As a seasoned analyst with over two decades of experience in the financial industry, I’ve witnessed the evolution of technology from COBOL to Java, and now, I see the Chainlink Runtime Environment (CRE) as a game-changer in blockchain applications, particularly for online banking.

At this year’s SmartCon 2024 held in October, Chainlink showcased its latest update for the Chainlink Runtime Environment, a development that could potentially reshape the landscape of blockchain applications within online banking, as per their statement.

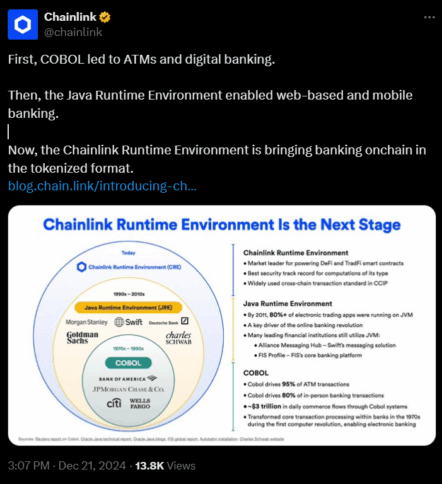

As a researcher delving into the evolution of banking technology, I’ve witnessed an incredible journey. From the foundational COBOL systems that powered early banking operations, we’ve progressed significantly. Today, it’s the Java Runtime Environment, or JRE, that has been instrumental in facilitating the growth of web-based and mobile banking solutions, transforming the way we interact with our finances.

Currently, the Chainlink Runtime Environment is aiming to expand upon existing enhancements by offering a versatile, decentralized, and scalable infrastructure. This robust system can accommodate a wide range of applications, such as on-chain financial solutions.

As a researcher, I’m constantly seeking ways to enhance the robustness and efficiency of the Chainlink platform. One key approach I’ve found is by dissecting its decentralized oracle networks (DONs) into modular components within the Chainlink Runtime Environment. This allows for more targeted improvements and adaptability in each segment, ultimately benefiting the overall system.

Through this modular approach, developers can construct tailored workflows by combining various functions such as consensus algorithms, network transactions, and external data retrieval. These custom workflows are capable of operation across multiple blockchain networks, enabling the creation of sophisticated decentralized financial solutions.

In simpler terms, the construction of CRE (Cross-chain Real Estate) enables the formation of digital financial services backed by tokens. These services can seamlessly connect with multiple blockchain platforms. This boosts cross-platform interoperability, thereby improving transaction security, transparency, and efficiency.

Utilizing Chainlink’s technology to integrate banking with the blockchain offers enhanced security as a key advantage. This is achieved through the immutable nature of blockchain transactions, preventing any potential manipulation and thus minimizing the likelihood of fraudulent activities. Furthermore, the decentralized structure of the blockchain ensures that no individual entity holds control over it, thereby decreasing the risk of data breaches or system malfunctions.

Employing CRE (Compliance Rules Engine), financial institutions can now design Decentralized Finance (DeFi) apps tailored to specific compliance standards, all while facilitating smooth interaction between private and public blockchains. This innovation could enhance the efficiency of banking systems substantially by enabling real-time transactions and decreasing operational expenses due to the absence of intermediaries.

Furthermore, Chainlink’s technology holds immense promise for transforming the conventional banking sector. It offers on-chain banking solutions that are not only safer but also more transparent and efficient compared to traditional methods.

Chainlink has the potential to disrupt existing financial architectures. By merging blockchain technology with their own systems, banks and financial entities could introduce innovative financial solutions, offering improved efficiency and security relative to current offerings.

In a recent blog entry, Uri Sarid, the Main Architect at Chainlink Labs, stated that this fresh runtime setting links all of Chainlink’s various capabilities, empowering developers to devise innovative applications within financial markets and blockchain networks.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-21 20:36