As a seasoned researcher with over two decades of experience in the volatile world of cryptocurrencies, I can confidently say that the current state of Bitcoin mining stocks is reminiscent of a rollercoaster ride without the thrill. The death cross pattern forming on the charts of Marathon Digital and CleanSpark is a stark reminder of the unpredictable nature of this market.

Investment-worthy Bitcoin mining shares have developed an unusual ‘death cross’ chart configuration, which typically suggests further hardships might be on the horizon.

CleanSpark and Marathon Digital have formed a death cross

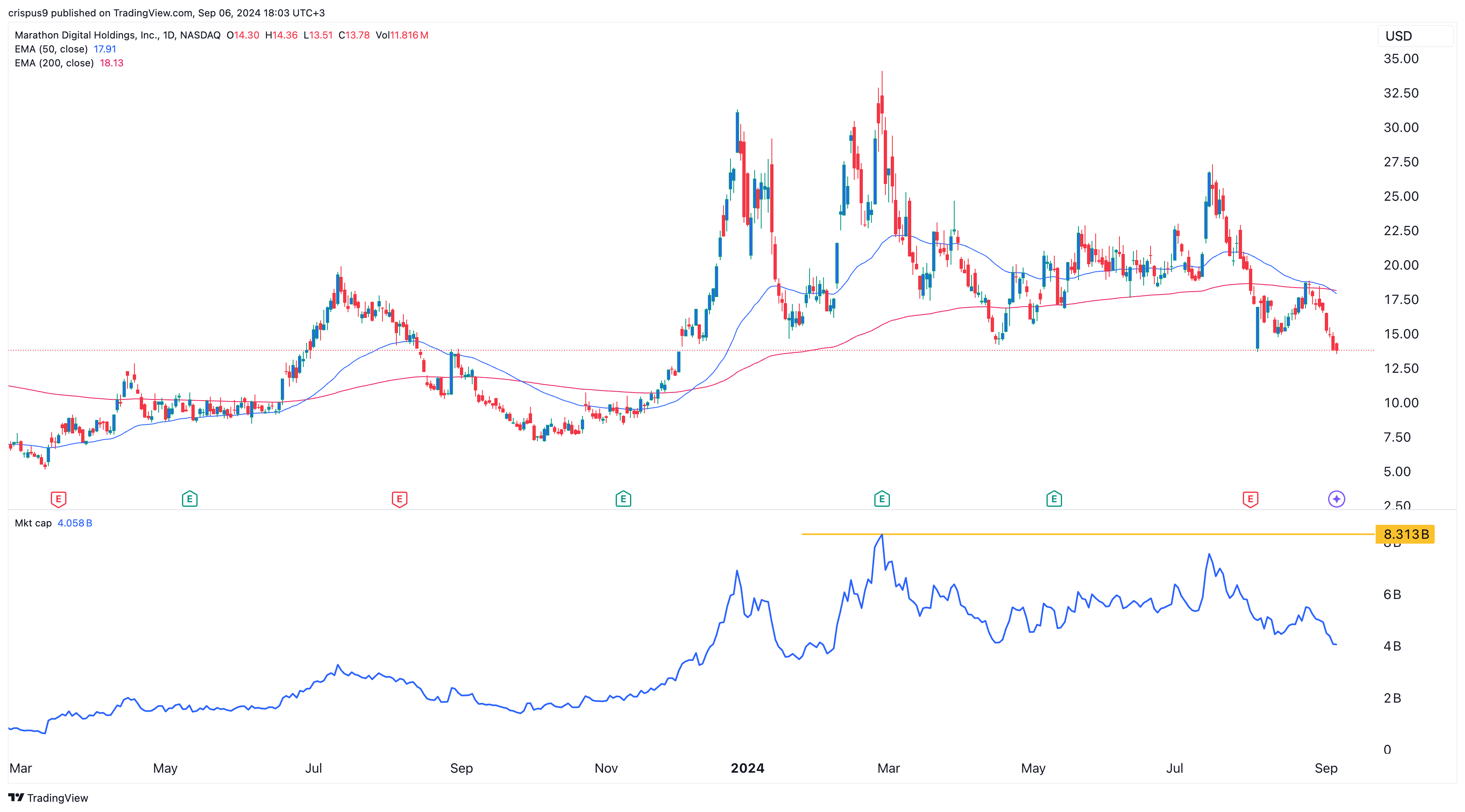

On September 6th, Marathon Digital, the leading mining company within the industry, reached a low not seen since December of the previous year, trading at $13.75. This represents a significant decrease of approximately 60% from its peak this year, effectively wiping out more than $4 billion in market value.

In a similar vein, the price of CleanSpark plummeted to $8.39, which is its lowest since February, representing a decrease of 66% from its peak this year. Consequently, its market capitalization has fallen from $5 billion in March to $2 billion.

Similarly, shares of other Bitcoin mining companies like Riot Blockchain, Core Scientific, Cipher Technologies, and Argo Blockchain have persistently dropped in value too.

Notably, Marathon Digital and CleanSpark have developed what’s known as a “death cross” formation. This occurs when the 50-day moving average falls below the 200-day moving average, which typically suggests further price decline in the following periods.

One way to rephrase the given text in a more natural and easy-to-read manner could be:

Bitcoin is also nearing a death cross

The decline in these mining stocks is being driven by two primary reasons: the drop in Bitcoin’s value and subpar output levels.

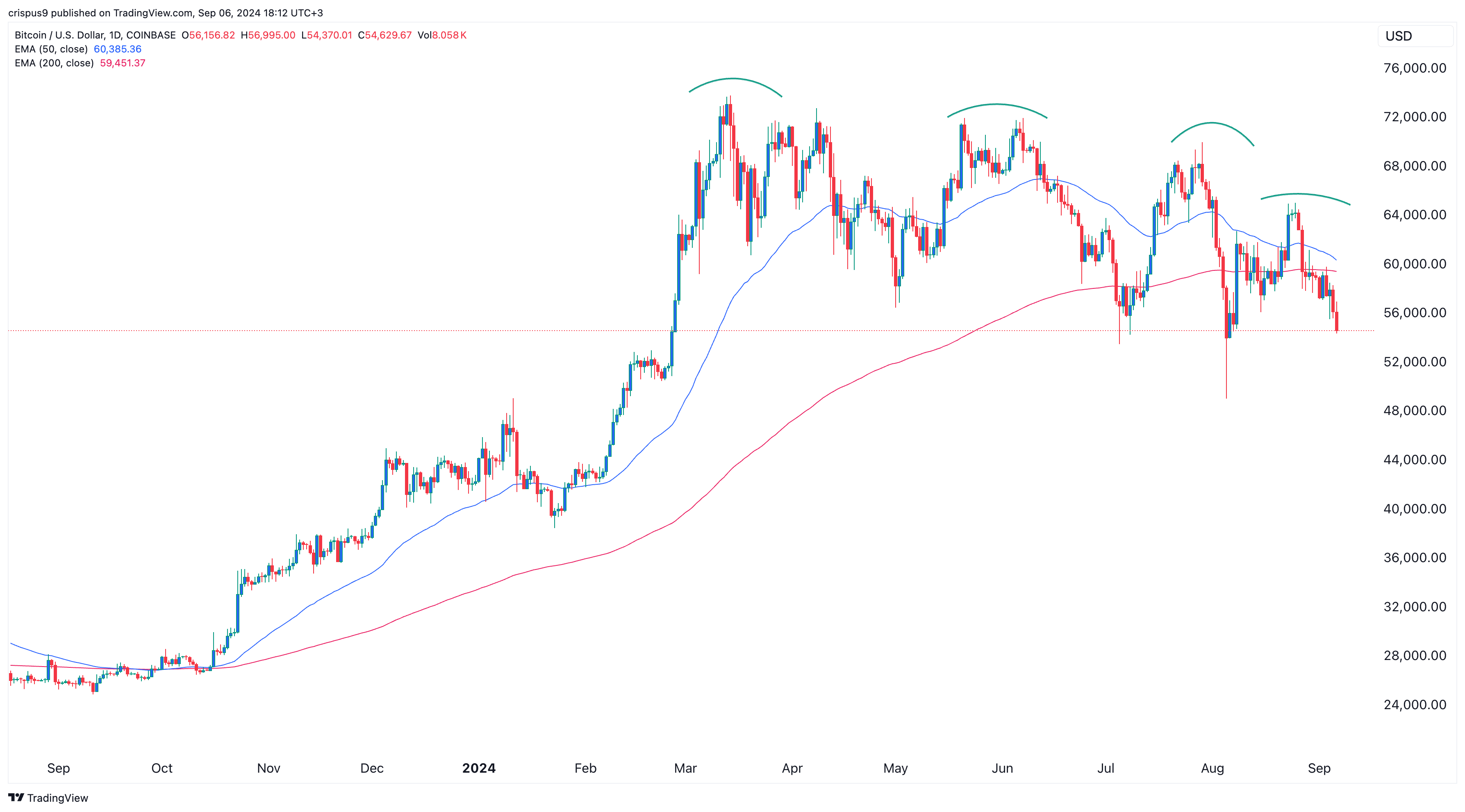

The price of Bitcoin dipped under $55,000, marking its lowest since August 7th. This represents a 25% decrease from its peak this year and a 15% drop from its August top.

The potential decline in Bitcoin’s price might persist due to a pattern of successively lower peaks and troughs it has displayed. Moreover, it is nearly at the point of creating a ‘death cross,’ which suggests that bearish traders have gained dominance. If it falls below the previous month’s low of $49,000, it could indicate more price drops to come.

Bitcoin mining operations have seen a reduction in the number of coins they’re generating compared to August, due to the halving event. For instance, Marathon Digital has decreased its coin production from 850 coins in April, then 692 in July, and now only produces 673 coins.

In a comparable fashion, CleanSpark minted 478 coins in August compared to 721 in April, while Riot Platforms mined 322 coins in August compared to the preceding month. Many other mining firms have observed a decrease in their production levels as well.

Given lower Bitcoin prices and reduced production, it’s likely that the revenue of companies like Marathon Digital, Riot Platforms, and CleanSpark will persistently decrease, as will the market value of their Bitcoin holdings. They currently possess 25,000, 9,334, and 7,052 coins respectively on their balance sheets.

Read More

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-09-06 18:58