As a seasoned researcher with a knack for deciphering cryptocurrency trends, I find myself intrigued by the recent surge of Celestia (TIA). Having closely followed its journey since its inception, it’s fascinating to witness this modular data network climb back up after three consecutive days of growth. The upcoming upgrade seems to be a significant catalyst, as is often the case with cryptocurrencies ahead of major updates.

For three straight days now, Celestia, a versatile data network, has seen an uptick following the recent announcement by its developers regarding an impending system enhancement.

The price of the Celestia (TIA) token climbed to $6.28, marking a 60% increase from its lowest point this year. This boosted its total market value to approximately $1.3 billion. However, it’s still 72% lower than its peak price of $21.10, which was previously recorded.

Over the last few weeks, Celestia has been a topic of significant interest with multiple notable updates. In particular, it successfully secured $100 million in investments from Bain Capital, Robot Ventures, and Placeholder during September. This new funding pushes its overall investment to an impressive $155 million, positioning it among the crypto sector’s most well-funded companies.

The fundraising occurred as developers and the community worked to scale the network to handle 1-gigabyte blocks.

In a statement this week, Celestia Labs unveiled the results of the Mammoth Mini testnet, which will implement 88 MB blocks with an average of 27 MB/s of permissionless data throughput. This is a significant step as the network moves towards 1 GB blocks and above, given that the network currently handles 2 MB blocks every 12 seconds.

Starting today, the Mammoth Mini test network is set to evolve into a publicly accessible testing environment. Assuming community agreement, this will be followed by the main network launch in 2025. It’s worth noting that cryptocurrencies tend to show strong performance before significant upgrades.

After the recent rollout of the Shwap upgrade, we now move forward to the Mammoth Mini upgrade. The Shwap upgrade significantly increased data sampling speed by 12 times and decreased storage needs approximately 16.5 times.

The significant potential issue that might impact Celestia’s price is the planned mass token release set for October 31st. This event will free up 175.74 million tokens valued at approximately $175 million, representing 16.3% of the total token pool. Token releases often lead to dilution, which can negatively impact existing holders, particularly those who earn through staking.

Celestia rose to a key resistance

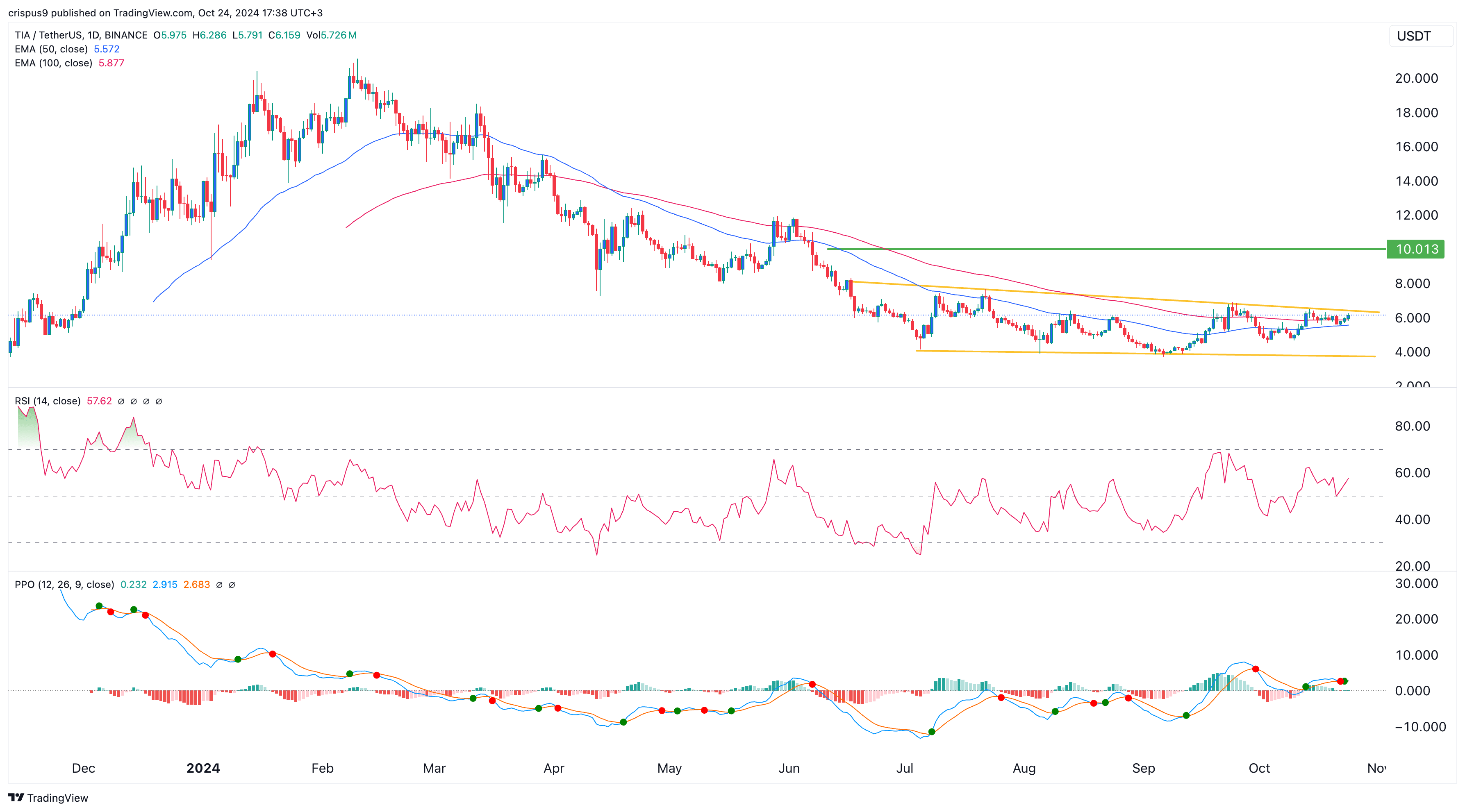

Today’s graph indicates that the TIA token was exchanging hands at approximately $6, which aligns with the upper boundary of a downward trendline. This trendline is drawn connecting the peak price movements observed since June this year.

the 100-day and 50-day Moving Averages, which are statistical tools used to smooth out price action over time. Furthermore, its Relative Strength Index (RSI), a momentum oscillator that measures the magnitude of recent price changes, has surpassed the 50 mark, indicating it’s trending upward rather than neutral or downward. Lastly, another indicator called the Percentage Price Oscillator (PPO) has crossed above zero, suggesting Celestia’s price has risen more than its base rate over the same period.

In simpler terms, the graphical formation of Celestia resembles an “inverse head and shoulders” pattern. This suggests that if it breaks above its current trendline, we might expect more growth, possibly escalating towards the significant price point of $10.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-24 18:00