As a seasoned researcher with a keen interest in financial markets, I find Cathie Wood’s perspective on Bitcoin intriguing. Having closely followed the gold market for decades, it’s fascinating to see parallels being drawn between the two assets. While gold has a market cap of $15 trillion, Bitcoin, still relatively new, stands at a mere $2 trillion.

Cathie Wood, the head of ARK Investment Management, thinks that Bitcoin might be even larger than gold in significance. She anticipates that Bitcoin’s potential market capitalization of $2 trillion could someday exceed gold’s current market value of approximately $15 trillion over a period of time.

On December 5th, Cathie Wood responded to Federal Reserve Chair Jerome Powell’s remarks about Bitcoin (BTC). She likened this leading cryptocurrency by market capitalization to a digital form of gold.

As a passionate crypto investor, I personally find myself aligning with ARK Investment Management’s perspective. To me, Bitcoin seems like a concept that outshines even the value of gold. Just like how gold has traditionally held its place as a store of value, Bitcoin, in my eyes, carries the potential to surpass those boundaries and establish itself as something far greater.

Gold, a commodity with a history stretching far beyond Bitcoin, currently boasts a market capitalization of approximately $15 trillion. In contrast, the market cap of Bitcoin has recently hit the $2 trillion mark. This observation leads her to believe that Bitcoin is still in its nascent stages and holds significant potential to outperform gold’s market value.

In a recent post, Wood stated, “Gold, priced at around $2,700, represents a market value of approximately $15 trillion. On the other hand, Bitcoin’s current market capitalization stands at just $2 trillion. Despite surpassing $100,000, Bitcoin is still considered to be in its early stages.

Currently, Federal Reserve Chair Powell likened bitcoin to a digital, virtual form of gold. Notably, the gold market stands at approximately $15 trillion, while bitcoin’s market cap hovers around $2 trillion. Despite surpassing $100,000, many experts view bitcoin as still being in its early stages of development.

— Cathie Wood (@CathieDWood) December 5, 2024

On December 5, Bitcoin surpassed the $100,000 mark for the first time ever in its history, following a 5% increase over the past 24 hours. This remarkable milestone was confirmed by data from crypto.news. As a result, Bitcoin’s market capitalization also grew by approximately 5.74%, reaching a staggering $2 trillion. At the moment of writing, each Bitcoin is being traded at around $101,690.

Just prior to Bitcoin’s significant rise to $100,000, Fed Chair Jerome Powell referred to Bitcoin as “virtual gold” because traders often use it, along with gold, to preserve the worth of their money rather than for transactions. In his view, Bitcoin is primarily a rival to gold, not the U.S dollar.

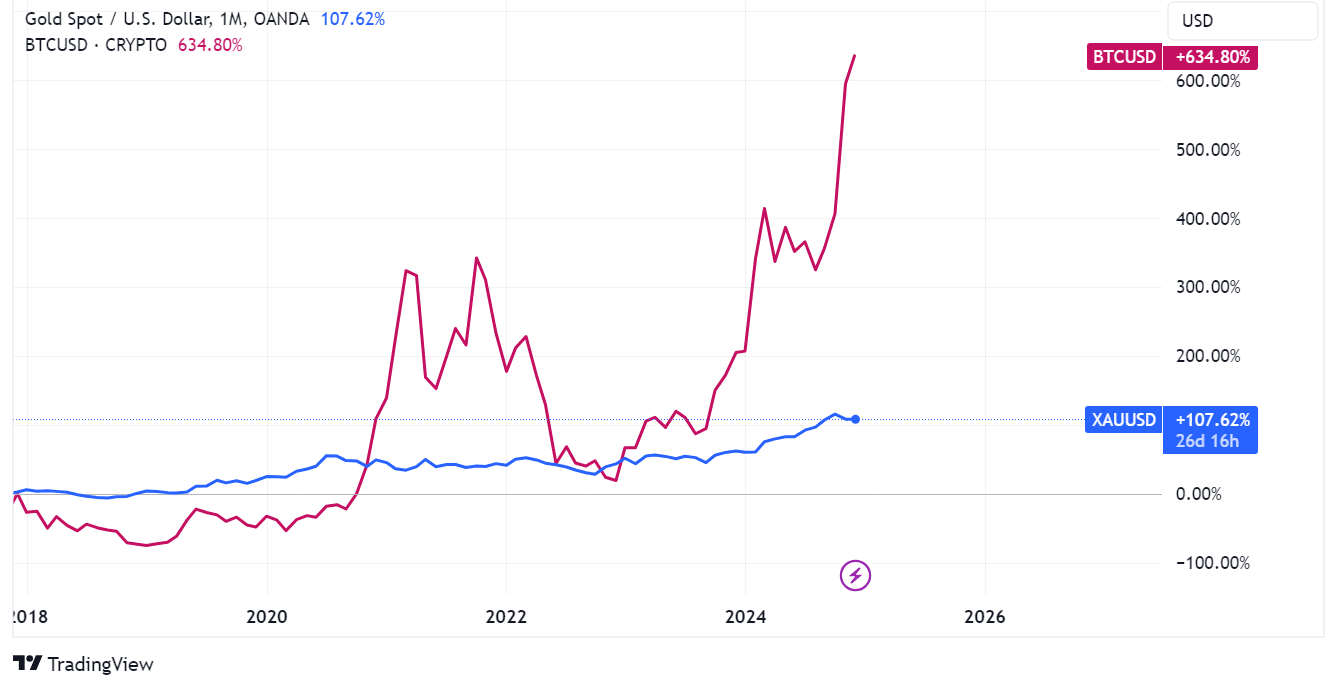

Over a long period, traders have observed a correlation between the price fluctuations of Bitcoin and gold, typically with Bitcoin’s price rising after gold’s increase. This trend is primarily attributed to their shared role as “safe investments,” providing protection for investors against the unpredictability of fiat currencies.

In times of economic downturn when global currencies lose value, investors frequently seek refuge in assets such as gold and Bitcoin. This is because the worth of these assets isn’t tied to any particular currency. Additionally, they have a common trait – their scarcity, as both must be mined before they become available on the market, although mining for gold and Bitcoin takes place in very different ways.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Brent Oil Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-05 11:59