As an experienced financial analyst, I believe that the recent token burn by the now-defunct Celsius Network has significantly impacted the price of its native token, CEL. The massive burn transaction, which saw over 94% of the total supply being sent to a null address, triggered a surge in CEL’s price, with gains of over 360% in just one week and 67% in the last 24 hours.

As a financial analyst, I’ve observed an remarkable price uptick in the defunct Celsius Network’s native token, CEL, post its substantial token burn event.

According to on-chain records, Celsius Network destroyed approximately 94% of its entire CEL token supply on April 30. This massive transaction reduced the total circulating CEL tokens from 695.65 million to just 40.55 million. The transferred tokens were sent to an address with no balance, making it the third-most significant transaction in Celsius’s history.

After the burn event, CEL experienced a significant surge, increasing by an impressive 360% over the past week. The asset has also seen a notable gain of 67% within the previous 24 hours. At present, it is being traded at $0.94 – a price point last reached in November 2022.

In simple terms, the overall value of all Celsius tokens in Circulation is presently estimated at thirty-eight point two million US dollars, while the total amount of these tokens exchanged daily reaches seven hundred and eighty million US dollars.

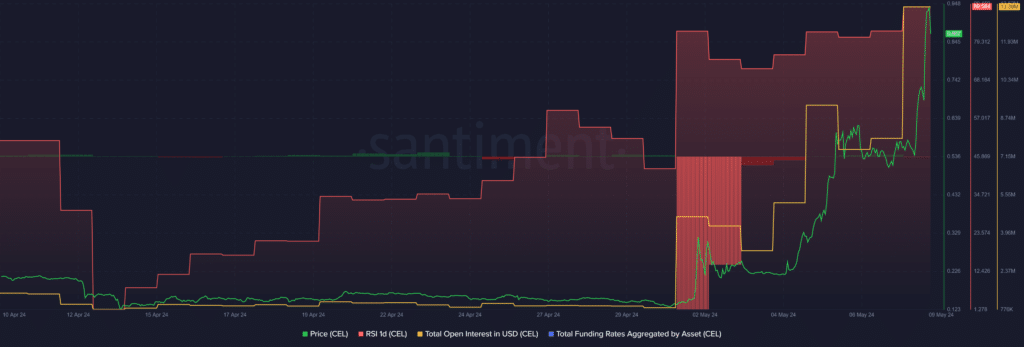

Based on the data I’ve analyzed from Santiment, the CEL Relative Strength Index (RSI) has increased from 82 to 89 within the last 24 hours. As a researcher, I can interpret this information to mean that Celsius is currently experiencing overvaluation and overheating at its current price point, as indicated by the RSI reading.

According to Santiment’s data, Celsius’ open interest experienced a notable rise by 69% over the past 24 hours. This jump brought the total from $7.91 million to $13.39 million. Such a significant growth in open interest for CEL may lead to heightened asset volatility as a result of potential increased liquidations.

Although the cost increase persists, the Celsius total funding rate remains close to a 0.004% discount at the given moment, according to market intelligence data. Translated, traders placing wagers against CEL‘s price rise are currently outnumbering those holding long positions.

As a crypto investor, I’ve noticed that CEL‘s Relative Strength Index (RSI) and open interest have been increasing lately. This indicates that the token is currently in a high volatility zone. While this can present opportunities for gains, it also means that a significant price drop could be imminent. It’s essential to exercise caution and consider implementing risk management strategies to mitigate potential losses.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-09 13:34