As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I have seen my fair share of market fluctuations and unexpected turns. However, the recent surge in Bitcoin Cash (BCH) has certainly caught my attention.

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

A study combining blockchain data, technical signals, and derivatives market info suggests that Bitcoin Cash (BCH) might continue to rise, potentially reaching a level similar to its mid-April 2024 high of approximately $569.10 again.

Table of Contents

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

On November 21st, Bitcoin reached an all-time peak of $98,384, marking a significant achievement as it aims to surpass the $100,000 milestone. Notably, Bitcoin Cash was born as a result of a split from Bitcoin in 2017, representing an offshoot or substitute version.

In the realm of crypto investments, back in May 2021, Bitcoin Cash (BCH) soared to an impressive peak of $1,650. However, since the spring of 2024, my BCH holdings have been stuck in a consolidation phase, with no discernible trend yet to emerge.

Over the past few weeks, the value of BCH has surged by approximately 30%, according to data from November 15th. Analysis of its on-chain metrics indicates a potential continuation of this upward trend for the Bitcoin Cash derivative token.

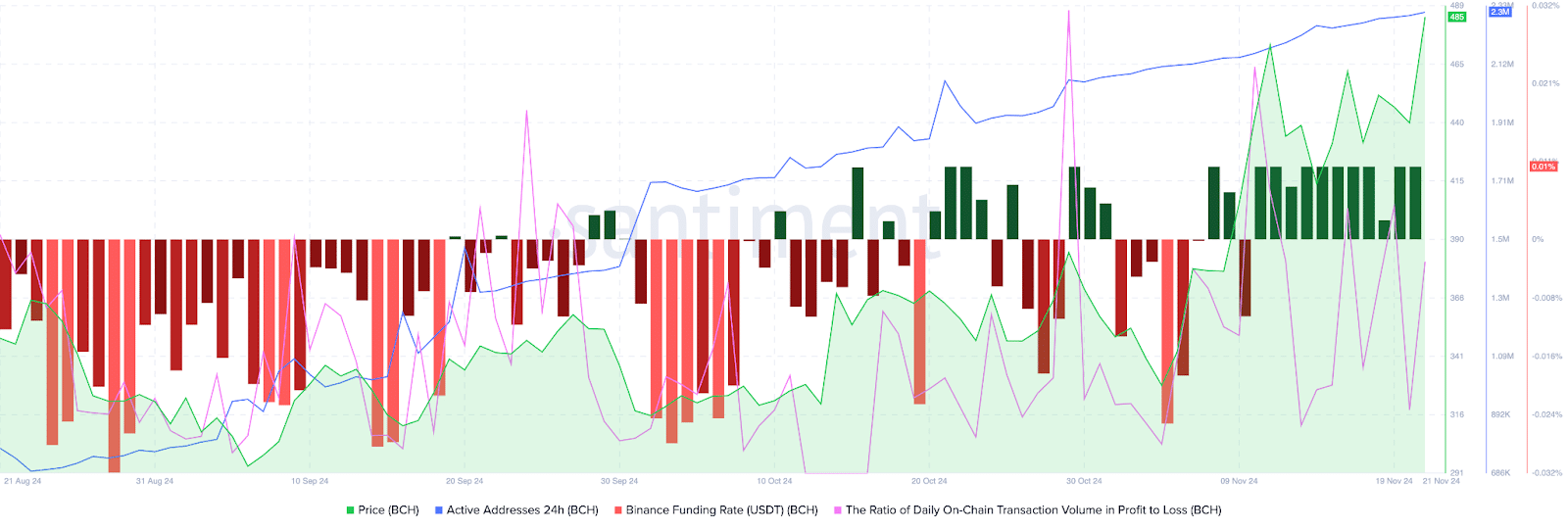

The number of active Bitcoin Cash addresses has been steadily increasing since August 2024, as indicated by Santiment’s data. This upward trend in active addresses suggests that Bitcoin Cash traders continue to show interest in the token, lending credence to a bullish outlook for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss surpassed 2 and was 2.141 on Thursday. In BCH trades conducted on-chain, there were twice as many profitable transactions compared to those resulting in losses, offering a positive outlook for the cryptocurrency spun off from Bitcoin.

Since November 10th, the funding rate on Binance has remained positive. This suggests that over the past eleven days, traders have generally shown optimism about potential increases in Bitcoin Cash’s market value based on data from Santiment.

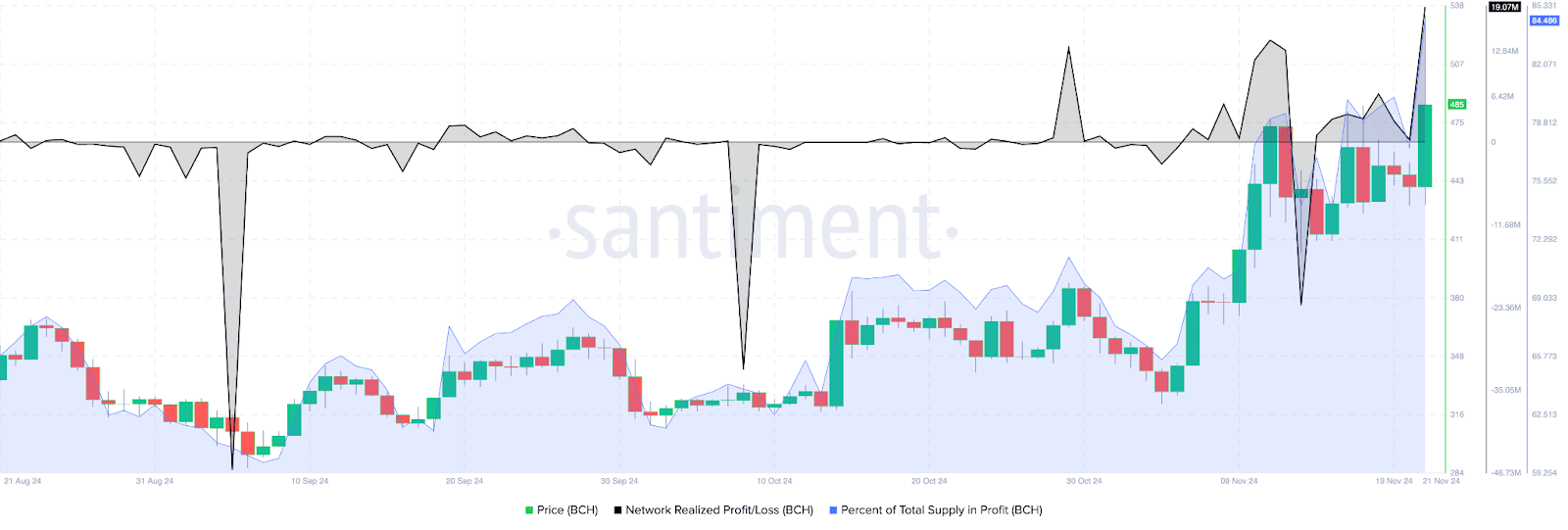

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Keep a close watch for notable fluctuations in Non-Performing Loans (NPL). Steep upward surges suggest high levels of profit-taking, which may lead to increased selling activity and potential pressure on trading floors.

Approximately 84.48% of Bitcoin Cash’s total supply is currently generating a profit for its owners, as reported on November 21st. This statistic can assist traders in evaluating the potential for significant profit-taking or selling by existing BCH holders, thereby helping them to strategize entry and exit points when trading in the spot market.

Derivatives traders are bullish on BCH

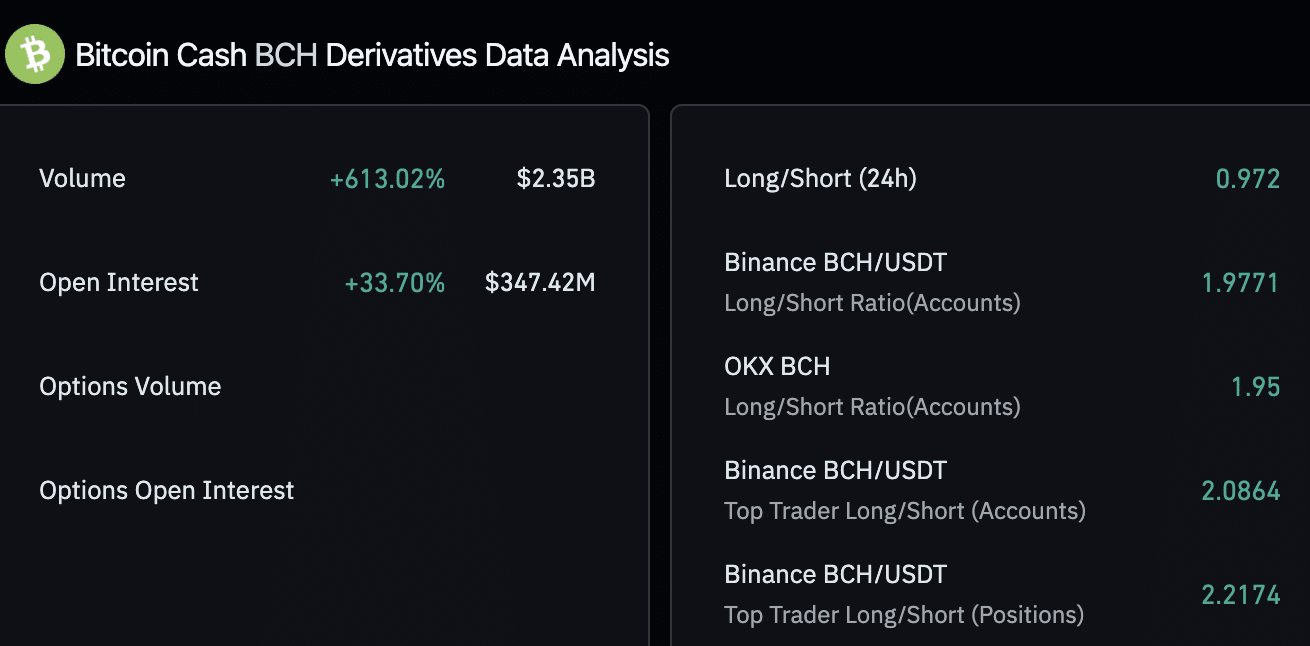

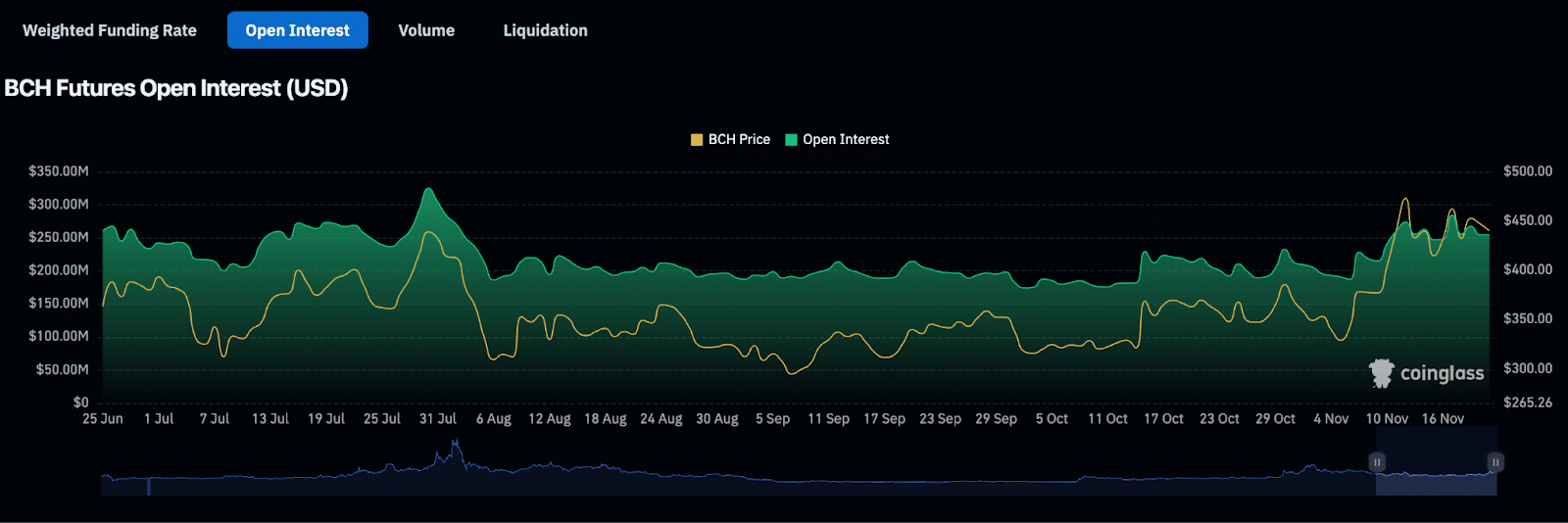

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

In the given period, derivatives trading volume surged a staggering 613%, reaching an impressive $2.35 billion. On both Binance and OKX exchanges, the long/short ratio is significantly above 1, leaning closer to 2, indicating that traders continue to be optimistic about BCH’s price trajectory and anticipate further increases.

The BCH futures open interest graph indicates a consistent rise in the value, coinciding with Bitcoin Cash price growth since November 5, 2024. Open interest has risen from $190.74 million to $254.87 million between November 5 and 21.

Technical indicators show BCH could gain 18%

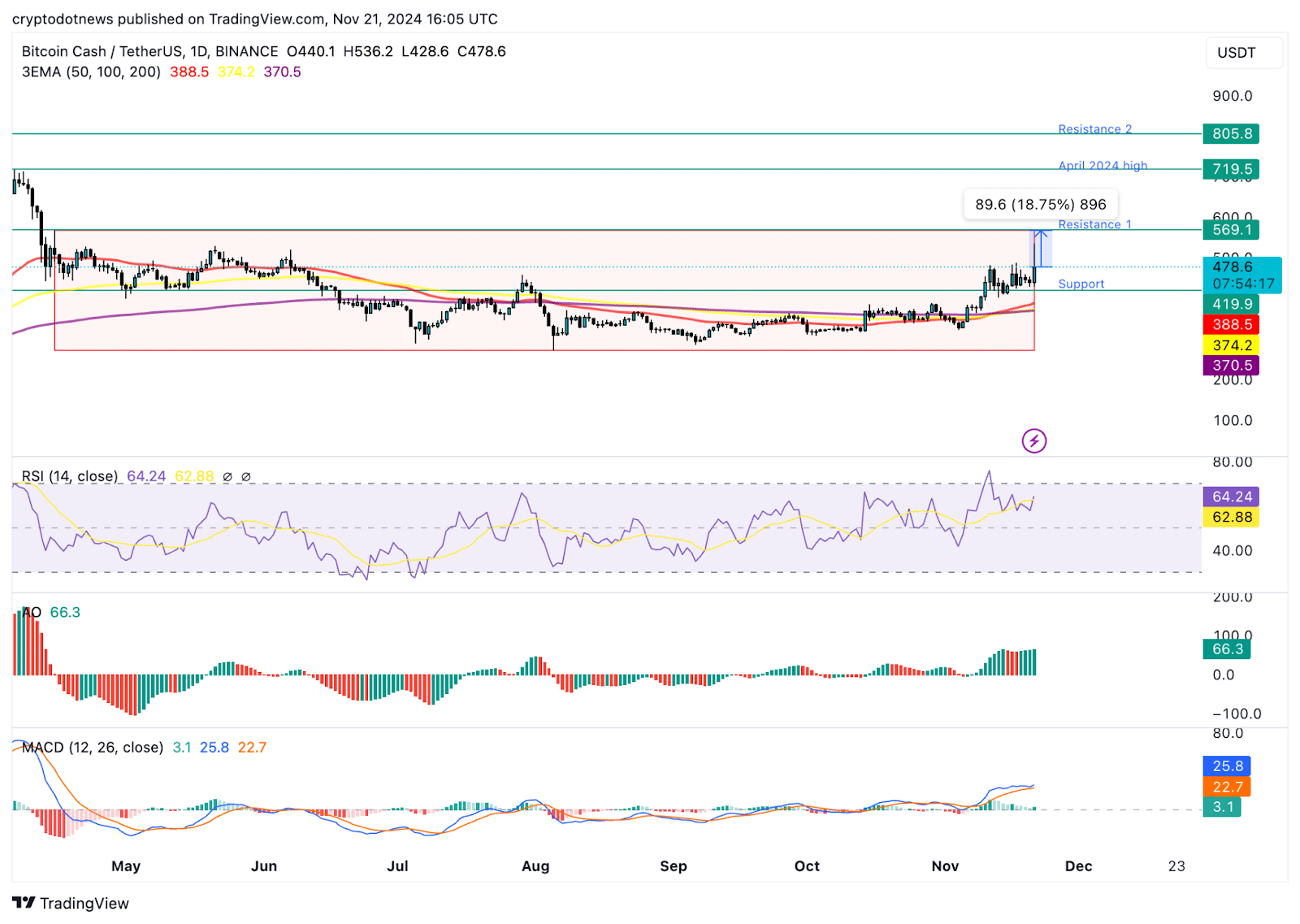

As a crypto investor, I’ve been closely watching the BCH/USDT chart on Tradingview.com and it appears that the token is currently in consolidation. This means it’s bouncing around within a specific range right now, which for BCH is between $272.70 and $568.20. If we see a daily candlestick closing above $568.20, it could signal a bullish breakout, indicating a potential upward trend.

In simple terms, the record high of $719.50 in April 2024 represents the significant barrier (resistance) for Bitcoin Cash (BCH). Another crucial point to watch is around $805.80, a level that was also significant back in May 2021.

The Relative Strength Index (RSI) currently stands at 64, which is below the “overvalued” zone of 70 and higher. This RSI reading supports a bullish outlook for Bitcoin Cash (BCH). Additionally, another important momentum indicator, the Moving Average Convergence Divergence (MACD), displays green histogram bars above the neutral line. This indicates that BCH’s price trend has an underlying positive momentum.

Based on the analysis, the Awesome Oscillator aligns with the results from RSI and MACD, suggesting that these three technical indicators are pointing towards a probable increase in value.

If BCH fails to rise above its upper limit, it might weaken the argument for a bullish trend. Potential supports could be found at two levels: around $419.90, which is the midpoint of its range, and roughly $388.50, where the 50-day exponential moving average lies.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-22 15:00