As a seasoned crypto investor with over a decade of experience in the volatile world of digital currencies, I can’t help but feel a sense of déjà vu when looking at Cardano’s current situation. The parallels between the market conditions in 2019 and today are striking, and history tends to repeat itself in the crypto space more often than not.

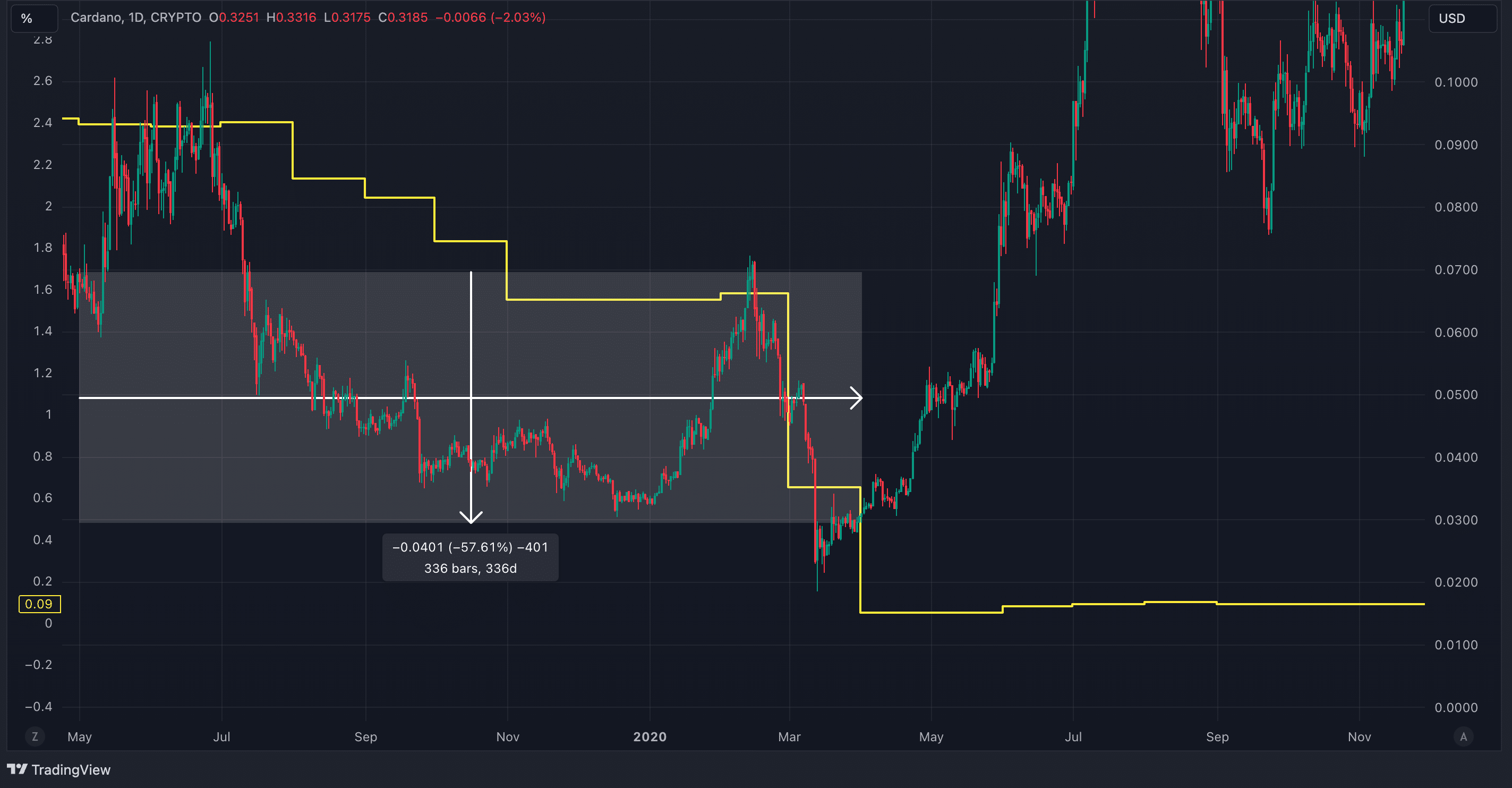

In simpler terms, when the Federal Reserve reduced interest rates in 2019, Cardano fell by about 57%. Given that another potential interest rate reduction is expected, this could set up a situation similar to before, potentially leading to significant decreases in the value of Cardano.

Table of Contents

Cardano prepares for September decline

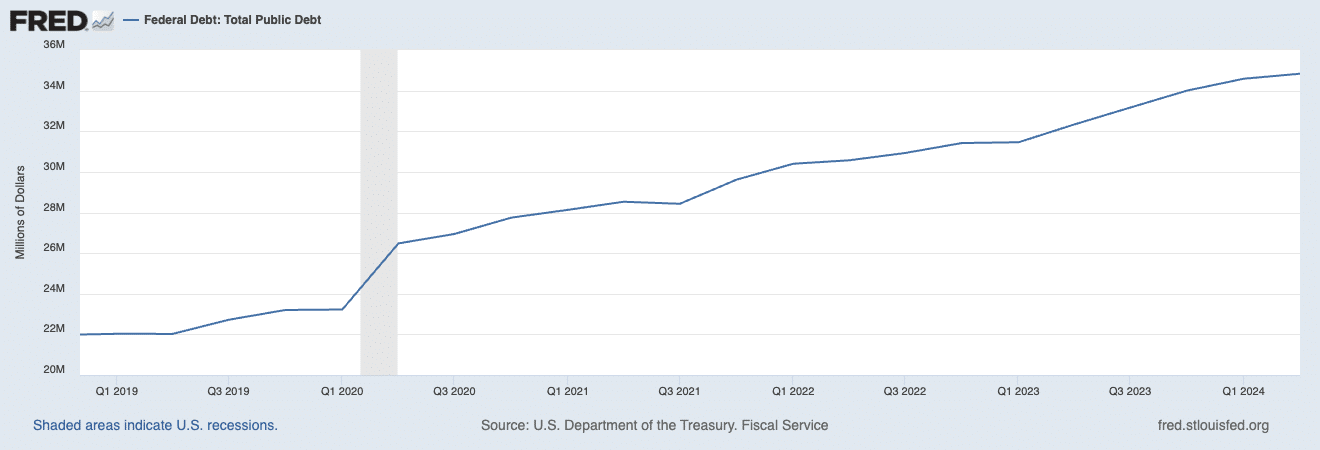

In May 2019, the Federal Reserve reduced its benchmark interest rate for the first time, decreasing it from 2.42% to 2.39%. At that point in time, rates were significantly lower compared to today, and the national debt was approximately $22 trillion. As of now, the debt has surged nearly to $35 trillion, while the interest rates have more than doubled, standing at 5.33%, as compared to the 2019 levels which were considerably lower.

In 2019, when interest rates began to decrease, Cardano underwent an unexpected plunge. Following a short period of regaining ground, the downward trend persisted for several months until early 2020. Later on, there was an upswing, but the market downturn that coincided with the COVID-19 pandemic, which led to additional interest rate reductions, also impacted Cardano and the overall market, resulting in a noticeable decrease in value. Although it’s not entirely clear how interest rate cuts directly affect crypto declines, there seems to be a definite correlation between the two.

As a crypto investor, I’m closely watching the upcoming Federal Reserve meeting. Historically, cryptocurrencies have mirrored traditional finance movements, like during the 2019 rate cut. Given the current CME data suggesting another rate cut, there’s a possibility that we might see a replay of that trend. If so, Cardano could experience a protracted decline over several months, potentially until the end of this year, before starting to recover around early 2025. This repeat pattern could drive down Cardano’s price to approximately $0.15. I’m preparing my portfolio accordingly and encourage others to do the same.

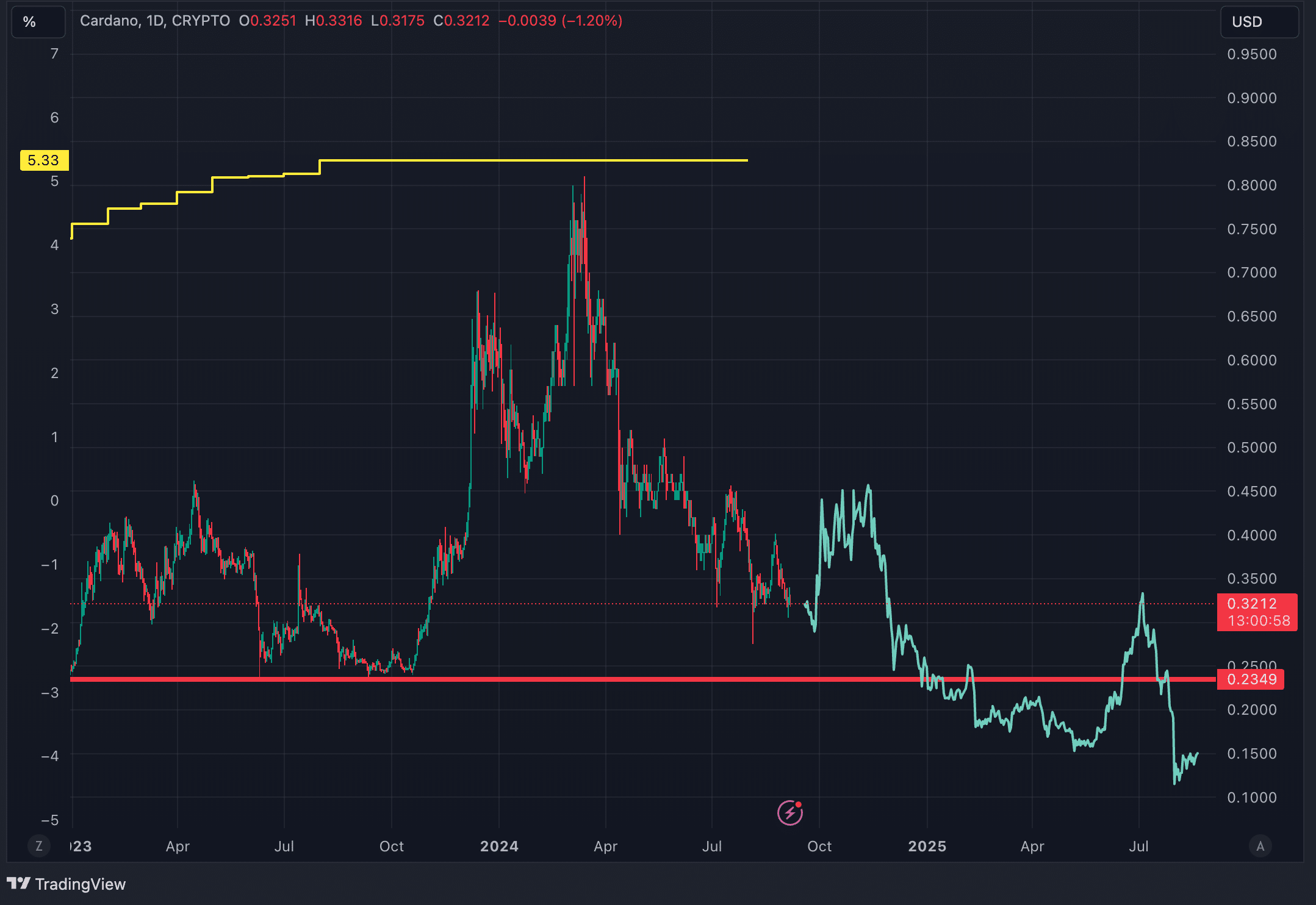

Furthermore, it’s worth noting that September has historically posed challenges for both stocks and cryptocurrencies. For instance, during a halving year like 2020, Cardano experienced a decline as well. Given the recent 10% drop from the start of this month and considering its past difficulties in September, there’s a possibility that Cardano may experience a more significant fall in the coming weeks and months, potentially dropping below its 2022 support level at $0.2349.

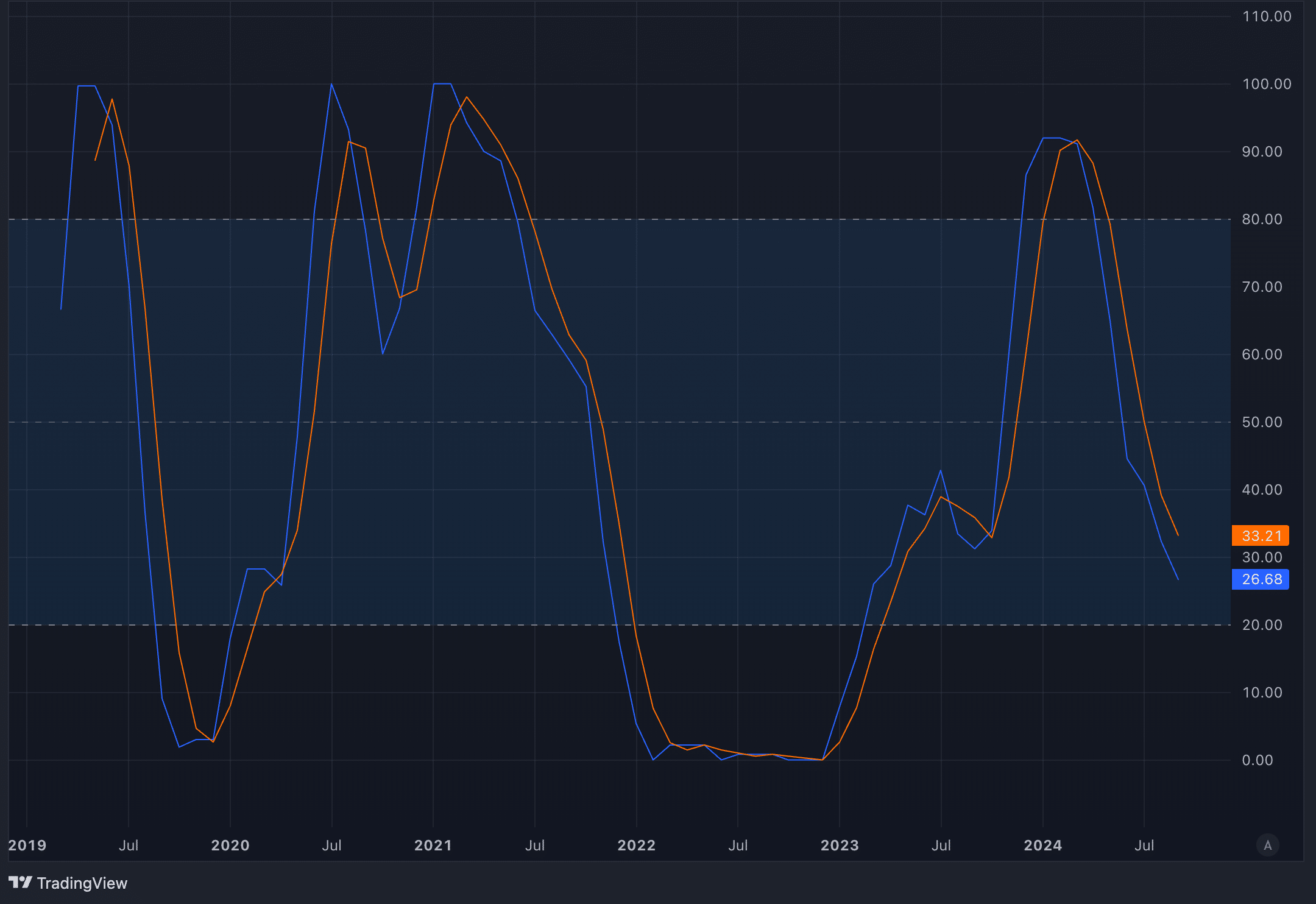

Cardano’s bearish momentum grows with SRSI, MACD, and VRVP

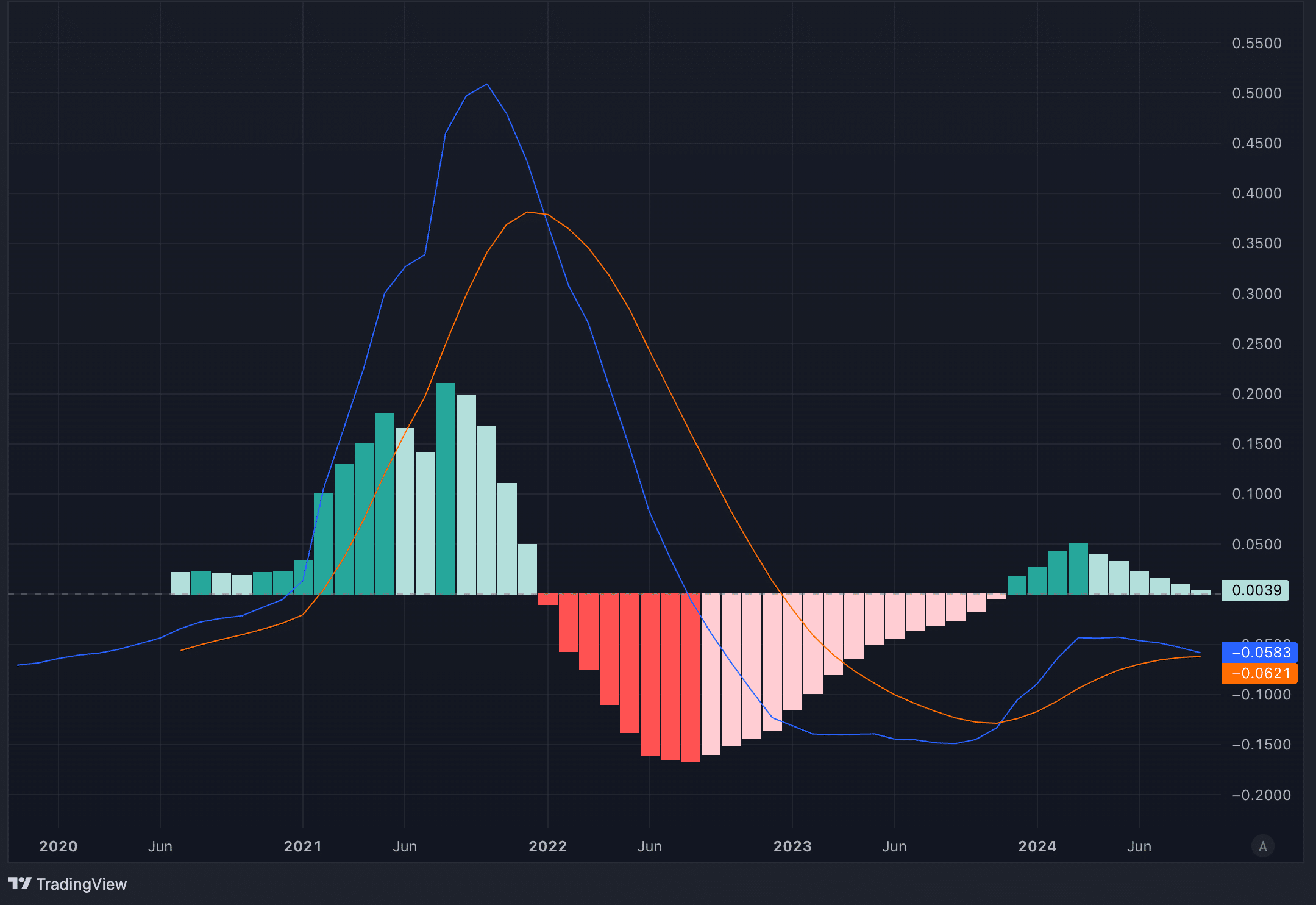

Instead of concentrating on short-term fluctuations which many traders often do, taking a broader, long-term perspective might provide a clearer understanding of the overall context. The monthly Stochastic RSI (SRSI) and MACD indicators for Cardano are signaling potential risks that require attention, and they seem to predict a challenging outlook for ADA.

The SRSI monitors an asset’s price movement by focusing on its price fluctuations over a given period. This indicator spans from 0 to 100, with figures under 20 indicating potential undervaluation or oversold conditions. Since March 2024, the SRSI has been trending downwards and is now approaching the region that suggests possible overselling.

Meanwhile, the MACD indicator appears to be displaying a bearish trend as well. On the monthly chart, the MACD line has already dipped beneath the signal line, indicating increasing downward pressure. Furthermore, the histogram, which measures the distance between the two lines, is on the verge of turning red, signifying an escalating bearish force.

Combining the bearish indicators from the Stochastic RSI and MACD, the Visible Range Volume Profile (VRVP) further strengthens this negative outlook. In simpler terms, the VRVP illustrates where significant trading activity has taken place at different price levels. For Cardano specifically, the current price range’s volume bars appear quite slim, signifying insufficient support. However, a notable volume bar can be found at the $0.15 level, suggesting a robust support zone there. Beneath the present price, there is a void in the volume profile, meaning that if Cardano continues to decline, there will be limited trading activity to slow down the drop until it reaches the $0.15 level.

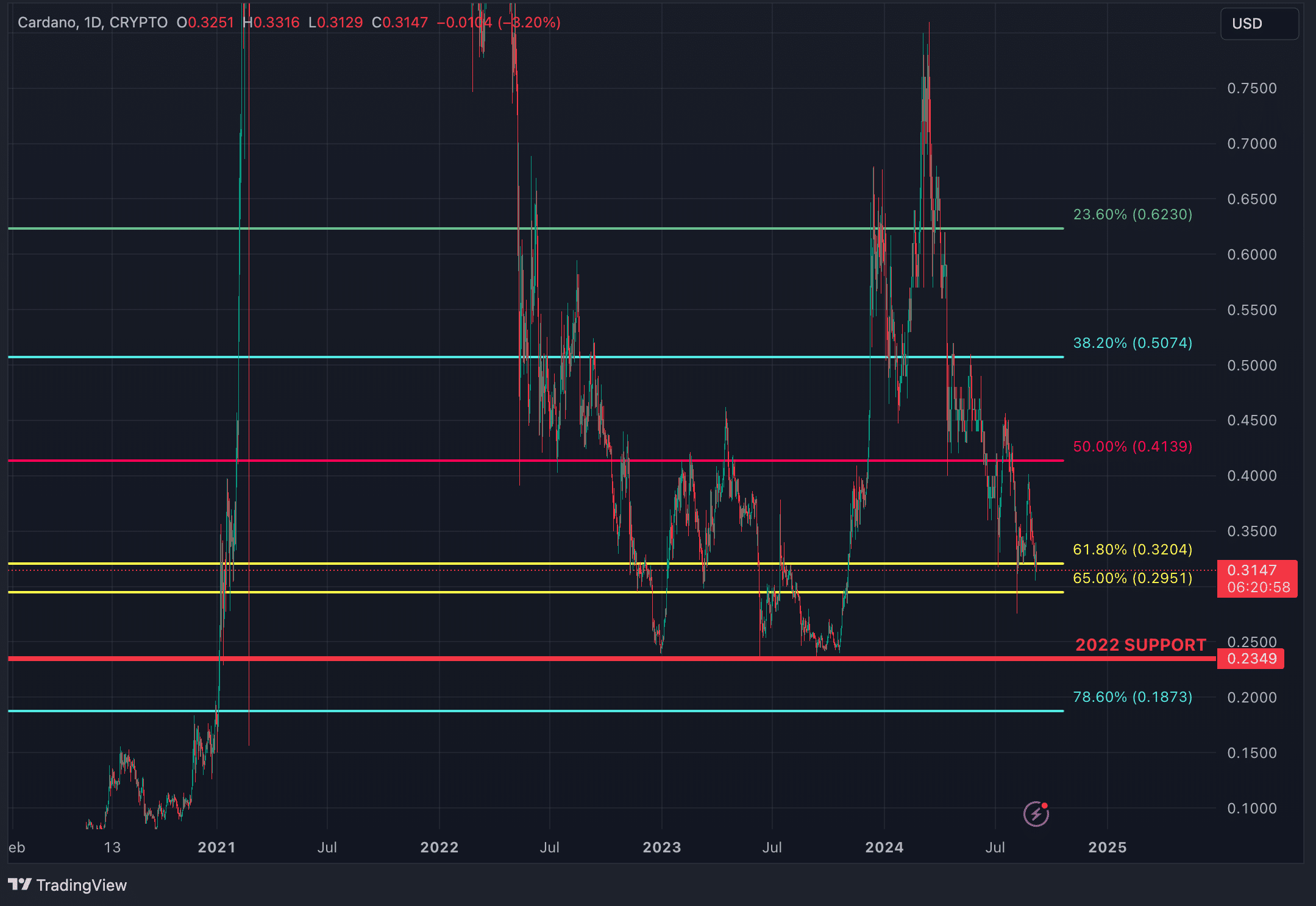

Is Cardano’s 2022 support line strong enough to hold?

Although some bearish signals suggest potential drops for Cardano, certain factors might prevent it from plummeting drastically. Currently, the price is positioned within a Fibonacci golden pocket, which stretches from the all-time low to the high in March 2024 and ranges between $0.2951 and $0.3204. This area has acted as support so far. However, when considering other Fibonacci retracement levels, Cardano has already dipped below the 78.6% retracement on all of them, casting some uncertainty about the durability of this golden pocket in the long run.

A significant support point can be found at $0.2349 – a level that held firm even during the 2022 market downturn for ADA. At the moment, ADA is trading around $0.315. If it were to fall to this support level, it would mean a decrease of approximately 25%, which certainly wouldn’t be an optimal situation.

Strategic considerations

From our perspective, it’s possible that Cardano (ADA) may experience a temporary recovery, or what is sometimes called a “dead cat bounce,” before the Fed meeting on September 18. Following this event, however, we anticipate a prolonged downtrend for ADA, lasting approximately 2-3 months. This is due to the Federal Reserve’s anticipated slowing of its rate cuts.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-09-06 22:00