As a seasoned analyst with over two decades of experience in the financial markets under my belt, I can confidently say that Chainlink’s recent price rally is more than just a temporary blip. My years of studying market trends and analyzing various indicators have taught me to recognize the potential for sustained growth when I see it, and in this case, I believe Chainlink is poised for further gains.

The price of Chainlink has persisted in a powerful surge, peaking at $30 – a peak not seen since the month of November 2021.

In simpler terms, the price of Chainlink (LINK), the leading oracle service in the blockchain sector, surged to $30.17, representing a substantial increase of more than 270% compared to its record low in September.

The coin soared due to several tailwinds that could drive further gains in the near term. For example, Donald Trump’s World Liberty Finance selected Chainlink as its oracle provider and acquired 78,387 LINK tokens valued at over $2.3 million.

Hedera Hashgraph (HBAR) – a widely recognized layer-1 network – chose Chainlink as its oracle service provider, aiming to enhance the use of Decentralized Finance and Real World Asset tokenization. In simpler terms, Hedera is partnering with Chainlink to make it easier for people to utilize decentralized finance solutions and tokenize real-world assets on their network.

In addition, Chainlink is working together with Swift Society, a prominent global payment network. Swift, handling more than $150 trillion in yearly transactions, intends to utilize Chainlink’s Cross-Chain Interoperability Protocol to simplify international money transfers.

In the past few months, Chainlink has successfully formed significant collaborations, extending to prominent entities such as Emirates NBD, Coinbase, and UBS – a global leader in wealth management.

Simultaneously, Chainlink’s market dominance expands significantly, as the total value locked within its network exceeds $40 billion. This substantial amount overshadows the combined value of the next ten oracle services.

Furthermore, it appears that an increasing number of Chainlink investors are opting for self-custody, with the amount of tokens held on exchanges decreasing to about 255.8 million. This decrease in exchange-held tokens often indicates less selling pressure.

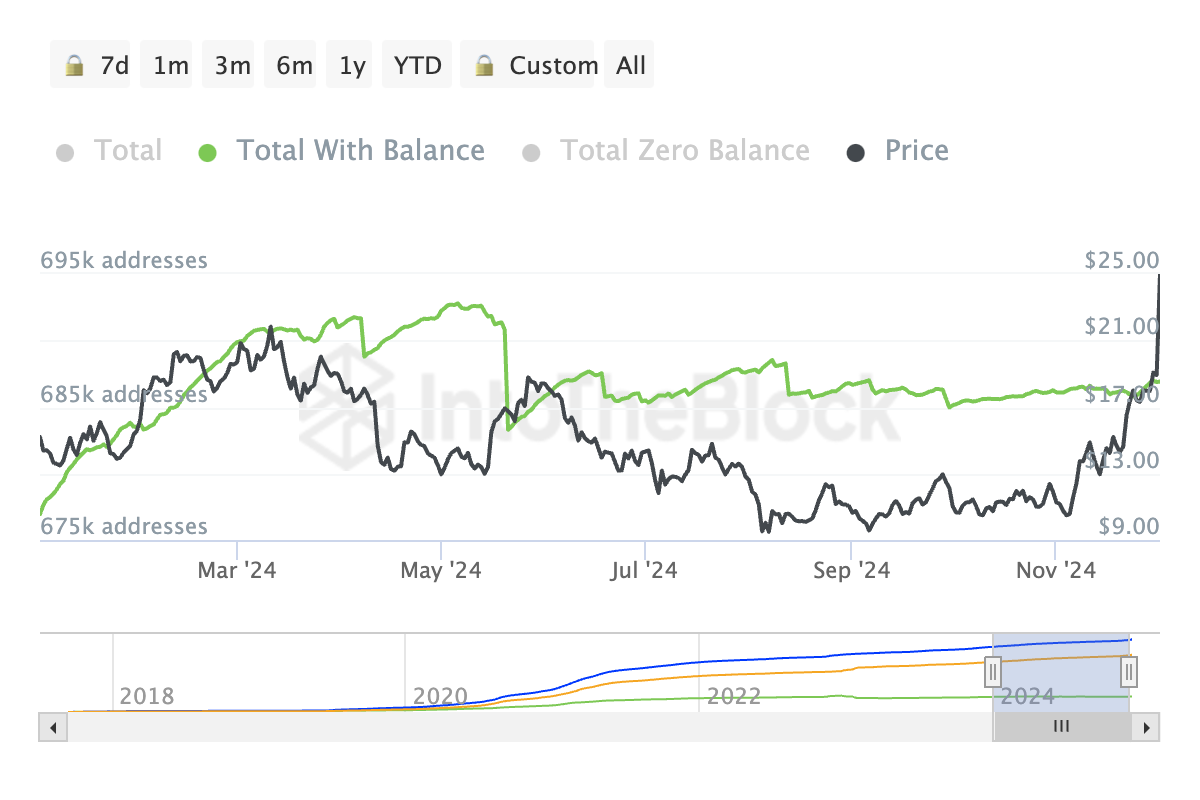

According to data from IntoTheBlock, there’s been a significant increase in the number of unique wallets holding the LINK token over the last few weeks.

Chainlink price technical analysis

Over the last several months, the graph for LINK indicates a robust upward trajectory. It surpassed the significant resistance point of $22.80, marking its highest price reached on March 11 this year.

According to Murray Math Lines, Chainlink has surpassed its overbought threshold and currently trades above both its 50-week and 25-week moving averages. Moreover, the Relative Strength Index suggests that Chainlink’s momentum is on an upward trend.

As a crypto investor, I find myself optimistic about Chainlink’s potential for growth. Given current trends and market conditions, it seems plausible that LINK’s price might surge by approximately 80%. If this prediction holds true, we could see the token reaching its all-time high of $54 once again.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-12-16 20:44