As a seasoned crypto investor with a keen interest in the industry’s regulatory landscape, I find the recent findings by Chainalysis on the use of illicit funds in cryptocurrency exchanges and stablecoins concerning. The statistics presented in these articles illustrate the growing challenge of combating money laundering and sanctions evasion in the crypto space.

As a crypto investor, I’ve come across some concerning statistics. Based on data from Chainalysis, approximately one-third of all cryptocurrencies originating from illicit sources between 2019 and now have been deposited into sanctioned services like Russia’s exchange, Garantex.

Since 2019, cryptocurrency exchanges have received approximately $100 billion in cryptocurrencies from notoriously illegal sources. This startling figure underscores the increasing need for global coordination in implementing effective anti-money laundering regulations.

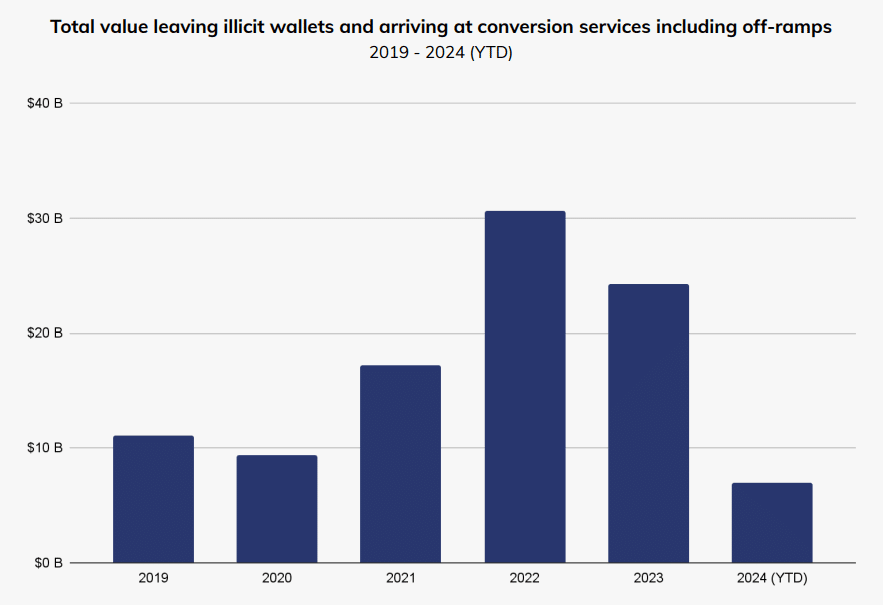

Based on the findings of blockchain investigation firm Chainalysis, approximately one-third (30%) of cryptocurrencies derived from suspicious sources ultimately reached authorized platforms such as Russia’s digital exchange, Garantex. The largest transaction volume involving tainted crypto and approved services was observed in 2022, with an estimated $30 billion worth of ill-gotten gains transacting on these platforms.

According to Chainalysis, the data encompasses solely the aggregated amounts transferred from illicit sources to crypto exchange platforms. However, it’s important to note that this figure does not account for the value exchanged among intermediaries. Such transactions can consist of numerous individual interactions, ranging from tens to hundreds.

A New York-based company reports that a larger share of illicit funds being transferred via intermediary wallets is no longer tied to popular cryptocurrencies such as Bitcoin and Ethereum. Instead, stablecoins now represent the bulk (around 60% or more) of these illicit transactions’ total volume.

As a researcher studying the digital finance landscape, I’ve observed an increasing adoption of stablecoins. However, it’s essential to acknowledge a concerning aspect: their issuers hold the power to freeze funds. For instance, Tether, the leading stablecoin issuer, has reportedly frozen around 1,600 addresses containing approximately $1.5 billion worth of USDT based on Chainalysis’ findings. The value of assets frozen in other stablecoins remains undisclosed.

As a crypto investor, I’ve noticed the increasing popularity of stablecoins among those looking to bypass restrictions. In late May, according to a report in crypto.news, Russia’s two largest unsanctioned metal producers turned to Tether’s USDT stablecoin for cross-border transactions with Chinese clients and suppliers. This came after the U.S. Treasury Department warned it would impose secondary sanctions on banks facilitating such evasive activities.

Following Venezuela’s PDVSA corporation’s heightened adoption of USDT (Tether) for crude and fuel exports due to intensifying American sanctions, Venezuelan Oil Minister Pedro Tellechea acknowledged that the country employs various currencies based on contractual agreements. Certain contracts opt for cryptocurrency as a preferred method of settlement.

After Tellechea made that remark, Tether explicitly restated its intention to comply with the OFAC SDN list and unveiled plans for swiftly blocking blacklisted accounts.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-11 17:18