As a researcher with a keen interest in blockchain technology and its potential to revolutionize traditional finance systems, I find the recent announcement by Chainlink about their Chainlink Runtime Environment (CRE) framework truly exciting. Having closely followed the evolution of financial technologies over the past few decades, it’s fascinating to see how far we’ve come from the early days of COBOL and Java Runtime Environment (JRE).

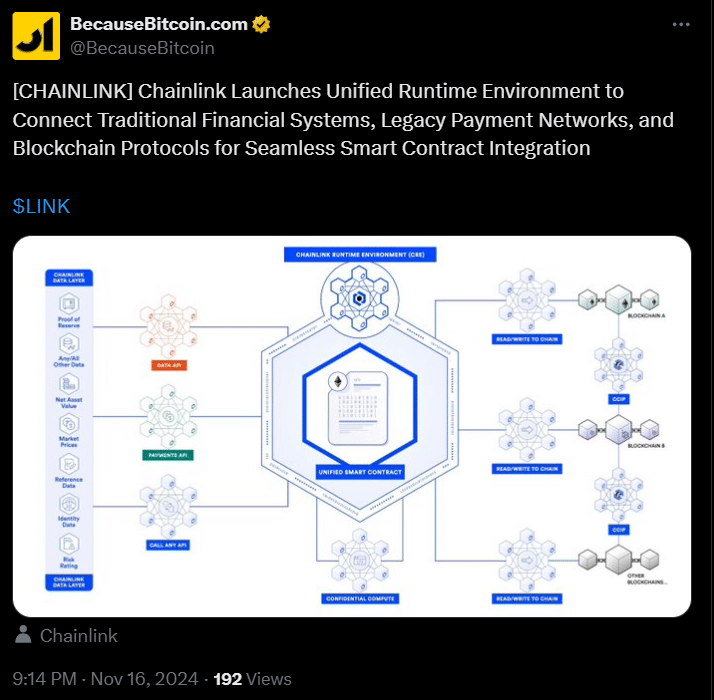

Today, Chainlink unveiled the Chainlink Runtime Environment (CRE), a framework aimed at facilitating seamless integration between traditional financial entities such as banks and payment systems, and blockchain technology.

As stated in the official announcement, the CRE is slated to take over outdated systems such as COBOL and Java Runtime Environment (JRE). Notably, COBOL, first introduced in 1959, played an essential role in designing early financial devices like ATMs and electronic banking systems. In a similar vein, JRE, developed during the 1990s, has served as a fundamental component for online banking solutions.

In simpler terms, both old systems were groundbreaking when they first appeared, yet they can’t keep up with today’s blockchain needs. Introducing the CRE (Chainlink), we are developing a unified system that works seamlessly with blockchains, aiming to update these outdated infrastructures for modern use.

Additionally, the rollout of the CRE takes place during Chainlink’s ongoing effort to integrate traditional finance within the blockchain environment. Notably, at the recent SIBOS banking conference, Chainlink unveiled a partnership with SWIFT, the globally recognized interbank messaging system, enabling banks to link SWIFT messages with blockchain systems.

Besides its existing collaborations, Chainlink introduced tools such as the Blockchain Data Privacy Manager and the Cross-Chain Interoperability Protocol (CCIP) last year, enabling companies to utilize blockchain technology while maintaining confidential data securely.

In addition, Chainlink is investigating the integration of Artificial Intelligence (AI) with its oracle services. This blend could result in immutable, tamper-proof records for financial transactions like proof-of-reserves, enhancing trust among businesses and users regarding their data.

By collaborating with the CRE and its associated initiatives, Chainlink is simplifying the process for banks and enterprises to venture into the blockchain domain, envisioning a seamless future where these two systems can harmoniously integrate.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-11-16 23:48