Ah, Chainlink. The cryptocurrency equivalent of that friend who always promises to pay you back but never does. But wait! It seems like our dear LINK is finally stabilizing, as if it just remembered where it left its wallet. Technicals and fundamentals are waving their little flags, signaling a potential rebound. 🎉

On Monday, Chainlink was trading at a respectable $18.80, which is a whopping 20% increase from its lowest level last week. I mean, who knew a little sell-off could lead to such a dramatic comeback? It’s like watching a soap opera where the villain suddenly turns into a hero. 📈

Now, let’s talk about the catalysts that might just send LINK soaring into the stratosphere. Chainlink is the largest oracle provider in the crypto world, which is a fancy way of saying it’s the go-to for decentralized finance players like AAVE and Compound. It’s like being the most popular kid in school, but instead of a lunch table, it’s a blockchain. 🍔

And if that wasn’t enough, Chainlink is also making waves in the real-world asset tokenization industry. Its cross-chain interoperability protocol, CCIP, is like a secure highway for token transfers and messaging across multiple chains. Think of it as the Uber of crypto—only without the awkward small talk. 🚗💨

But wait, there’s more! Chainlink has partnered with some big names in financial services. It’s like the cool kid who suddenly starts hanging out with the prom queen. Collaborations with Swift, UBS, Coinbase, and Emirates NBD? Talk about a power move! 💪

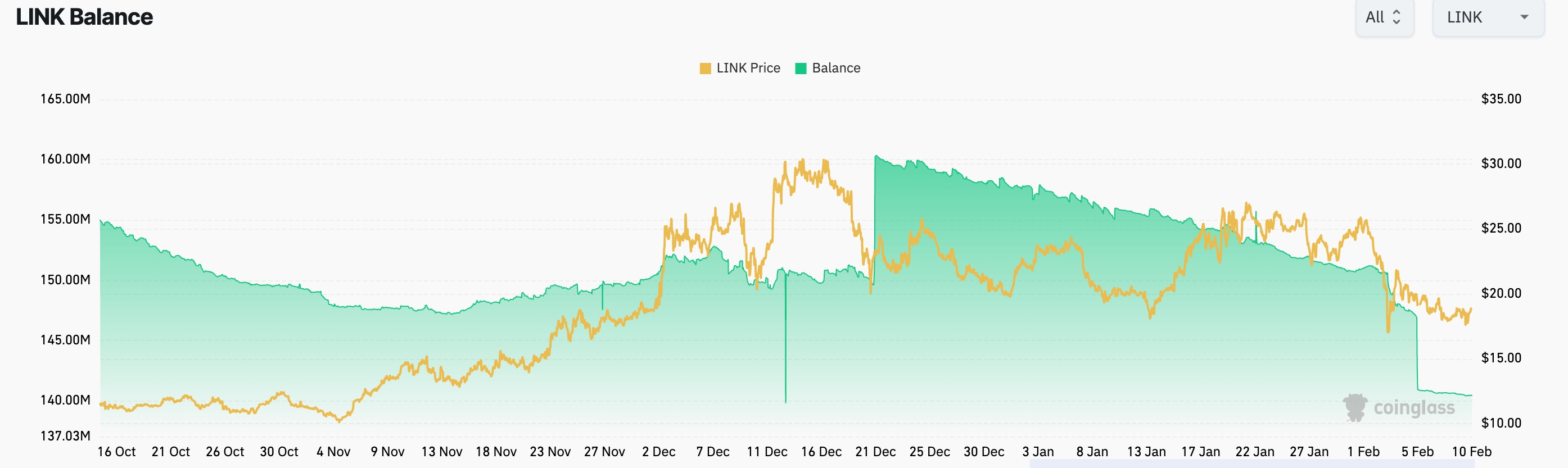

Now, here’s the juicy part: a new catalyst might just push Chainlink’s price higher. LINK balances on exchanges have dropped recently, with only 140 million LINK tokens left on exchanges tracked by Coinglass. That’s down from 150 million in December. It’s like watching a game of musical chairs, and it seems like everyone is holding onto their tokens. 🎶

Declining exchange balances are a bullish indicator, suggesting that investors are hoarding LINK like it’s the last slice of pizza at a party. Plus, there’s rising demand for Chainlink’s staking services, with over 40.87 million LINK tokens currently staked, yielding a delightful 4.32%. Who knew crypto could be so… productive? 🍕💸

Chainlink price forecast

Now, let’s take a peek at the daily chart. LINK peaked at $31 in December before plummeting to $16 last week. This dramatic drop coincided with the 61.8% Fibonacci retracement level and the 200-day Exponential Moving Average. It’s like a rollercoaster ride that makes you question your life choices. 🎢

But fear not! Chainlink’s price has formed a bullish flag pattern, which is a fancy way of saying it’s trying to break above the key resistance level at $19.12. If it succeeds, we might just see it retest the next major resistance level at $25.60, which is about 35% above the current price. So, buckle up, folks! It’s going to be a bumpy ride! 🚀

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Pi Network (PI) Price Prediction for 2025

2025-02-10 17:54