As an experienced analyst, I’m closely monitoring the recent bullish momentum of Celestia’s native token, TIA. With a 13% increase in price within the past 24 hours and trading at $10.30, the asset’s market cap has surged to $1.92 billion, making it the 57th-largest cryptocurrency.

As a Celestia (TIA) analyst, I’ve noticed an uptick in positive chatter surrounding our native token on social media platforms. This buzz has given the price a significant boost, indicating a potentially strong upward trend for TIA.

At present, the value of TIA has risen by 13% over the past 24 hours and is currently being exchanged for $10.30. Its market capitalization has expanded to a substantial $1.92 billion, ranking it as the 57th largest cryptocurrency. The daily trading volume for Celestia has experienced a significant surge of 107%, reaching an impressive $140 million.

Significantly, Celestia hit its peak price of $20.91 on February 10th, but it has experienced a substantial decrease of approximately 52% since then.

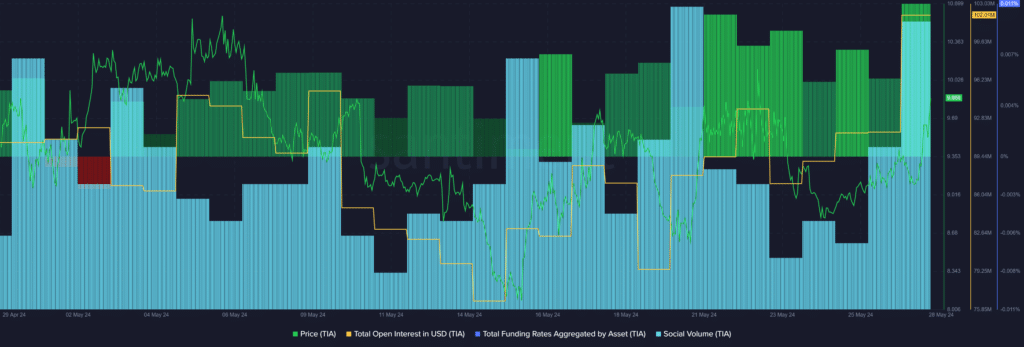

Based on Santiment’s data, there was a 78% increase in discussions about Celestia on social media within the last day. A significant proportion of this chatter originated from X and Reddit, where investors were speculating a possible price rise.

On October 31, 2023, the modular blockchain, named Celestia, was introduced to the public with a pool of approximately 580,000 eligible users for its airdrop. Unlike traditional monolithic blockchains, Celestia sets itself apart by employing data availability sampling (DAS) instead of relying on consensus for execution.

This technique helps with scaling the network and also removing settlement constraints.

Beyond the social buzz, according to Santiment, the total open interest for TIA experienced a substantial growth of approximately 12% over the last 24 hours. This surge brought the figure up from $91.6 million to $102 million. The swelling open interest may serve as a precursor to heightened price fluctuations in the future.

With a larger number of potential sell orders on the market, even slight price fluctuations could trigger additional liquidations, leading to heightened price instability.

As a researcher studying market trends, I’ve noticed an intriguing development based on data from the market intelligence platform. Specifically, the total funding rate aggregated by TIA has increased significantly over the past 24 hours, rising from 0.005% to 0.011%. This indicator suggests that traders are currently placing bullish bets, even amidst a broader market correction.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Gold Rate Forecast

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-05-28 13:32