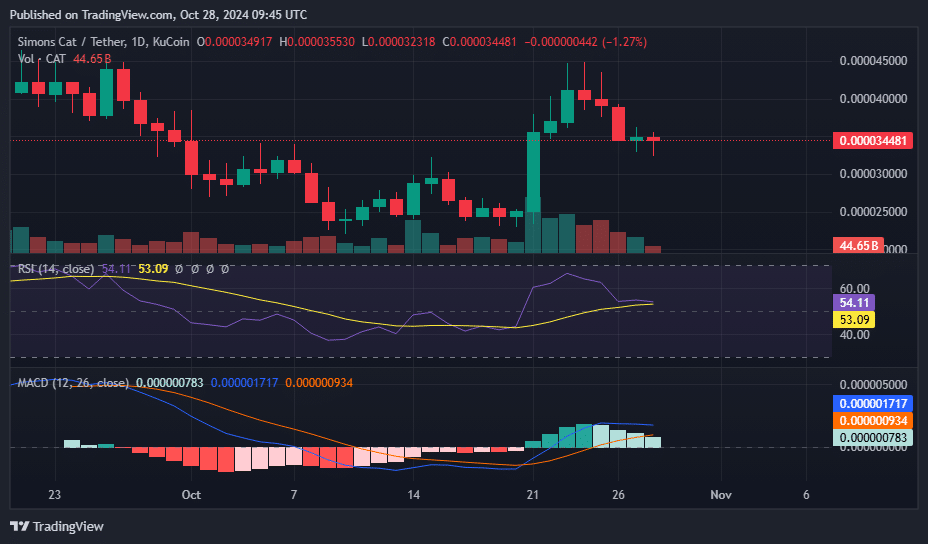

In a recent post on X, pseudonymous trader Zak pointed out that Simon’s Cat (CAT) has developed a bull flag pattern. On October 21st, CAT experienced a significant jump from $0.000024 to $0.000035, which forms the flagpole in this pattern.

Following its peak at approximately 0.000038 USD, the token experienced a dip and settled at 0.000034 USD, forming a typical flag pattern. Typically, a breakout from this pattern suggests a prolongation of the upward trend, potentially leading to additional price increases.

Mr. Albert noticed that the meme coin remained stable within a narrow band from October 23 to October 26, with prices fluctuating between $0.000038 and $0.000044. He pointed out that if it managed to break free from this tight range, particularly above $0.000033, there could be a potential for further growth in the near future.

The meme coin was up 37.6% over the past 7 days, with its market cap reaching $233 million when writing, up from $166 million on Oct. 21. This rise was accompanied by a jump in daily trading volume, which was hovering above $60 million at press time.

The fact that CAT has been listed recently on the cryptocurrency platform OKX has generated enthusiasm within the digital currency community, due to a noticeable increase in purchase actions by investors.

Pseudonymous trader Crypto Bull disclosed buying $250,000 CAT. Another community member pointed out that a whale had picked up $26,000 worth of the meme coin days after the OKX listing.

At the same time as this purchasing spree, the price surge of CAT also corresponded with an increase in the number of wallets owning the token. This figure climbed from 231,676 on October 21 to 235,666 on October 28, as more investors jumped on board to cash in on its rising fame.

Although there are encouraging advancements, the short-term momentum seems to be waning based on the analysis of technical signals.

Looking at the daily CAT/USDT chart, the Relative Strength Index (RSI) has moved down from almost excessively high readings of 66 on October 23, now sitting at a more balanced 54. This indicates that the current bullish momentum may be starting to slow.

In simpler terms, the MACD (Moving Average Convergence Divergence) indicator is suggesting a bearish trend. This happens when the MACD line (orange) drops below the signal line (blue), and the histogram shrinks, indicating it might lead to a temporary slowdown or even slight decline in the near future, unless significant buying activity occurs.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-28 13:42