As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I find myself observing the current market trends with a mix of intrigue and cautious optimism. The sideways movement of Bitcoin near the $90,000 mark has indeed brought a sense of calm to the broader cryptocurrency market, but it’s important not to read too much into declining trading volumes on centralized exchanges.

The relatively stable position of Bitcoin near the $90,000 level has brought a sense of calm to the larger cryptocurrency market as trading volumes on centralized exchanges have noticeably decreased.

On data from CoinGecko, it’s reported that Binance, the leading cryptocurrency exchange in terms of daily trading volume, experienced a drop of approximately 15.2%, ending the day with around $26.6 billion in trades. So far, Binance has listed 385 different tokens and offers 1,260 distinct trading pairs on its platform.

The data indicates a drop of 14.6% in Bybit’s daily trading volume to approximately $5.7 billion. Despite listing more cryptocurrency assets, 512 in total, than Binance, the Dubai-based platform has fewer active trading pairs, currently numbering 630. The most frequently traded pair on Bybit is Bitcoin (BTC) with USDT.

Data from CoinGecko shows that OKX, a major cryptocurrency exchange based in the Seychelles, experienced a decrease of approximately 18% in its daily trading volume, reaching around $4.6 billion.

The decrease in CEX (Centralized Exchange) trading volume coincides with a 4% drop in overall trading activity on decentralized exchanges, bringing the total down to approximately $9 billion across all platforms, according to CoinGecko.

The gathering of Bitcoin around the $90,000 area has triggered a general slowdown in the market, as notable cryptocurrencies such as Ethereum (ETH), BNB (BNB), and Toncoin (TON) have moved into an overbought state.

This action is typically viewed as typical, as both long-term and short-term investors often seek to capitalize on attractive prices by realizing their profits.

Crypto liquidations decline

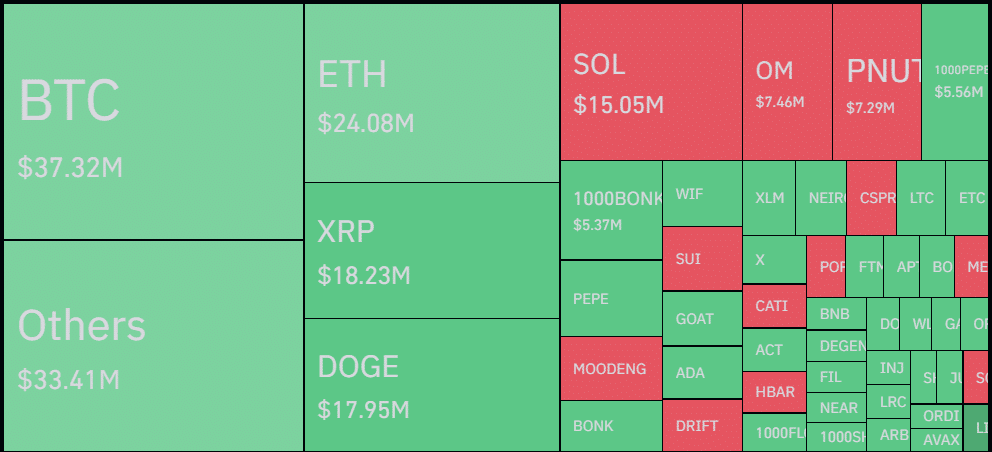

Over the last 24 hours, the total value of crypto liquidations has steadily dropped from a peak of $869 million on November 12th to approximately $231 million as of now. This decrease includes $141 million in long positions and $90 million in short positions, based on data provided by Coinglass.

In a significant turn of events, Bitcoin surpassed others by triggering liquidations worth approximately $37.3 million – this includes $24.7 million in long positions being closed, along with $12.6 million from short positions being closed out.

With decreasing liquidations, investors are looking forward to more upward market pressure, as the total crypto open interest has increased by 1.5%, reaching approximately $104 billion according to Coinglass statistics.

An uptick in the overall Open Interest might signal heightened market-wide turbulence, since the market finds itself in the “excessive optimism” area.

Remarkably, Bitcoin’s direction—whether up or down—could significantly impact the wider market, given that it accounts for around 56.2% of the total market capitalization.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-18 10:29