On Friday, Sui saw a 4% increase, building upon its impressive 14% surge this week. Meanwhile, Uniswap started recuperating on Friday following a nearly 8% decrease in value over the weekly period. It’s possible that these tokens could provide greater returns for their holders in the upcoming week.

Table of Contents

Bitcoin eyes recovery, Sui and Uniswap could rally alongside

Bitcoin (BTC), the leading digital currency, experienced a drop of close to 3% in value this week. However, it’s showing signs of recovery as we speak on Friday. At the moment of writing, BTC has gained almost 3% on the day, with its price sitting comfortably above $94,000.

As a researcher examining the cryptocurrency market, I’m observing an intriguing trend: Bitcoin seems to be gearing up for potential recovery. However, my attention has been drawn towards two altcoins, Sui and Uniswap, that could yield significant gains in the upcoming week. Sui, in particular, appears poised to continue its upward trajectory, potentially reaching even greater heights. Interestingly, Uniswap is currently reversing its losses from last week, with UNI tokens appreciating by almost 4% just on Friday alone. This could be a promising sign for those interested in these digital assets.

SUI and UNI trade at $5.0865 and $13.371 at the time of writing.

On-chain and technical indicators support gains

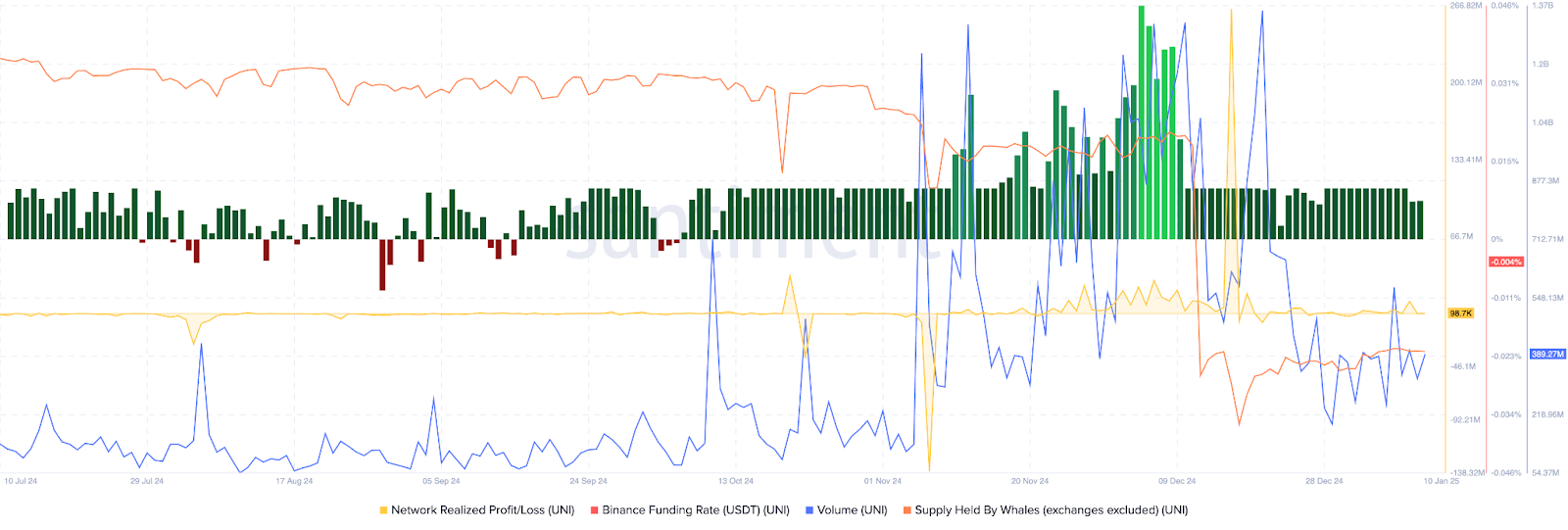

The data from Uniswap suggests a positive outlook for DeFi tokens. The Network’s profit/loss metric indicates that UNI token holders have been slower to sell their tokens in the last fortnight. Usually, when profit-taking slows down, it decreases the pressure to sell the token.

From December 28th to January 10th, we’ve seen a steady rise in the trading volume. An uptick in volume along with a price increase often fosters growth in the value of the token.

As an analyst, I’ve noticed a persistent increase in the amount of UNI tokens held by large investors since mid-December. Importantly, this UNI isn’t stored within exchange wallets, meaning it doesn’t contribute to selling pressure. Instead, this accumulation signifies growing investor confidence in the potential of UNI.

For approximately a month now, the funding rate on Binance has remained consistently positive, which lends credence to a bullish argument regarding the potential rise in the price of UNI.

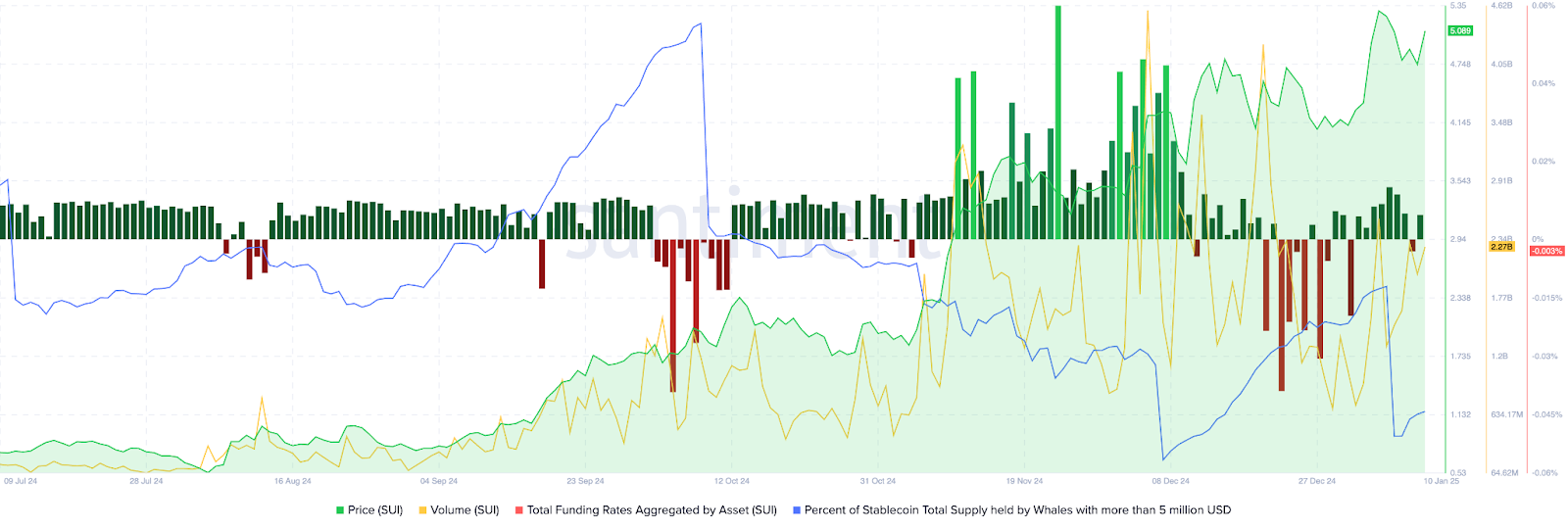

During the period from December 27 to January 10, the trading volume of SUI has shown a steady increase with notable high peaks. Simultaneously, funding rates for SUI on major exchanges have become generally positive, and the price has risen as well.

Over the past three days, the proportion of stablecoin total supply owned by whales with assets exceeding $5 million has risen, suggesting increased interest and demand for this token on various trading platforms.

What to expect from SUI and UNI next week

UNI is firming up near $13.05, which represents the 50% Fibonacci retracement point of its surge from $6.640 to $19.459. The Relative Strength Index (RSI), a significant technical marker, suggests potential for more growth in UNI.

RSI is sloping upwards and reads 44, close to the neutral level.

Keep a close watch on the market, as the Moving Average Convergence Divergence (MACD) indicator shows red bars below the neutral line for UNI, suggesting a growing downward momentum in the price trend.

If UNI continues to increase, its DeFi token might aim for the previous high of around $15.595 reached on January 6. As UNI approaches this level, it may encounter resistance at that price point, which represents a potential 17% surge in the token’s value.

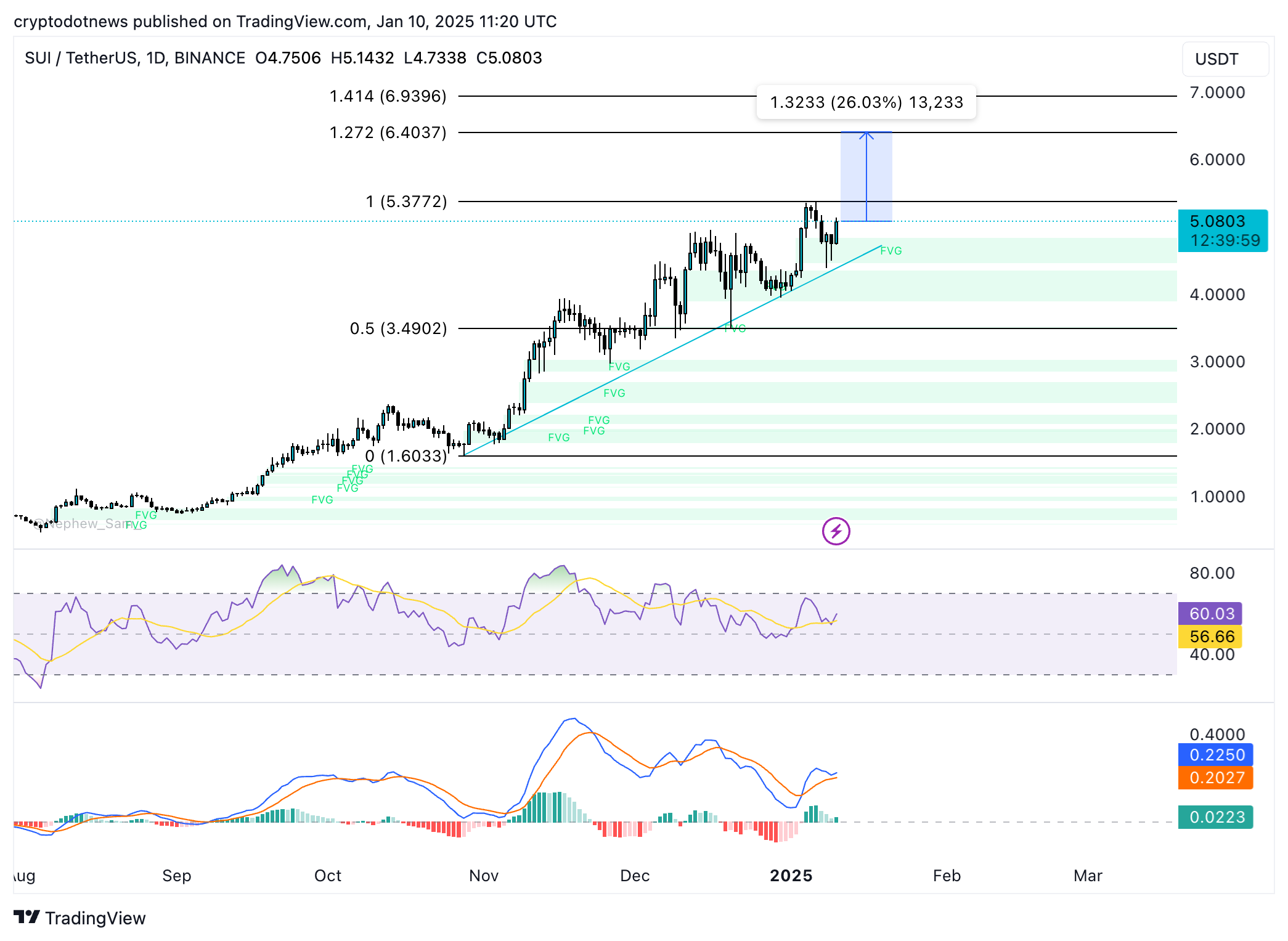

The value of SUI, a token from the Layer 1 blockchain, has been on an upswing since November 2024. Currently, it’s nearly touching its highest point of $5.3772. It’s possible that this upward trend could persist and push SUI towards the 127.2% Fibonacci retracement level at approximately $6.4037.

In simpler terms, the price of SUI has been increasing since November 2024 and is almost reaching its maximum value of $5.3772. There’s a chance it might continue climbing up to around $6.4037 based on certain mathematical calculations.

SUI could rally 26% and test resistance at $6.4037.

The Linear 1 token appears to be following a bullish outlook, as indicated by two key indicators:

1. The Relative Strength Index (RSI) is on an upward trajectory and currently stands at 60, suggesting that the token may be overbought but still has potential for further growth.

2. The Moving Average Convergence Divergence (MACD) presents a positive picture, with green bars appearing above the neutral line. This implies that there is strong momentum supporting the increase in the price of SUI.

State of the crypto market

David Morrison, Senior Market Analyst at Trade Nation told Crypto.news in an exclusive interview,

“Bitcoin is looking a bit perkier this morning and has made back most of yesterday’s losses.”

In its market deep dive, analysts at Crypto Finance observe that:

This week, Bitcoin (BTC) encountered another obstacle as the United States Department of Justice received approval to sell off 69,000 BTC that were seized from Silk Road. With a value roughly equivalent to $6.5 billion, this potential sale seems to have alarmed traders and forced out less resilient investors. So, why is this important? The Department of Justice’s Bitcoin holdings constitute a substantial share of the total market liquidity. In an economic climate that is already volatile, this news further intensified the instability.

Regardless, Bitcoin seems to be maintaining crucial support near $92,000. A potential drop beneath this point might lead to a more significant retreat.

In the crypto market last Friday, a total of $329 million worth of assets were sold off within a 24-hour period during liquidation events. Notably, more than $88 million of these liquidations involved Bitcoin, which is the largest cryptocurrency currently. As traders keep an eye on the liquidations in the coming week, they might be able to discern if the market is showing signs of improvement and increased demand for crypto.

Reason for optimism as US regulatory outlook improves

As a researcher delving into crypto policy and regulation, I recently observed David Carlisle’s insights at Elliptic. Notably, he highlights that the year 2024 has seen significant advancements that are poised to influence the cryptocurrency landscape for years ahead.

Carlisle posits that by the year 2025, advancements in crypto policy and regulation may occur. It’s possible that U.S. banking regulators will ease restrictions on crypto involvement for financial institutions, while President-elect Donald Trump’s administration might foster a supportive attitude towards cryptocurrencies.

The selection of important positions such as the SEC Chair, the AI & Cryptocurrency Regulatory Lead, and the CFTC Chair by the new President can significantly shape the regulatory strategies and policies concerning cryptocurrencies within the United States.

75% of Ripple‘s current job openings are located within the United States, according to CEO Brad Garlinghouse, who attributes this shift to what he calls the “Trump effect.” This positive impact on cryptocurrency companies and a favorable regulatory climate in the U.S. could fuel interest in cryptocurrency among American traders.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

2025-01-10 18:58