As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I’ve seen my fair share of bull runs and bear markets. The recent dip in Chainlink (LINK) has been a familiar sight, but it doesn’t discourage me.

Over the past three days, the value of Chainlink has undergone a notable downward shift, undoing part of the progress achieved during the previous week.

The Chainlink (LINK) token dropped to $27, representing a 13% decrease from its peak this year, which has increased its total market capitalization to surpass $17 billion.

The retreat in this particular cryptocurrency was akin to the declines observed in other well-known digital currencies. Bitcoin (BTC) dipped from $108,000 to $105,000 at its weekly peak. In a similar vein, Ethereum, Ripple, and Solana all experienced drops of more than 3%.

Meanwhile, one whale persisted in gathering LINK tokens, anticipating a possible price rise. As per LookOnChain, this whale withdrew approximately 65,000 LINK tokens valued at around $1.8 million on December 18. This action was part of a pattern that started four days prior, increasing the whale’s total holdings to over $17.3 million.

40 minutes ago, a large investor (whale) removed approximately 1.81 million dollars worth of LINK from Binance. Over the past four days, this same whale has withdrawn a total of around 17.31 million dollars in LINK from Binance.

— Lookonchain (@lookonchain) December 18, 2024

The accumulation came shortly after Donald Trump’s World Liberty Financial acquired LINK tokens worth over $2 million. The upcoming Decentralized Finance platform has selected Chainlink as its oracle provider.

In simpler terms, Chainlink is highly respected in the blockchain world for its robust foundations. Major DeFi platforms like AAVE, Spark, and Compound use its oracle services. The value secured by Chainlink has exceeded $41 billion, outranking competitors such as Chronicle, Pyth, and Edge.

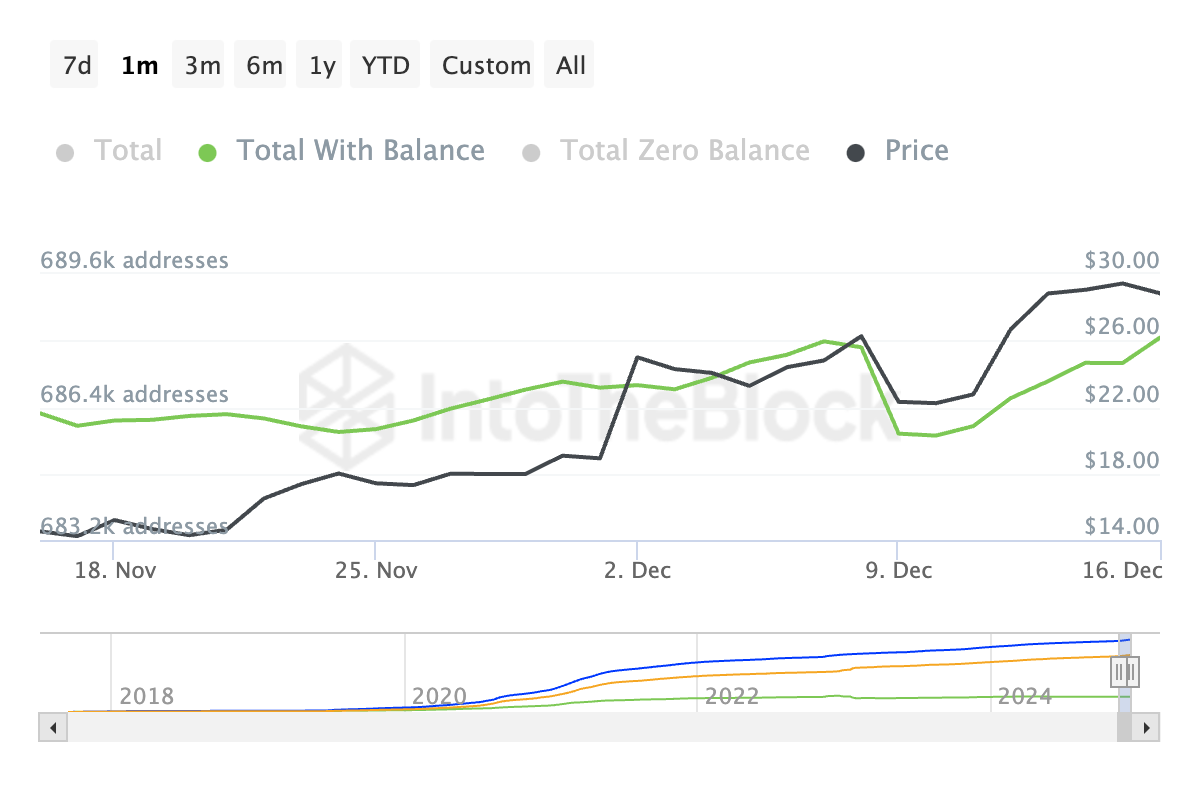

The count of individuals holding Chainlink has consistently gone up as well. Based on information from IntoTheBlock, a staggering 688,000 wallets now hold LINK, surpassing the 30-day average of 686,000. This growth suggests that there is ongoing interest in the token.

It’s anticipated that Chainlink will gain advantages through its collaborations with Swift Network and significant platforms utilizing its tech for tokenization. Additionally, talks regarding the possibility of a Chainlink ETF being approved by the Securities and Exchange Commission are ongoing.

Chainlink price analysis

On the 4-hour scale, it’s evident that LINK’s price reached a high of $30.95, forming a tiny triple-top chart configuration – a bearish indication. Since then, its value has dropped and dipped beneath the pattern’s neckline at $27.58.

As an analyst, I’m observing that Chainlink is slightly above the 23.6% Fibonacci Retracement level, currently hovering around $26. It seems to have dipped below both the middle line of the Andrew’s Pitchfork and the 50-day moving average, suggesting a potential downward trend.

Consequently, the currency is expected to keep climbing prior to the Federal Reserve’s decision. If this occurs, it might dip to the subsequent psychological level around $25 before rebounding, as investors take advantage of the price decrease.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-18 17:16