As a seasoned crypto investor with a decade of experience navigating the tumultuous waters of this digital frontier, I can’t help but feel a familiar pang of dismay upon hearing about yet another exploit, this time involving Vow. The crypto market is like a rollercoaster ride, with its ups and downs, twists and turns, and the occasional unexpected drop that leaves you feeling queasy.

A company called Vow, which specializes in issuing discount vouchers through a decentralized system, has experienced an exploit that could potentially lead to the downfall of its native token.

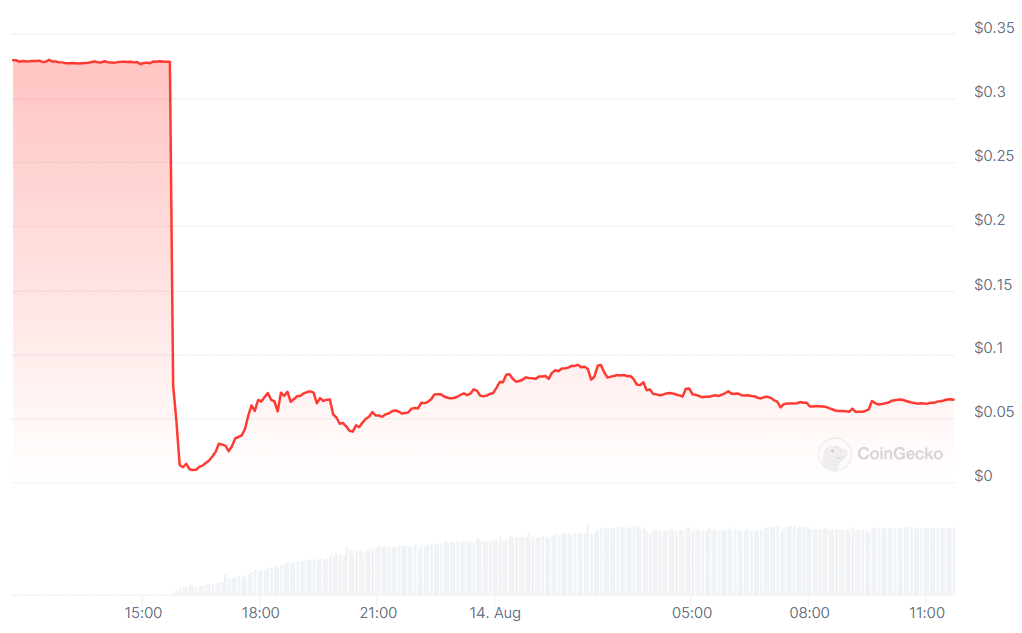

As reported by CertiK and published in crypto.news, Vow suffered an immediate loss of approximately $1.2 million following its test of a rate-setting feature on August 13.

According to a recent post by Vow, the duration for the test ranged between 15 and 30 seconds, starting when we adjusted the rate setter until its return to the default setting. The report indicates that during this test, the value of “vUSD received per VOW token” was altered from 1 to 100.

Subject: Update on Recent Market Incident and Ongoing Efforts

Dear Community,

We want to clarify the recent incident that has occurred while our team was testing the USD rate setter function of the v$ contract in order to mint v$ for the new lending pool and oracle functions.…

— Vow (@Vowcurrency) August 13, 2024

During a brief trial period, a bot managed to gather approximately 20 million VOW tokens, which held a value of around $6.6 million at the instant of the hack. Subsequently, this bot traded these tokens for Ethereum (ETH) on Uniswap V2, amassing a total of 452 ETH, equivalent to roughly $1.23 million.

As a dedicated researcher involved in this project, I’m excited to share that we’re actively addressing the issue at hand. To ensure our token maintains its optimal balance, we’ve decided to enhance the burn rate by 50%. This strategic move will help reduce the circulating supply of our token back to its usual level.

Update: Change in VSR Burn Rate Immediately Implemented

— Vow (@Vowcurrency) August 13, 2024

The exploiter still holds the ETH received from Uniswap, according to Etherscan data.

In contrast to most crypto hacks I’ve encountered, this time, the culprit didn’t transfer the stolen funds into a fresh wallet. Instead, it appears that the attacker’s address has been linked to Tornado Cash, a well-known cryptocurrency mixer, approximately four months ago on April 23.

Currently, the value of the VOW token has dropped by 80% within the last 24 hours, and it’s being traded at $0.06 as I write this. At the moment, its total market capitalization stands at approximately $41 million.

The heightened anxiety about the hack led to an enormous 1,400% rise in VOW’s daily trading activity, pushing its value up to $12 million.

As per a Crystal Intelligence report from June, the cryptocurrency world has seen approximately $20 billion stolen by hackers and fraudsters since 2011. In the second quarter of 2024, the industry suffered from 72 separate incidents and lost a staggering $572.7 million to these malicious activities.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-14 10:58