As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market of 2018, I can confidently say that Polygon (MATIC) is shaping up to be a promising investment opportunity this year. With its current price action and the various technical indicators pointing towards an upward trajectory, I’m optimistic about potential gains of 145% by year-end.

It appears that Polygon is looking promising for significant growth, possibly reaching an increase of about 145% before the end of the year. Although it may face some temporary hurdles, its solid foundation and optimistic signals point towards a potentially profitable investment prospect.

Table of Contents

Support and resistance levels

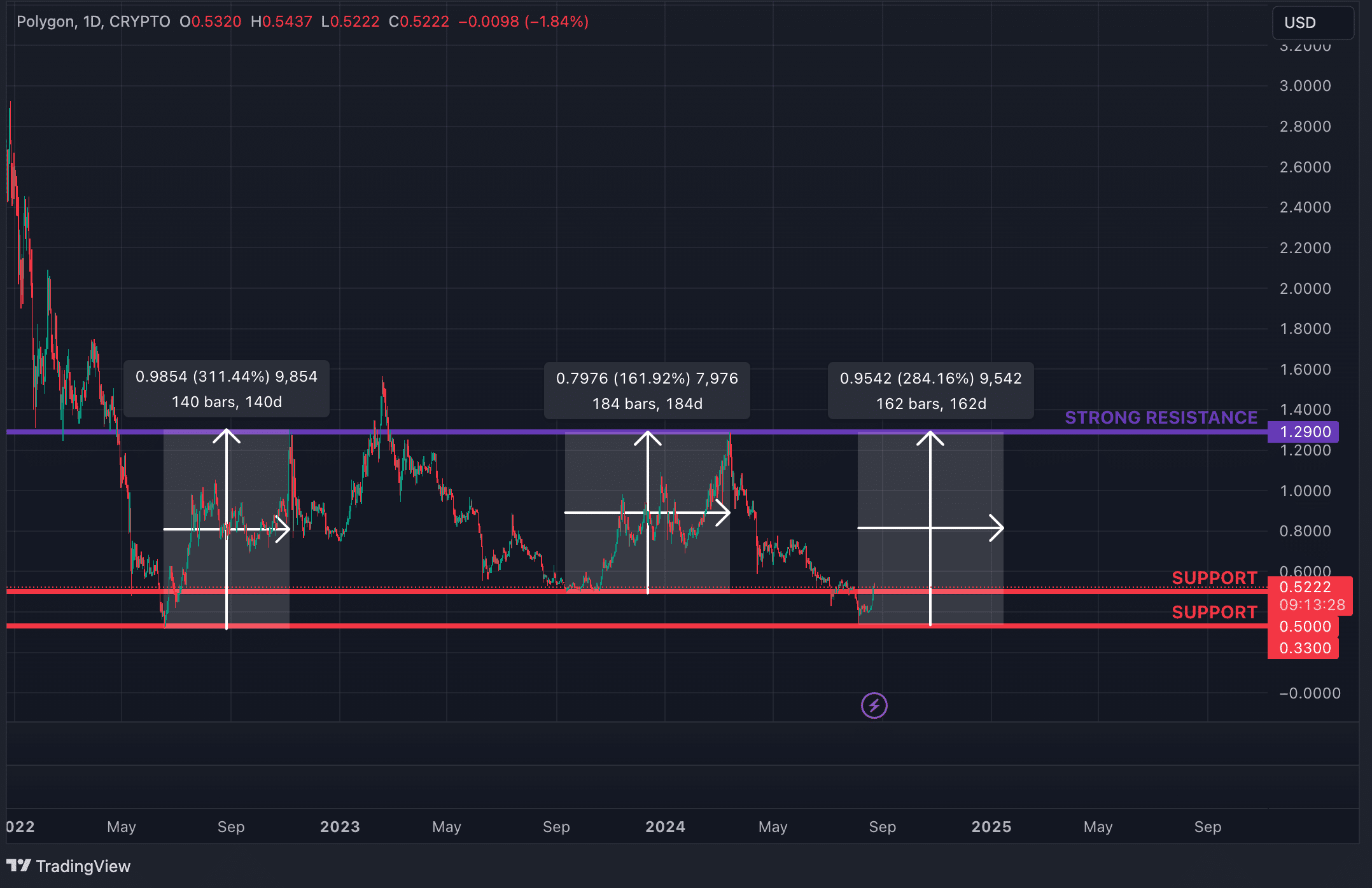

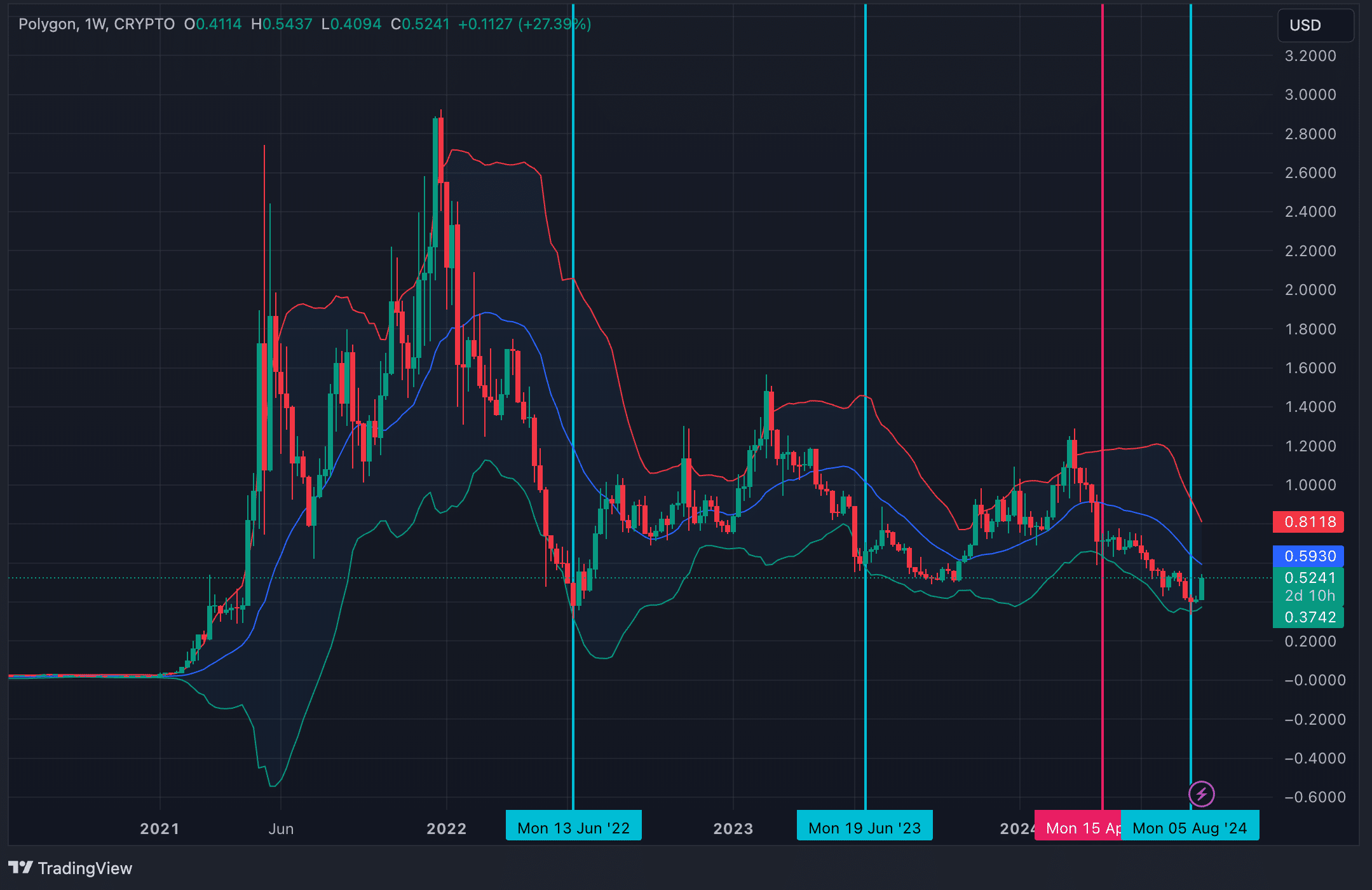

Right now, the cryptocurrency Polygon (MATIC) is being traded above a significant price range, marked by two key support points: $0.33 and $0.50. Historically, the $0.33 level has shown promising signs of potential price increases, notably in March-April 2021, June 2022, and August 2024. Following a touch at $0.33 in June 2022, MATIC experienced a substantial surge of 311.44% within 140 days.

The significant level of $0.50 has played a crucial role in shaping the price movement of MATIC over the past two years. This asset has generally moved within a range that extends from around $0.50 at its lowest point to approximately $1.29 at its highest, with the $0.50 mark providing a solid base for upward trends. During the period spanning August to October 2022, MATIC experienced a significant rise of nearly 161.92% over a span of 184 days after a brief consolidation around the $0.50 price point. In the past, MATIC’s upward surges originating from these levels have often encountered resistance near $1.29.

Considering the predicted interest rate decreases in September and the historical sluggishness of cryptocurrencies in that month, MATIC could experience a phase of stabilization around the $0.50 region before continuing its climb towards the year-end goal of $1.29. Even though market fluctuations might temporarily push the price down to $0.33, this wouldn’t negate the overall optimistic forecast. The range between $0.33 and $0.50 offers a tactically wise entry point for long-term investments. Investing in a long position within this range could potentially result in higher returns compared to attempting to buy at inflated prices during periods of intense market action later on. Additionally, various other signals suggest the continuation of an uptrend.

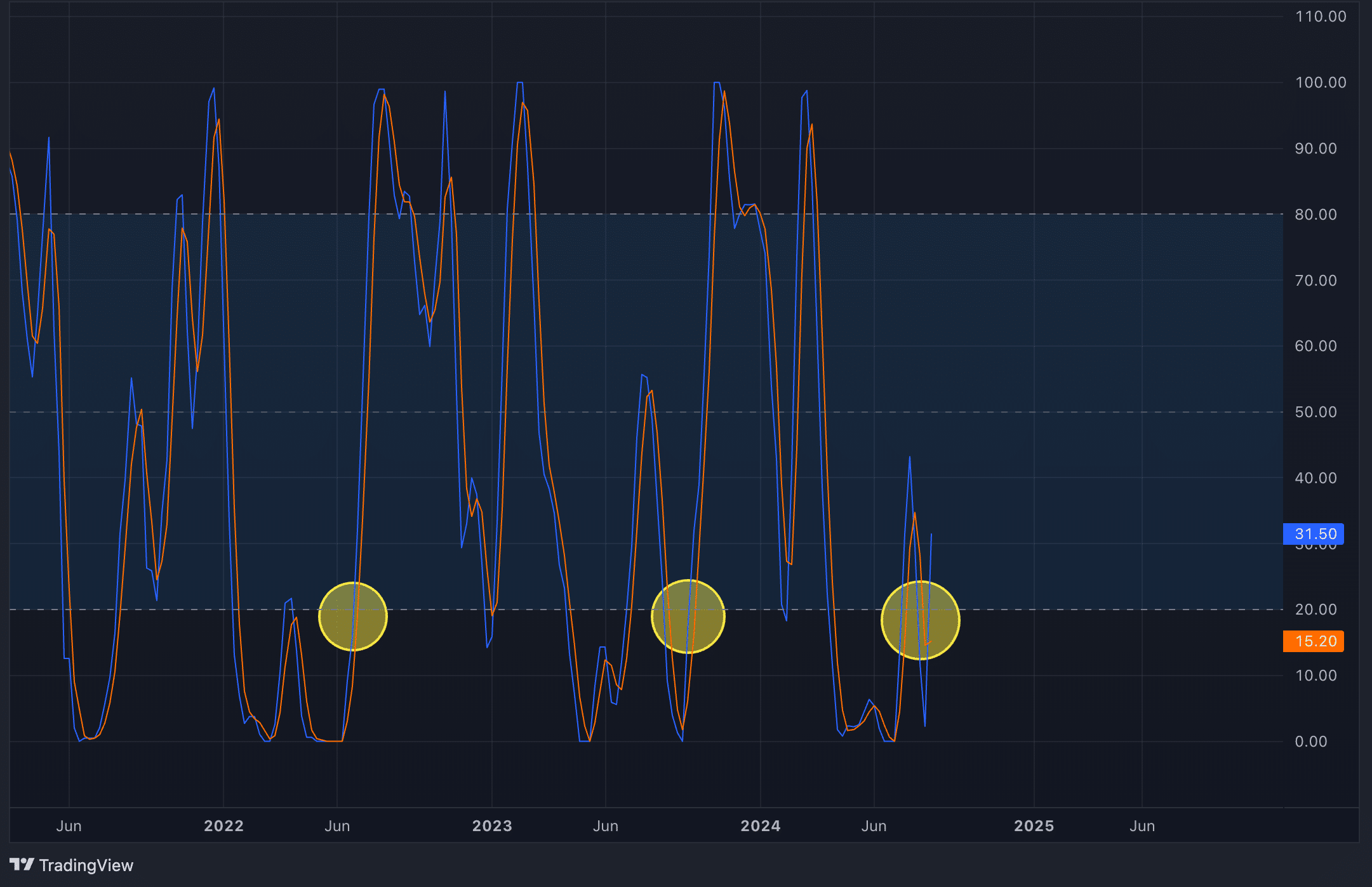

Stochastic RSI

When the Weekly Stochastic RSI falls below 20, it suggests a good opportunity for investment. While there may be some instances of false signals where the indicator drops without causing significant market movement, the region under 20 is still an appealing spot to start long positions. The shift from a bearish to bullish trend happens as the Stochastic RSI passes the 20 level, consolidates, and then moves back above it, indicating a return of strong upward momentum.

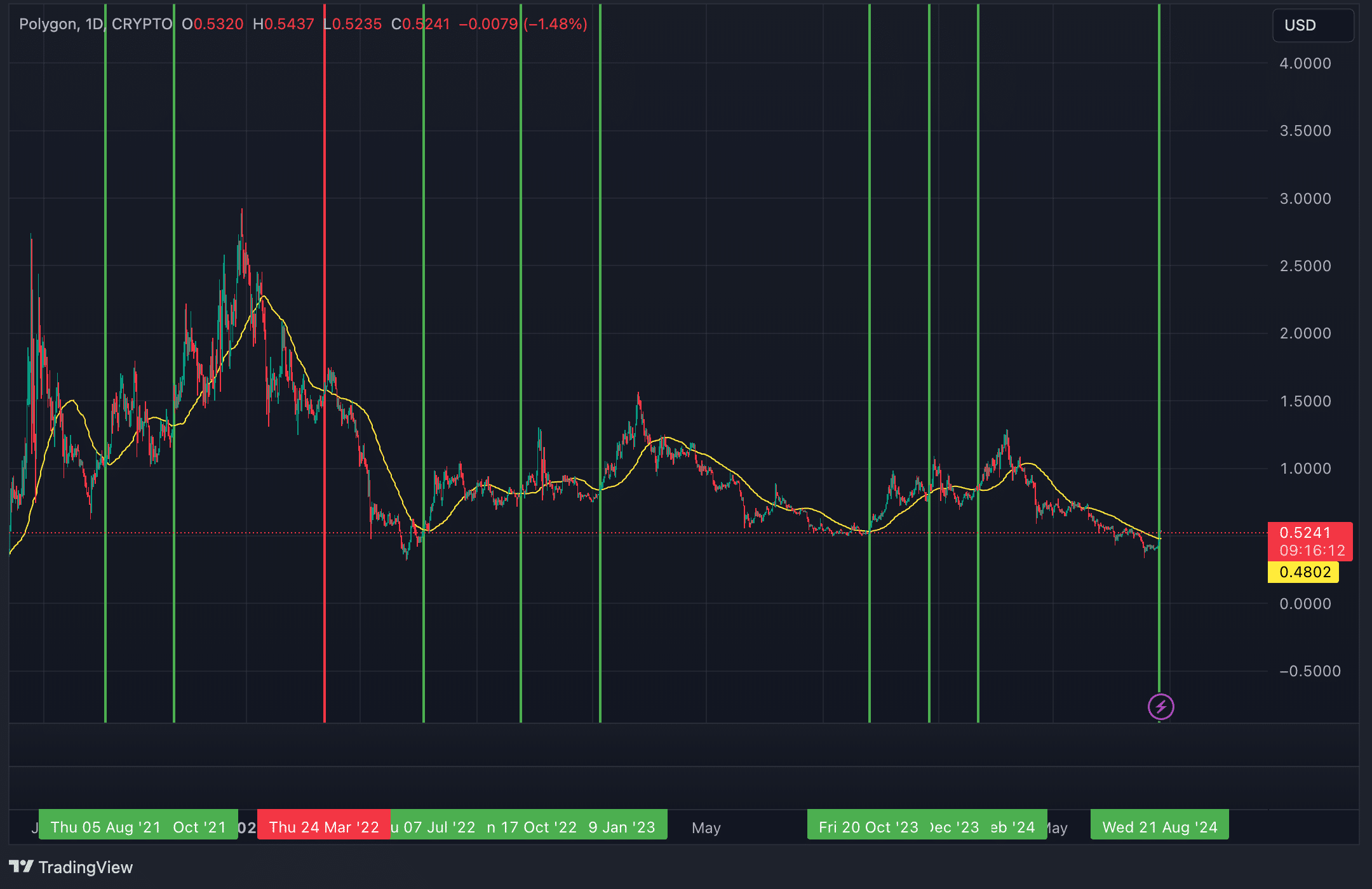

50-day Moving Average

For the past year, in about 9 out of 10 cases when the price surpassed the 50-day moving average on a daily basis and stayed at least 10% higher for three or more consecutive days, the market experienced a significant upward trend. Similarly, MATIC has exhibited this pattern by staying above $0.50 for several days now.

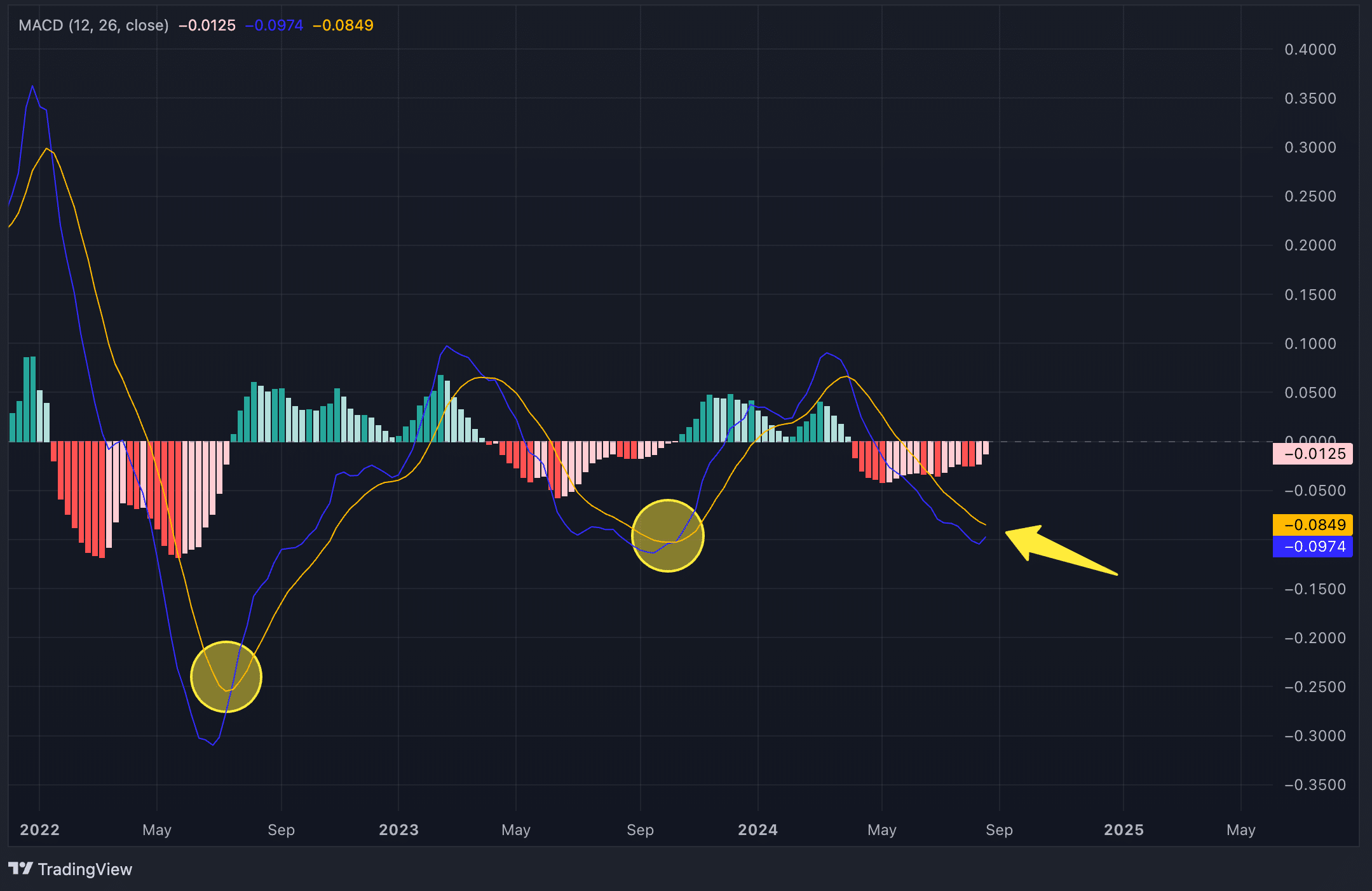

Moving Average Convergence/Divergence

One way to rephrase the given text for a more natural and easy-to-understand style is as follows:

Bollinger Bands

In about 75% of times when MATIC‘s price reached its lower limit, significant upward trends ensued. This happened in June 2022, June 2023, and most recently in August 2024. This pattern might suggest a potential recurrence. However, it’s important to note that in April 2024, the touch of the lower limit didn’t lead to an actual upward trend; instead, it was a false signal.

Strategic considerations

Matic offers a promising long-term investment with considerable growth prospects, however, it’s important to note that temporary price swings might happen due to broader economic conditions. There could be a dip down to around $0.33 or a pause in the price action near $0.50, but the forecasted year-end price of approximately $1.29 still seems plausible.

Traders have three options:

-

Enter long now: Entering a long position at the current level and holding until year-end could yield around 145%.

Wait for a retracement: Those expecting the September rate cut to trigger a short-term market downturn may choose to wait for MATIC to drop to around $0.33 before entering. This approach could result in a return of about 290% by year-end.

Short MATIC before going long: A more aggressive strategy would involve shorting MATIC down to $0.33 and then switching to a long position. However, successfully executing this strategy requires a high degree of accuracy in predicting a market decline, which is a challenging and speculative endeavor, even more so than the price analysis presented. While this scenario could be profitable, the risk is substantially higher.

Considering the doubts we face, it might be wiser to select between the first or the second possibility. Regardless of the choice made, the chance of experiencing significant losses by the end of the year appears minimal.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-08-23 22:14