As an analyst with a background in digital finance and regulatory compliance, I see Circle’s MiCA compliance and European expansion as a strategic move that could potentially disrupt Tether’s dominance in the stablecoin market. With the first EMI license granted to a stablecoin issuer under the EU’s new framework, Circle is poised to offer USDC and EURC to European users, filling the void left by some platforms delisting Tether’s offerings.

Circle is permitted to promote its USDC stablecoin offerings throughout Europe in accordance with the European Union’s MiCA regulations.

Circle, a leading stablecoin company, has become the first in its industry to comply with the EU’s MiCA regulations, which oversee digital asset business operations. With an Electronic Money Institution (EMI) license obtained from French regulators, Circle Mint France will now be responsible for issuing EURC and USDC stablecoins specifically for European users.

Newsworthy Update: @Circle unveils the availability of USDC and EURC for EU customers under newly implemented stablecoin regulations; Circle marks the first global issuer to adhere to MiCA. Commencing July 1st, Circle natively provides both USDC and EURC to European clients. (Details to follow.)

— Jeremy Allaire – jda.eth (@jerallaire) July 1, 2024

Trading cryptocurrencies like Bitcoin, Ethereum, and Solana can be risky due to their volatility. However, using stablecoins provides a more stable alternative. Stablecoins are digital assets that maintain a consistent value, typically pegged to the US dollar or other fiat currencies such as the Euro. Thus, they offer a less volatile means for entering and exiting cryptocurrency markets.

As a researcher studying the regulatory landscape of stablecoins in Europe, I can share that the recent development has brought clarity to the uncertain waters surrounding these digital assets. The Markets in Crypto-Assets (MiCA) regulation, which promises stringent rules for their usage, has dispelled doubts about their future in the EU. One such rule is the daily issuance limit of €180 million ($215 million) in transaction value that firms must adhere to within the European bloc.

Is Circle positioned to upend Tether?

As a researcher studying the cryptocurrency landscape, I believe that Circle’s acquisition of an EMI (Electronic Money Institution) license and MiCA (Markets in Crypto-Assets) compliance could potentially position the company as a formidable competitor in the European market and even challenge the dominance of Tether, the largest stablecoin issuer.

As an analyst, I’ve been closely monitoring the market rumors regarding Tether’s European prospects. Notable actions taken by some trading platforms, such as Bitstamp’s delisting of Tether EURT, and Uphold’s discontinuation of support for USDT and other dollar-pegged stablecoins, have sparked intrigue and fueled further speculation about the future of Tether in Europe.

A vacuum is developing in the market with Circle securing the first MiCA stablecoin license, and Allaire’s company, the USDC issuer, intending to relocate its legal base from Ireland to the United States before an IPO. As regulations on stablecoins in the U.S. tighten, USDC could strengthen its position as a leading global player in this field.

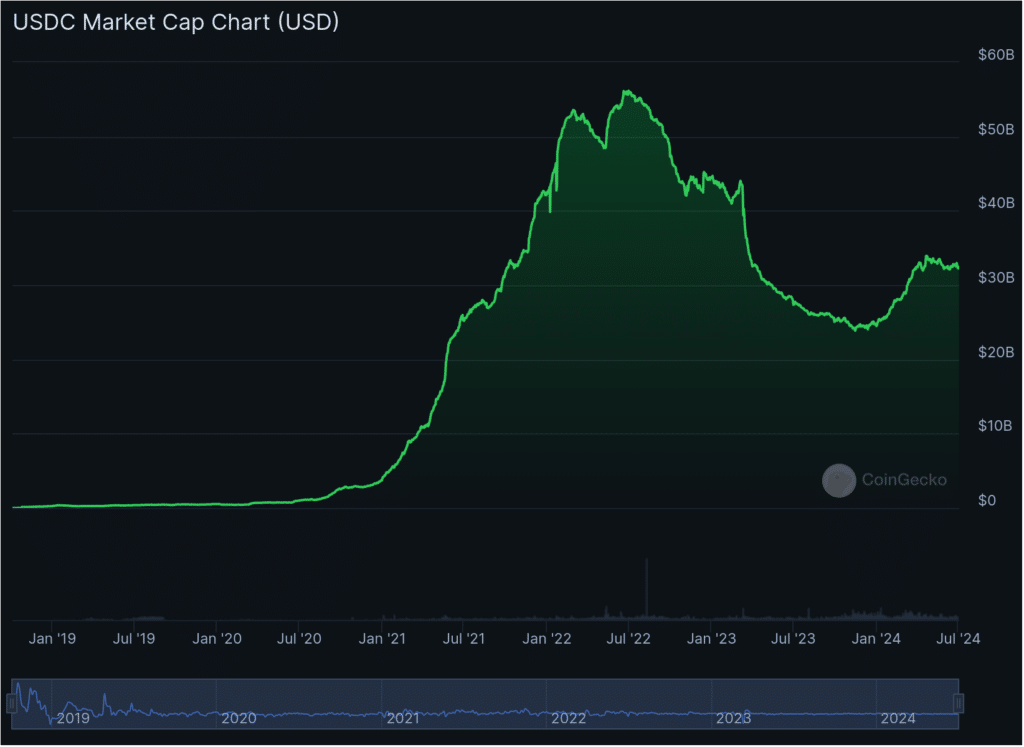

Despite USDC currently trailing behind Tether with a market capitalization of $32 billion versus Tether’s leading $113 billion, USDC faces an arduous journey to surpass it. At the present moment, USDC is falling short of its June 2022 peak value of approximately $55 billion.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-01 21:10