Chinese cryptocurrency traders prosper despite China’s stringent bans on mining and digital money dealings.

In 2020, China played a significant role in the Bitcoin mining scene, responsible for over 75% of the global Bitcoin hashrate. However, this changed drastically following the Chinese government’s crackdown on cryptocurrencies. Nowadays, with investors showing renewed interest in promising digital assets, regulations appear to be easing somewhat.

Chinese Bitcoin traders continue to play a major role in Bitcoin transactions. They contributed to the recent cryptocurrency price drop due to market changes, not as a result of fresh regulations from China.

Chinese trade for billions of dollars despite the ban

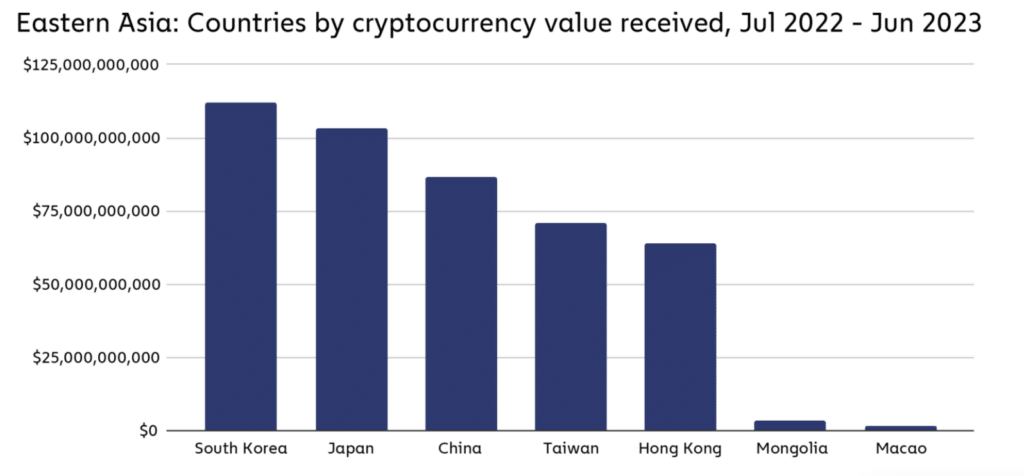

Based on Chainalysis’s data, the Chinese cryptocurrency market handled approximately $86.4 billion worth of crypto transactions between July 2022 and June 2023. Around 3.6% of these transactions involved large retail purchases priced between $10,000 and $1 million. This percentage is almost twice the global average.

Experts from Chainalysis suggest that recent happenings in Hong Kong might indicate China’s potential embrace of cryptocurrencies, making Hong Kong a possible laboratory for these initiatives.

How to bypass restrictions

In spite of China’s prohibition on cryptocurrency trading since 2021, Reuters indicates that losses in the Chinese stock market during the past three years have led investors to return to cryptocurrencies. A financial executive named Dylan Run, based in Shanghai, views Bitcoin as a secure investment alternative, similar to gold.

Around the beginning of 2023, concerned about China’s economic slump and falling stock market, Run decided to move some of his investments into cryptocurrencies.

Despite being outlawed, cryptocurrency trading persists among Chinese citizens. They carry on transacting in digital currencies like Bitcoin via platforms such as OKX and Binance, or through off-the-counter deals. Additionally, some individuals use foreign bank accounts to acquire cryptocurrencies.

Variety of payment methods

Due to China’s prohibition on cryptocurrencies, investors like Dylan Run have had to find inventive ways to handle their finances in this area. According to Reuters, one method Dylan employed was using bank cards from lesser-known rural banks to buy cryptocurrencies through unauthorized dealers. He deliberately kept his transactions under 50,000 yuan ($6,978) to prevent raising suspicion from the authorities.

Traders discover multiple methods to move cryptocurrencies; these include using cash or banking transactions. Cities such as Chengdu and Yunnan have emerged as popular destinations for these traders due to reduced regulatory oversight from the central government, which primarily focuses its attention elsewhere.

Based on the Wall Street Journal’s report, Chinese investors have discovered new ways to engage in cryptocurrency trading through social media networks such as WeChat and Telegram. Instead of relying on traditional centralized exchanges, they connect with each other in specialized groups on these platforms for seamless transactions.

In less regulated rural communities, people commonly exchange digital assets through face-to-face meetings. They frequently gather at casual spots like cafés or laundromats to share their digital wallet information or carry out deals using cash or banking services.

Hong Kong

In Hong Kong, residents with Chinese citizenship can take advantage of savings plans, allowing them to exchange up to $50,000 in foreign currency each year. Some individuals utilize this opportunity to invest in cryptocurrencies available within the Hong Kong market.

With China’s real estate market, valued at approximately $135.7 trillion, experiencing difficulties, an increasing number of citizens could soon look towards cryptocurrencies as an alternative. The property sector, which was once a major contributor to the world’s second-largest economy, ended 2023 with a significant drop in new home prices – the steepest decline in almost nine years. Despite the Chinese government’s attempts to support this sector, its struggles continue.

An unidentified Hong Kong cryptocurrency exchange leader shared with Reuters that they observe Mainland Chinese investors joining the cryptocurrency sector regularly. The economic instability in China has led people to seek safer investments outside the country due to its increasing risks, uncertainty, and disappointments.

Additionally, Chinese brokerages and financial institutions are now joining the cryptocurrency bandwagon. Motivated by the lack of profitable opportunities on the mainland, they have turned to Hong Kong for cryptocurrency business expansion.

If you’re a Chinese broker dealing with a sluggish stock market, waning IPO interest, and decreasing business sectors, it is essential to present a compelling growth narrative to your investors and board members.

Anonymous Hong Kong crypto exchange executive

Citizens now have an easier way to invest in cryptocurrencies thanks to fintech platforms like Ant Group’s Alipay and Tencent’s WeChat Pay. These services enable users to exchange yuan for stable digital coins at authorized dealers, which can subsequently be utilized for trading cryptocurrencies on multiple exchanges.

Based on Chainalysis’ findings, some believe that Hong Kong’s evolving role as a cryptocurrency center may indicate a shift in China’s stance towards digital assets or a newfound acceptance of crypto projects.

False geolocation

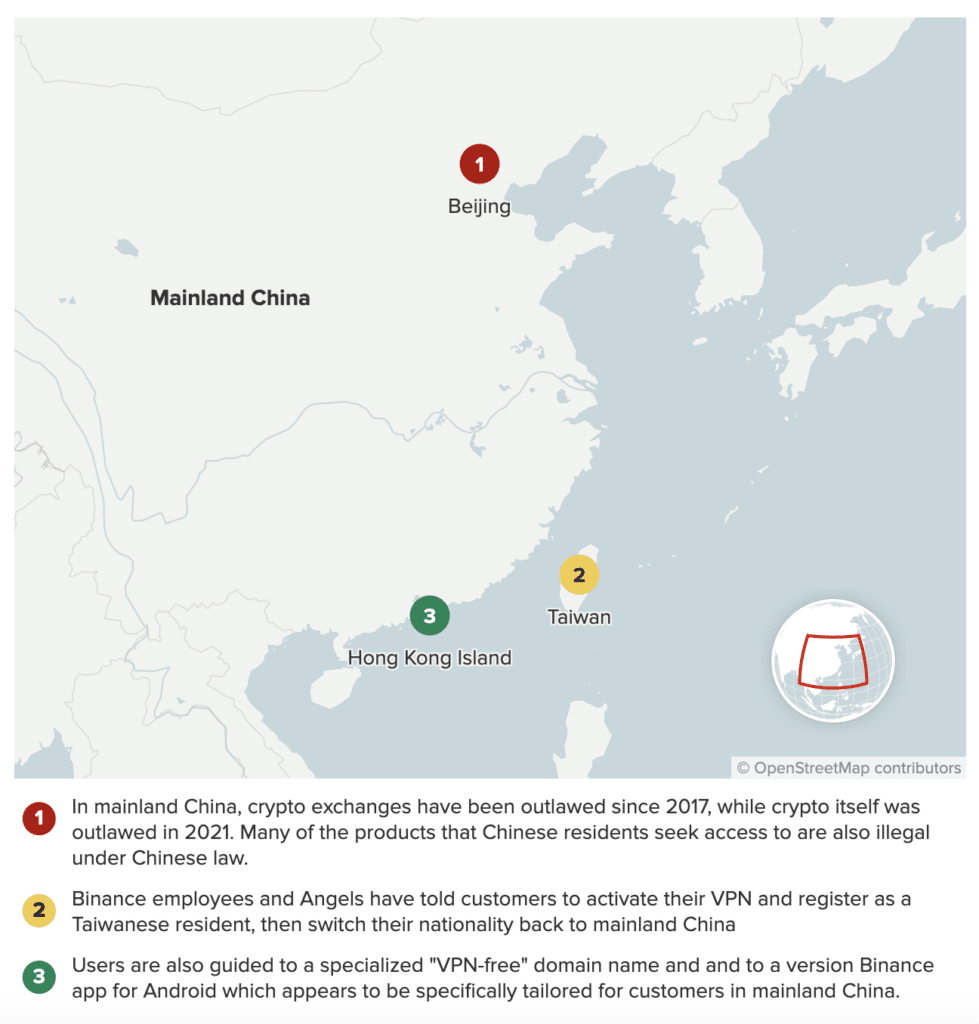

In May 2023, despite trading accounts being banned, some Chinese users persisted in accessing these platforms by circumventing geographical restrictions with VPNs. Notably, Binance recorded a staggering $90 billion in trades from Chinese users that month, which accounted for approximately 20% of the exchange’s overall volume. As reported by CNBC, it was alleged that Binance staff had encouraged Chinese clients to bypass KYC (Know Your Customer) procedures.

In the previous year’s report, it was brought to light that certain traders created crypto accounts using false identification papers, which included documents related to their citizenship status.

Instead of giving accurate home and financial information, some unscrupulous traders attempt to deceive KYC procedures and open accounts in defiance of established regulations by supplying fabricated residence and banking details. This clandestine method for cryptocurrency trading stands in stark contrast to the country’s stringent regulatory framework.

China is looking for salvation in crypto

An increase in the popularity of Bitcoin and other cryptocurrencies can be attributed to the disappointing returns from traditional Chinese investments. With the government’s efforts to regulate the real estate market and China’s ongoing economic shift, investments in stocks and property have become less enticing. However, there are considerable obstacles that make conventional investment opportunities less appealing. These include a large state-owned enterprise sector with unclear management, uncertain regulations, and a complex credit rating system.

The current economic situation in China has hastened the stock market downturn and fueled anxiety about its future. As a result, cryptocurrencies are gaining popularity as a possible solution, providing some stability and growth prospects in the midst of the Chinese economy’s turmoil. The increasing interest in cryptocurrency investments among Chinese traders is a significant indication of this trend, representing a shrewd adaptation to the evolving economic and regulatory landscape.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

2024-04-17 14:00