As a seasoned analyst with over two decades of experience in the financial sector, I find myself intrigued by this latest development between Celsius and Tether. Having witnessed numerous market turbulences and bankruptcies throughout my career, I’ve learned to read between the lines and decipher the nuances that often lie beneath the surface of such legal disputes.

Bankrupt lending platform Celsius has filed a lawsuit against Tether seeking 39,542 BTC.

Table of Contents

As per the court case, the sum served as security for a loan extended by the creator of Tether (USDT), the stablecoin. In response to the early 2022 drop in Bitcoin‘s (BTC) price, Tether demanded additional collateral to secure the loan.

In response to Tether’s petition, Celsius complied, yet the security for the loan remained vulnerable. The legal documents state that as Celsius was collecting funds according to the agreed terms during the stipulated period, Tether swiftly sold off all the pledged collateral within a matter of hours.

As stated in the lawsuit, on June 13, 2022, during the turmoil, Alex Mashinsky (former Celsius CEO) is accused of allowing Tether to liquidate collateral in an orderly fashion. However, it was emphasized that the lender did not receive a written consent for this action.

Due to current federal bankruptcy laws, Tether’s actions are now under scrutiny. Therefore, it’s advisable to prevent any preferential or fraudulent transactions involving Bitcoins. The ultimate goal is to reclaim the Bitcoins or their value for the benefit of Celsius’s estate.

As a crypto investor, I received news from the company that rather than adding more security by way of additional collateral, they directed Tether to sell off our Bitcoin collateral, worth roughly $815 million, in order to settle an open position.

Apart from the initial 39,542 BTC, Celsius also requested an extra 15,658 BTC and an additional 2,228 BTC. It is said that this extra amount was supplied as additional collateral, bringing the total to 57,428 BTC.

Tether’s response

As a researcher, I’d rephrase Paolo Ardoino’s comments about Celsius in this manner: “Regarding Celsius, I observed that the entire process – from ensuring over-collateralization, to triggering margin calls and executing liquidations – was handled according to the instructions given by their management team.”

Notes:

1. This complaint shows a lack of basic understanding of the concepts of market slippage, block liquidation and risk management. Very poor arguments made. Also the liquidation was directed by Celsius management team and agreed each step in the way.

— Paolo Ardoino 🤖🍐 (@paoloardoino) August 10, 2024

In the year 2022, as stated by him, Tether distributed USDT to certain clients, among them being Celsius. The terms of service between Tether and its clients are straightforward: Customers who offer more Bitcoin than necessary as collateral receive USDT from Tether.

As an analyst, I find it concerning that the underlying knowledge regarding market slippage, block liquidation, and risk management appears to be inadequate in this case. The presented arguments seem weak at best. It’s worth noting that the liquidation process was orchestrated by the Celsius management team, with their approval at each step along the way.

Additionally, he emphasized that ensuring the security of USDT users continues to be Tether’s main focus. As stated by Ardoino, the company boasts a substantial capital of approximately $12 billion, which means that the stability of the stablecoin holders would remain unaffected, even in the event of an unfavorable situation.

In recent years, we at Tether have shown time and again that we’re built to withstand challenges. We’re unfazed by bullying tactics. We are assured in our ability to present the validity of our actions in a court of law.

What happened to the loan?

2020 saw Celsius entering into a loan arrangement with Tether, where they could obtain stablecoins USDT and EURT at reduced interest rates. At its maximum, the loans from Tether exceeded $2 billion, which were backed by a substantial amount of Bitcoin as security.

In the midst of Bitcoin’s fall in the summer of 2022, the crypto lending firm found itself on the brink of having its assets seized due to insufficient collateral. As stipulated in the contract, the company had to bolster their collateral reserves.

According to Celsius, Tether allegedly failed to act honestly by quickly selling a large quantity of cryptocurrencies, violating the established contractual terms.

The paper indicates that these circumstances eventually caused severe financial struggles and eventual bankruptcy for the business. The primary aim of Celsius’s lawsuit is to recover the Bitcoin holdings, alleging they were sold at prices lower than the market rate and with multiple breaches.

How did Celsius go bankrupt?

In June 2022, Celsius temporarily halted access to client funds. A month after this action, the company declared bankruptcy. Some financial experts claim that the cryptocurrency broker was grappling with cash flow issues. On the other hand, the firm asserted that this move aimed to “enhance liquidity stability.”

Greetings everyone! I’m Jason Stone here, and between August 2020 and April 2021, I had the pleasure of working with an exceptional team to oversee the management of the 0xb1 address.

— 0xb1 (@0x_b1) July 7, 2022

By the close of January 2023, it was discovered by a forensic analyst that Celsius Network experienced a deficiency of over a billion U.S. dollars in stablecoins around May 2021. Interestingly, despite this critical situation, neither the clients nor the regulatory bodies were informed until the company’s bankruptcy. However, they persisted in promoting their services during this period.

As a seasoned investor with years of experience in the cryptocurrency market, I have witnessed firsthand the rollercoaster ride that comes with investing in this volatile sector. The recent news about Celsius Network has been a stark reminder of the risks involved. Initially, when I heard about their reorganization plan being approved by most account holders and subsequently getting court approval, I felt a sense of cautious optimism. However, when the crypto lender announced they had completed bankruptcy proceedings and intended to pay creditors $3 billion, I couldn’t help but reflect on my own investments and experiences.

Celsius CEO blames prosecutors for collapse

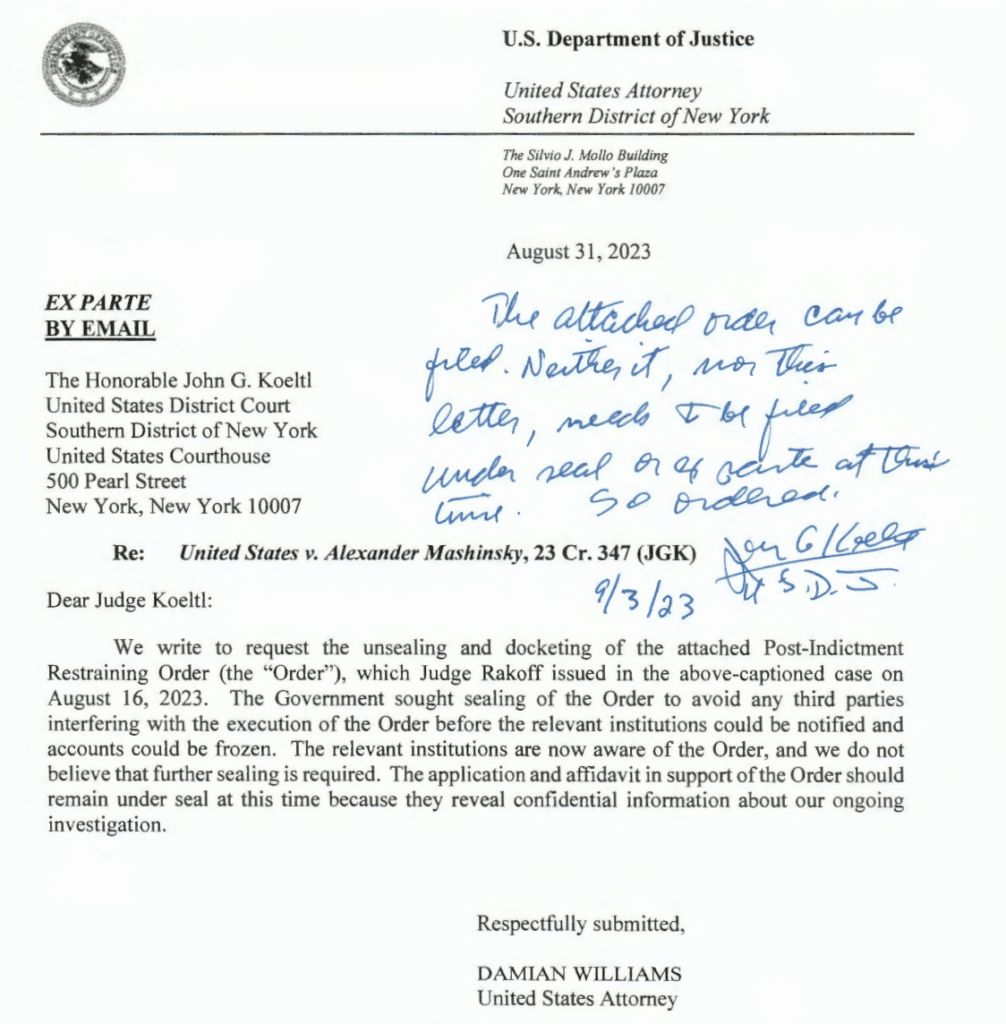

In July 2023, Mashinsky was taken into custody following a legal action initiated by the Securities and Exchange Commission against his company. The charges include fraudulent activities and manipulation of market conditions, with the company’s token being classified as a security. Bailed out at $40 million, Mashinsky is currently under investigation. Authorities plan to gather evidence over a period of six to eight weeks, which includes videos of Mashinsky online where he allegedly deceived investors.

In response to the accusations, he declared his innocence and his legal team labeled them as unfounded. Furthermore, Mashinsky has previously implicated the New York Attorney General’s office in the downfall of his company.

In September 2023, a court ruling led to the freezing of Mashinsky’s bank accounts and property holdings, which was an action taken in relation to a criminal investigation involving the company and its high-ranking executives.

What’s next?

1. The lawsuit doesn’t automatically mean that Celsius will achieve its desired outcome. At this point, it seems probable that the platform may encounter another lawsuit following a two-year bankruptcy struggle. Nevertheless, the legal action highlights how Tether has managed to avoid the financial challenges faced by other crypto companies during the 2022 bear market.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-12 18:37