As a researcher with experience in crypto markets, I believe that Mantra’s recent surge can be attributed primarily to its partnership with MAG, which brought positive sentiment and a significant price increase. However, this spike might not be sustainable due to the current market downturn and Bitcoin’s potential drop to the $50,000-$52,000 range.

As a researcher studying the cryptocurrency market, I’ve noticed that Mantra (OM) is one of the rare coins bucking the trend and experiencing growth in an otherwise downturned market. Yet, it seems that this upward momentum may not be sustainable indefinitely. In this article, we will explore the reasons behind Mantra’s recent surge and provide insights into its potential future movements.

Table of Contents

Partnership with MAG

As a researcher studying the cryptocurrency market, I’ve identified that the primary driver behind Mantra’s recent price surge was the July 3 announcement of its partnership with UAE real estate giant MAG to tokenize $500 million in real estate assets. This news instigated a wave of optimistic sentiment towards Mantra, causing a remarkable 31% price increase within eight hours. However, it’s essential to note that such sudden gains are often unsustainable and temporary. Indeed, I’ve observed that the Mantra price has already experienced a decline of over 18% in just over a day.

Market outlook and Bitcoin’s influence

As an analyst, I would advise paying close attention to Bitcoin’s price trend in order to gauge Mantra’s potential future performance. Based on our latest assessment, we anticipate that Bitcoin could dip down to the $50,000 to $52,000 mark. At the point when I penned that analysis, Bitcoin was trading near $57,000, and its current price stands around $53,500.

If Bitcoin’s price dips by an anticipated 3-7%, it’s reasonable to expect a similar trend in the broader crypto market due to historical market correlation with Bitcoin. Thus, potential investors in Mantra should consider steering clear of long positions to minimize the risk of entering a downturning market.

Technical analysis: Fibonacci retracements and support levels

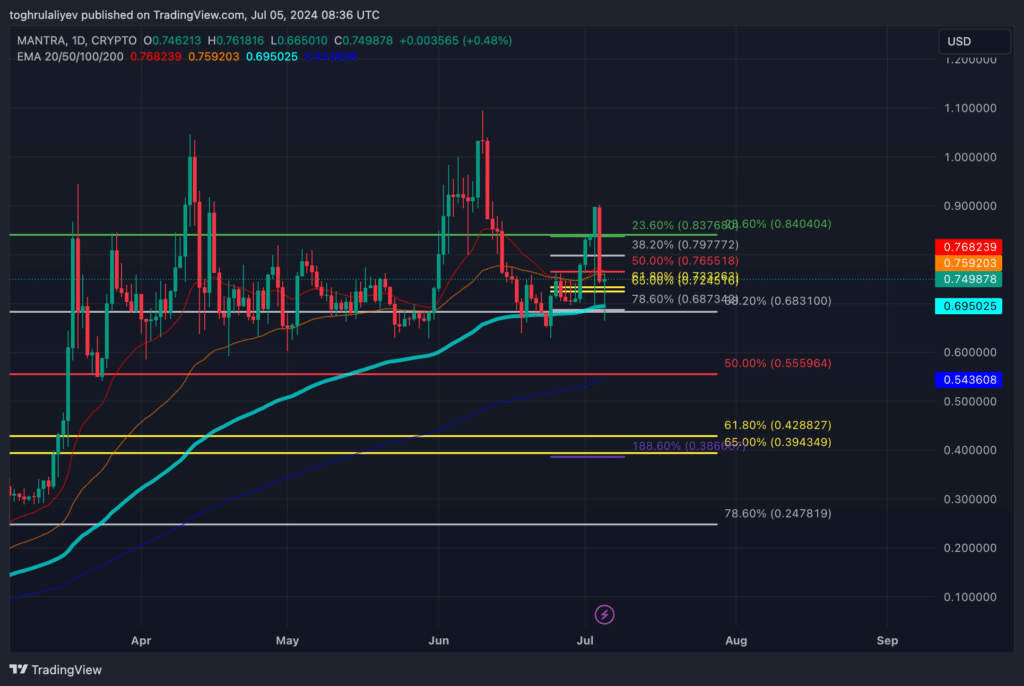

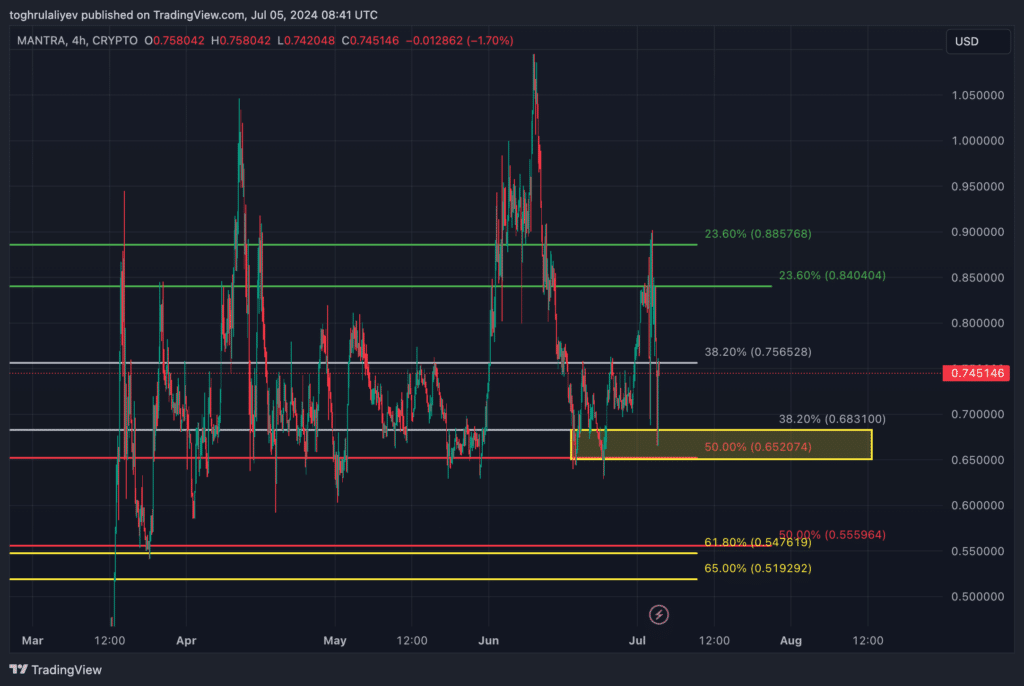

Analyzing Mantra using Fibonacci retracements provides insight into its potential future movements.

- Short-term analysis: Mantra’s recent price used the 78.6% Fibonacci retracement from the June 24 to July 5 range as support. This level aligns with the macro 38.2% Fibonacci retracement from the low in December 2023 to the peak in June 2024 and the 100-day moving average on the daily timeframe. If Bitcoin holds its current levels, Mantra may consolidate around $0.75

- Downside risk: If the market declines further, positive news about Mantra will likely not be enough to sustain its price. Mantra may drop to its historical support levels, aligning with macro Fibonacci retracements from December and February lows to the June peak, potentially falling to the $0.652-$0.683 range.

Strategic considerations

When encountering tokens displaying atypical price behavior, it’s crucial to examine the wider market situation. Here are some factors investors might want to consider:

- News Impact: Determine if the news driving the token’s price is significant enough to counteract broader market trends.

- Market Absorption: Assess whether positive news can absorb market downturns or if the token will follow the overall market decline.

As an analyst, I would recommend considering a bearish position on Mantra by shorting it from its current price to the $0.652-$0.683 range. This trade carries substantial risk due to our assumption that Bitcoin will continue to decline below the projected range of $50,000-$52,000. With Bitcoin already dropping significantly from $63,000 to $53,500, it’s essential to acknowledge that this could be a high-risk move since the trend might reverse, and bulls may take over the market. Additionally, any positive news from Mantra regarding upcoming announcements could potentially boost its price, posing an additional challenge to our strategy. Ultimately, our success depends on Bitcoin continuing to decline and Mantra remaining quiet.

To sum up, it seems more profitable to sell short Mantra considering the present market scenario and anticipated drop in Bitcoin’s value. Nevertheless, potential investors are advised to carefully consider the associated risks.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-05 13:08