As a seasoned crypto investor with over five years of experience under my belt, I must admit that the recent surge in Cardano (ADA) has caught my attention. Having closely monitored its progress since its inception, I’ve seen its highs and lows, but this steady climb seems promising.

On November 10, Cardano experienced a 35% increase, and it has maintained its position near the $0.65 mark. The digital token of the competitor to Ethereum, ADA, is surging in tandem with Bitcoin, Ethereum, Dogecoin, and other major cryptocurrencies following Bitcoin’s all-time high on Wednesday.

Table of Contents

Cardano’s on-chain indicators signal price growth

On November 12th, Cardano (ADA) surged in tandem with Bitcoin (BTC), as Bitcoin achieved a fresh all-time peak, reaching $93,265. Simultaneously, the price of ADA reached a six-month high, standing at $0.6599.

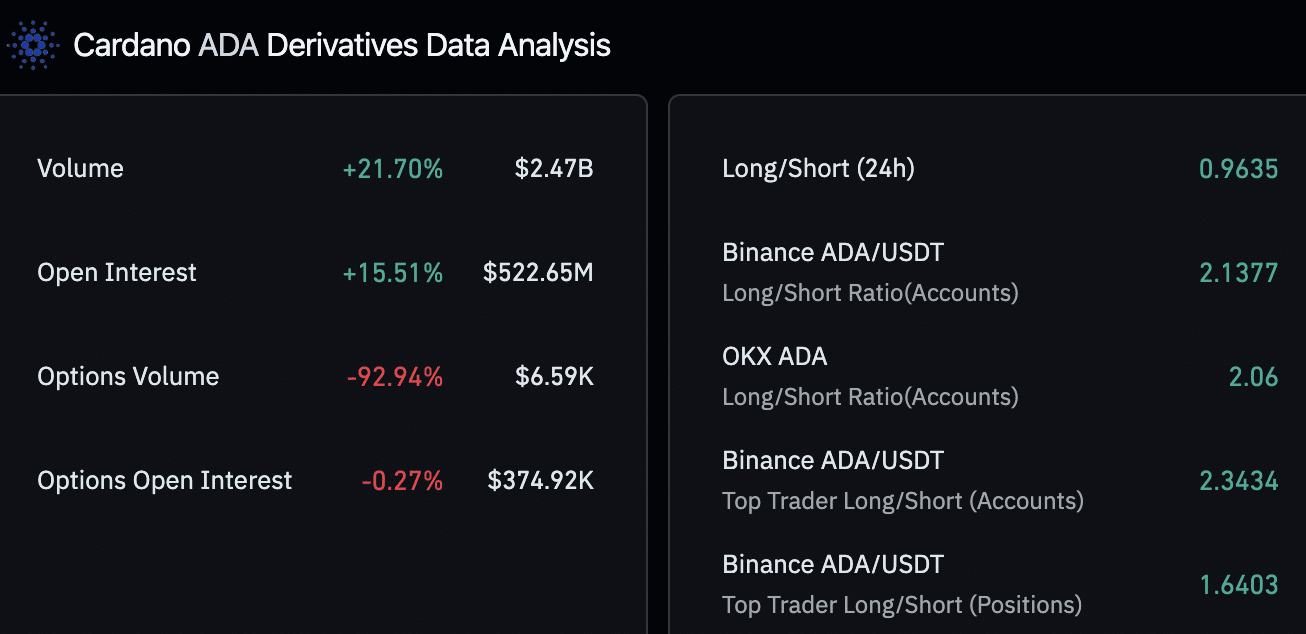

In the past 24 hours, enthusiasm for ADA has grown by 15.51%, as this cryptocurrency aims to surpass its March 2024 high of $0.8104. The ‘open interest’ figure shows us the number of open contracts that Cardano’s derivatives traders have, which indicates strong demand and market significance for ADA within futures trading.

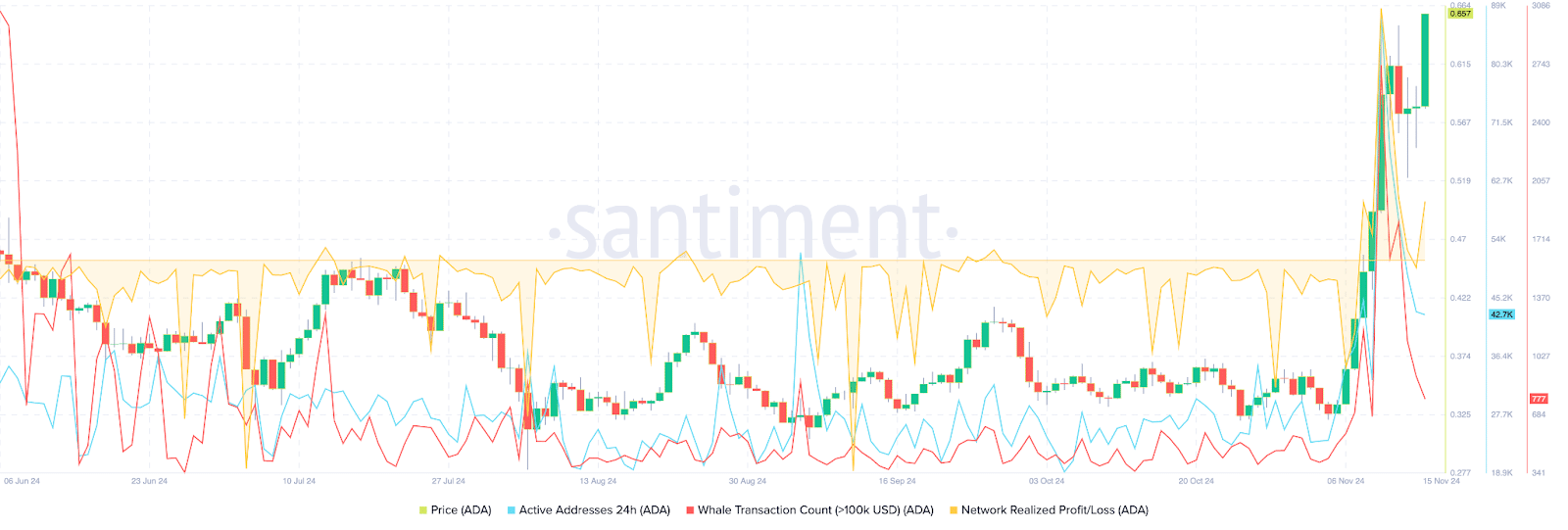

The key on-chain factors – the number of active addresses, the frequency of whale transactions, and the network’s realized profit/loss – all point towards a bullish outlook for Cardano prices. Notably, the number of active addresses surged by 42% in November, based on data from Santiment.

Over the same period, the number of whale transactions worth $100,000 or more reached its maximum of 2,737 on November 10, while large-scale investors continued to be quite busy in their investments throughout November.

The amount traders are earning has dropped significantly, from around $93 million on November 10 to approximately $21 million on November 15 (Friday). Generally, when profit-taking activities decrease, it lessens the urge to sell, creating a path for potential increases in the token’s value.

According to IntoTheBlock’s analysis, the relationship between Cardano and Bitcoin is quite strong (0.93). This means that Cardano’s performance is often influenced by Bitcoin’s condition and its price movements. If Bitcoin experiences a downturn or correction, it could potentially have a negative effect on Cardano.

Cardano eyes return to March peak at $0.8104 per technical indicators

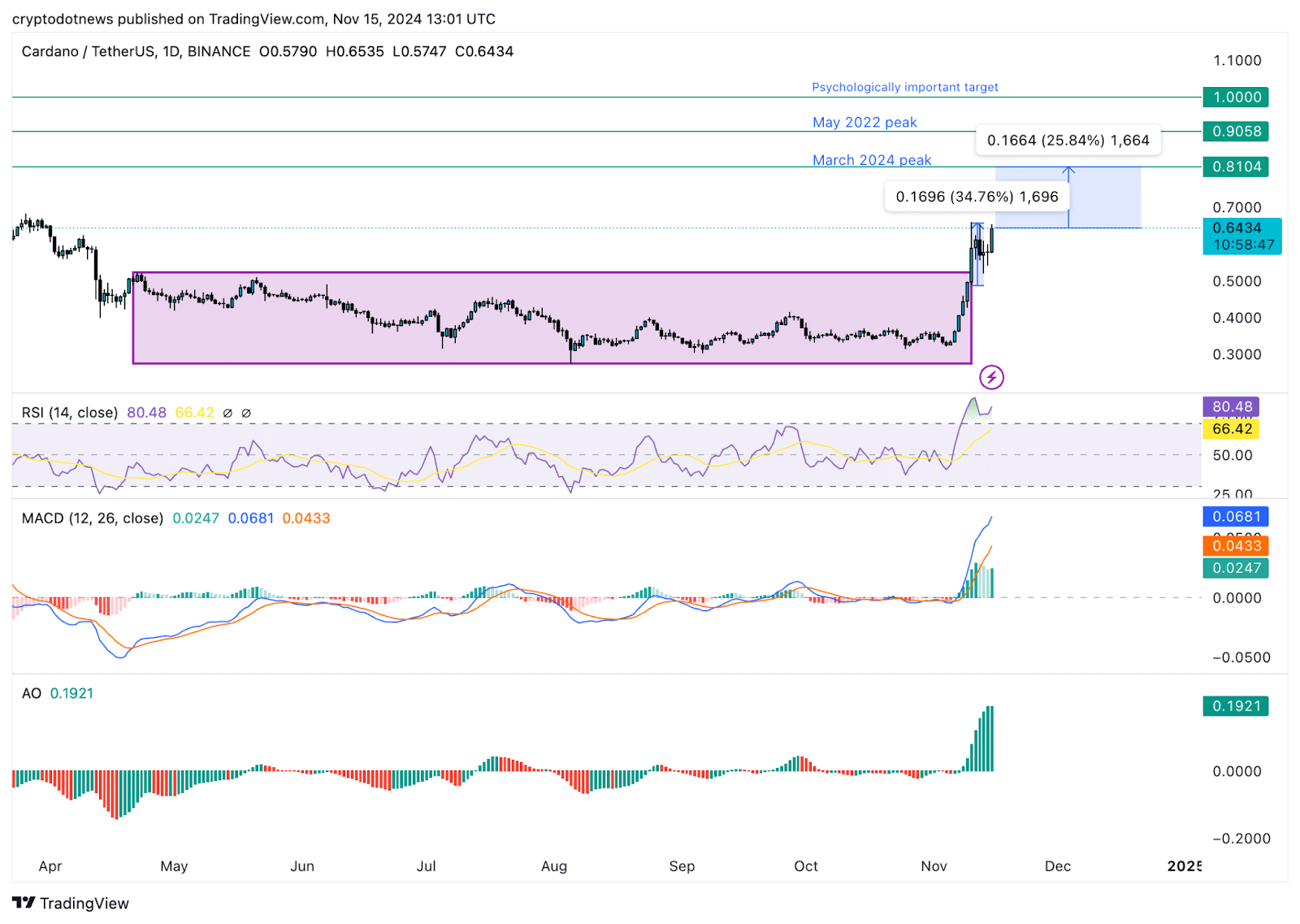

For approximately half a year, Cardano’s trading has been confined within a specific price range, as shown in the daily chart below. During the past six months, ADA has fluctuated between $0.5225 and $0.2756. However, Cardano has managed to break free from its prolonged sideways movement and is now preparing to challenge the resistance at the projected peak of $0.8104 in March 2024.

Reaching approximately $0.8104 signifies a roughly 25% increase in the value of this altcoin. Important resistance levels lie ahead at the high point reached in May 2022, around $0.9058, and the significant psychological barrier at $1.00.

In an upward trend, the $1 mark might serve as a barrier for Cardano’s price increase. If the daily candle closes above this point, it could potentially reopen the possibility of reaching its previous all-time high of $3, which was attained in September 2021.

When the Moving Average Convergence Divergence (MACD) indicator displays green bars above the baseline, it suggests that the momentum behind Cardano’s price movement is generally positive. This may indicate potential future increases in its value.

The awesome oscillator supports a bullish thesis for Cardano with no signs of reversal on the daily price chart.

Failing to surpass $0.5785 as a resistance point might undermine the optimistic outlook for Cardano (ADA). If this happens, it may instead find support within the specified range, and potentially drain liquidity at $0.5225, which is the upper limit of its daily price chart range.

Strategic considerations

According to data from Coinglass, the number of long (buy) positions compared to short (sell) positions for Cardano is greater across multiple platforms. Specifically, on Binance, it’s 2.1377, on OKX exchange, it’s 2.06, and on top trader accounts on Binance, it’s 2.3434. This means there are more people betting that the price of Cardano will rise (long positions) than those betting it will fall (short positions). Essentially, this suggests a greater confidence among traders that the token’s value may increase in the near future.

Information derived from futures markets is often utilized to inform decisions in the cash market. Additionally, such data is seen as a reflection of traders’ overall sentiment.

According to the Fear and Greed Index for Cardano, provided by cfgi.io, there’s currently “high levels of greed.” This condition is often seen as a potential sell signal or warning of an impending adjustment. Therefore, traders are advised to exercise caution when considering further investments in Cardano.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-11-15 18:31